Dark cloud cover. Trading realities.

There is no magic formula or indicator that clearly leads you to the light and His Majesty Profit. You could be a millionaire in six months or a year but you can also explore all the pain and bitterness of defeat and flush your own nerves in the toilet. Welcome to trading – realities that you will have to experience on your own skin.

Those guys who willing to google “best strategy” or “leading indicator” should better avoid this post. Here are only experienced ones who have been through battles of 1-minute price fluctuations and who have reached Zen of long-run speculative maneuvers. If you are in the ranks of the faithful and loyal legion – you will recognize yourself.

Like a little kid who is interested in the origin of scars on his father’s body, so Advisor, who doesn’t remain the idea to find the light in the clouds, will look into hidden corners of the soul and pull out what was buried for a hundred of fails and emotional splits.

1. I don’t want a job – I’m my own man.

Do you want to have a consistent income and make a living from trading? Do not any favors to your broker and start combining your job and trading. Advisor is personally asking you. Do you think you can trick the world and be the only lucky one in a million? It’s a long shot, believe me.

Trading is a business in which it’s unwise to spend your last dime. Be clever boy and make the right start – weight off your emotional skeleton from the very beginning.

Take the example: your deposit is $500 which is equivalent to all your available money, and thus your financial “pillow” (reserve) remained with nothing. In consequence of a series of loser trades, you may lose near 30-50% in a month and that’s a real enough situation. Sometimes even the most experienced traders can’t dodge the drawdowns – a poisoned arrow pierce their armor. The poison starts to permeate your body – it’s getting harder to move each passing day. Whether you admit it or not – your depo is in a bad situation and this is hitting you right at the weakest point – your wallet and your infantile hopes.

If you do not provide material support after a drawdown to your deposit, then who will?

Solution: Rationally thinking traders always have a stable income besides trading. Trading is starts from the desire to spend extra time and idle cash for doing trading itself.

2. A hundred bucks is enough for make a living from trading.

What size of deposit to manage – it’s a question that comes from the paragraph 1. Usually, not rich people come into trading. Statistics show that the average deposit for CIS countries is up to $100, Europe - from $300 to $600. Such a deposit is hardly enough for a full-value trading. But make a living from it is a dream of newbies and amateurs.

It is much easier to earn 10-20% per month from $2000-3000 than 200-300% in the same period from $100 depo. The result is the same - but the way you do it is completely different. The emotional weight of these two ways is absolutely not comparable.

Solution: Save your money on a normal deposit. Nobody starts to do a real business with 100 dollars. "Normality" of depo you will understand when 20-30% will be able to meet your monthly needs. Does it seem to be a nonsense? Well, watch your step when will use martingale to beat the losses in the hope of “boost” a small account.

3. Do not leave your deposit face-to-face with the market.

Sometimes traders need support, financially and morally. Mostly this happens when the deposit is draw down.

When it happens - you are vulnerable and open to hits that come in the form of unprofitable trades. In normal times, you would take it for granted and keep working, without any emotions. But once the depo is getting lower - everything is changed drastically.

Solution: Set the maximum possible percentage of a drawdown individually. As soon as the deposit reaches this mark – replenish it from the material “pillow”. There is nothing wrong with that. It is hard to imagine how many nerve cells will be saved by this decision. The deposit is your friend, remember this. Supporting him gives you an extra confidence and will lead your working ecosystem to a great step forward.

4. There is nothing in common between profits / losses and you.

Sometimes everything goes wrong, and the drawdown whispers something like: “Hey, why would it goes kaput?”. In the contrary, sometimes a series of victories are happened, and you are feel like the market is at your feet, right? Usually after such kind of an euphoria, the throwback is quite painful - losses grow like a snowball. Why so? The reason is pretty simple – you have trapped in a phychology pit. Grab the tools, let’s fix that.

It would seem that victories are happening because of a correct prediction of the market direction. And defeat, because it was wrong. Sounds logical, does not it? Maybe yes, a little. Trading differs from other professions, sometimes drastically.

In fact, you do not need to be right about the market all the time to make money consistently. On the other hand, you may have a true market idea, but lose your money. Yeah, the market is full of unpredictability, which is reflected in your mental state - a surprise for newcomers.

Solution: treat your trades with no emotions. This is achieved through mental relief by doing your job and hobbies, in addition to trading, as well as making a habit of not looking at charts more often than your trading plan requires. Open the order - and forget about it, is it not a dreamboat of all investors?

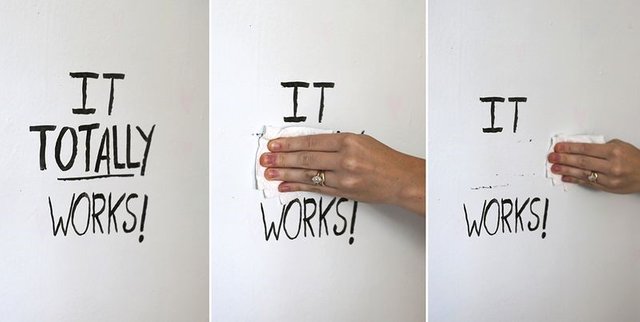

5. Visualization is your friend.

It is rarely mentioned, and it’s a great pity. Visualize everything you can - from small notes and a result of the last trade to your trading plan. It’s much better for you not to try to grab Bitcoin by the horns once again – it's more reasonable to buy a dry erase board and draw your ideas instead (Advisor did so).

Draw everything you can - plans for future, goals, ideas. Then hang it all in a prominent place and return to visualization every time at your workplace. A painted drawing will serve you and you will not miss any stuff you likely did before. It totally works, just give it a shot!

Solutions: to be an artist (joke).

6. My approach in trading is the only right and proper one.

What tools to use when analyzing the charts? Choose a fundamental or technical analysis for this purpose? Maybe it's better to use Price Action instead?

There is no point in supporting the 100-year war between Britain and France technical and fundamental analysis. Be flexible and do not let the Holy War narrows your horizons. A real trader does not have good and bad. The statements like "fundamental is evil, it serves Satan himself" or "Price action is cool and the Holy Grail is in it" point out that someone, at best, doesn’t really understand the complete market picture. Good forecast is rarely consisted of one horizontal or vertical line. Without a fundamental analysis, trader is like a blind and without technical analysis – an armless one. It sounds crazy, isn’t it? Is it possible to have a personal relationship between the analysis tools and trader? Obviously not.

Ignorance of the economy does not exempt from responsibility, ignorance of technical sings does not atone for sins (the trader's bible).

Solution: Learn a lot about the market. It could hardly be said that combining both fundamental and technical analysis would lead you to greater losses. Quite the opposite. You will discover new horizons and maybe reach your Zen of trading approach.

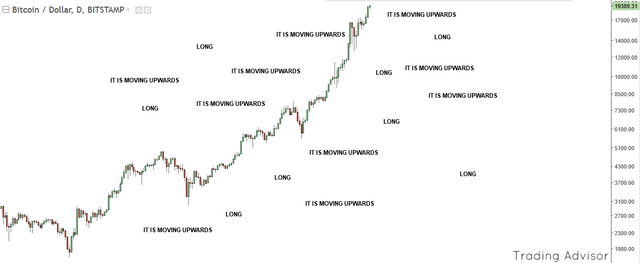

7. Comments are for weaklings!

Many believe that the comments on the chart only litter it up. A great misconception! For example, if you work on 1D TF, you can update comments only once a week. In the comments you can safely indicate absolutely everything - the next levels, the Demand / Offer zone, your overall forecast, etc. Done work for a couple of minutes is a good hint for weeks ahead.

Solution: Comments are our friends, you must invite them as soon as possible!

The conclusion.

All these 7 circles of the trader's hell are been through by absolutely everyone - beginners, experienced and veterans. Absolutely all traders, no exceptions, go through the cycles of depression, rejection and demotivation. It makes no sense to blame yourself for what have done - why? Is it not more productive to take your own mistakes and create a brand new strategy that is based on previous fails? It’s super-real, moreover: if you can admit that you were wrong – you can also built a reversal approach of yourself. In fact, it is often a bit harder than I told you, but the main idea is still the same – when you start a recognition-mistake process you will save lots of nerve and will act like 95% of market participants do not – start focusing on progress.

Congratulations @goodcatt! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @goodcatt! You received a personal award!

Click here to view your Board of Honor

Do not miss the last post from @steemitboard:

Congratulations @goodcatt! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!