Mortgage Calculator for Texas

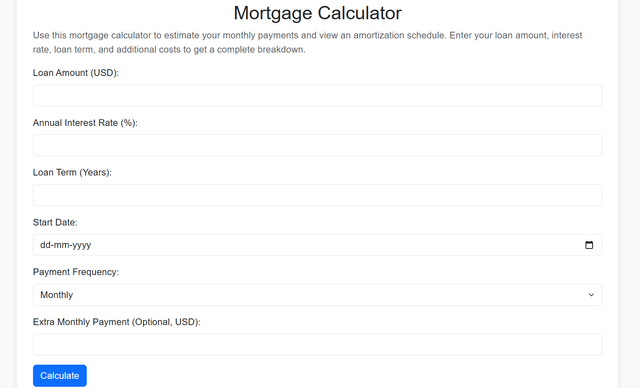

Here I wish to discuss the Mortgage Calculator . It features a clean interface with essential input fields for loan amount, interest rate, loan term, and optional additional costs like property taxes and insurance. Users can adjust these parameters to see how changes affect their monthly payments, providing a clear view of their financial commitments.

The tool's simplicity makes it accessible to everyone, including first-time homebuyers. It offers a quick and easy way to calculate monthly payments and includes an amortization schedule, breaking down each payment into principal and interest. This feature helps users grasp the long-term financial impact of their mortgage.

Who should use Mortgage Calculator? It's ideal for homebuyers, those considering refinancing, and real estate professionals. Its straightforward approach and optional inclusion of additional expenses make it a comprehensive resource for financial planning.

One notable aspect is its potential for educational value. While the calculator itself is effective, adding explanations of terms like amortization and interest rates could enhance user understanding. Overall, the tool efficiently aids in understanding mortgage payments, offering accuracy and practicality for anyone navigating the home-buying process. It stands out as an essential resource for simplifying complex financial decisions.