Recognizing the Risks of Stock Investing in the Capital Market

Risk management is very important, by understanding it, you are one step ahead of other investors. What are the risks? This article will explain it.

In the article, we know that in order to win the battle, we must not only recognize ourselves, but also recognize who our enemies are.

Similarly, in investing in the stock market, a wise investor not only focuses in the pursuit of profit, but also must know about the risks faced in investing in the stock market.

In other words, knowing the type of risk faced in investing in the stock market is one thing to know in order to beat the market.

By recognizing those risks means we have known the enemy we meet (or will we meet) in the stock market.

RISKS OF STOCK INVESTISING

Then, what are the risks we need to know (and be wary of) in investing in the stock market?

1. Beware of Economic and Political Conditions

The economic and political conditions of a country are very crucial and can not be underestimated by an investor. Investors prefer to invest in a safe and conducive country rather than investing in a war-ravaged country.

Perhaps we still remember during the economic crisis and riots in 1998, the Indonesian stock market suffered a devastation. Stock prices fall even some stocks until no price at all (Rp0).

Or let the riots of 1998, the year 2016 yesterday was a big event like BREXIT (British Exit), where the British state broke away from the EU to make regional stock markets fall.

Other cases, for example, political condition related to Presidential election also usually also influence the movement of stock exchange.

The question is, what should I do if there are unstable economic and political conditions? In theory, you'd better divert your money from the stock market to the money market (bonds or deposits).

When there is a crisis in a country, then the stock market will fall without any mercy and nothing can fight it.

2. Beware of Exchange Rate Risk

Next, we need to be wary of changes in currency exchange rates. Changes in currency exchange rates can also be said to be very influential on the stability of the stock market.

Changes in a stable currency exchange rate or a normal change actually will not cause turmoil in the stock market. Unlike the case when changes in currency exchange rates occur drastically in a short time. This has the potential to create a turbulent stock market, especially companies that have debt in the form of foreign currency.

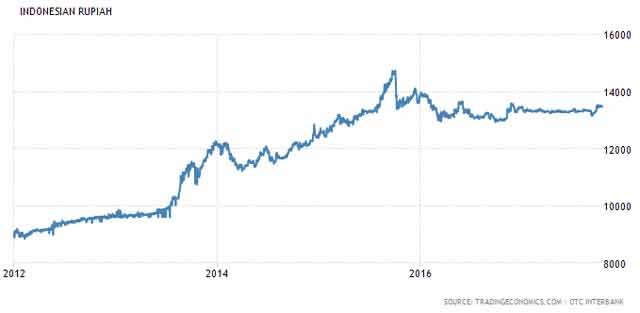

Maybe you still remember when in the middle of 2013 ago, where the US Dollar strengthened from Rp9.000 to Rp12.000 in a few months? Or mid-year 2015 where the Rupiah weakened against the US Dollar from Rp12.000 to Rp14.500 also within a few months?

Note that in that period, the JCI weakened quite significantly. While on the other hand, a significant strengthening of the exchange rate will lead to deflation that is detrimental to the economy as a whole. The impact of the deflation is the weakening of the country's growth due to the close of the export market.

3. Beware of Every Company's Business Risk

In the Annual Report, usually a company explains what are the risks faced by the company. Suppose coal companies are at risk of volatility in coal prices, where coal company stock prices fall when commodity crashes occur in 2012.

Another example is suppose the automotive companies and their supporters (financing, tire manufacturers, etc.) are at risk of economic growth. This happens when sales of cars and motorcycles plummet in 2015, causing the price of ASII class shares (Astra) also dropped significantly.

In addition to ASII, tire manufacturers such as GJTL (Gajah Tunggal), or finance companies such as ADMF (Adira Finance) and WOMF (WOM Finance), stock prices also fell.

By knowing the business risks of the company, we will be able to anticipate the risk of such losses. How do we know the business risks in the annual report? The way you can see in the "Managed Risk" section.

4. Beware of Liquidity Risk

This risk is related to the value of capitalization and the magnitude of a share transaction. The importance of liquidity of a stock is mainly due to unexpected factors that require you to sell all of your shareholdings.

The sales process will be easier if there are buyers who are ready to accommodate, but what if it does not exist? This risk will also be closer to investors or fund managers who manage large amounts of funds (billions of dollars).

Imagine if you want to sell stock quickly for hospital costs, but because the price is not illiquid, you have to sell it at a low price. Therefore, keep in mind also the factor of liquidity in investing in stocks.

I myself have a count that our position sizing in a stock is a maximum of 5% of the average daily transaction volume of the shares. Suppose the average transaction is Rp 2 billion, then my maximum position sizing is Rp100 million only.

5. Beware of Emotional Risk

As an investor (or trader), we are human beings who can not be separated from the feeling of greed and fear. If the stock price rises usually comes a feeling of greed.

For example, we are already floating profit 10%, normally we would think what it would be like if we enjoy 20% profit?

Or vice versa, when we are in a state of 10% floating loss, normally we will be afraid of what if the stock price continues to fall to 20%.

Therefore, it is important for us to know the intrinsic value of a stock as our basis for minimizing greed and fear.

good