Blockchain.io – The Euro standard crypto exchange

Blockchain.io, most would have thought it will cost a fortune to buy such a catchy domain name. The CEO of blockchain.io Pierre Noizat has the foresight to purchase the blockchain.io domain name in 2012 for EUR10 when the word blockchain is not even popular yet. He started Paymium, the first European bitcoin exchange back in 2011. After few years of planning, research and hardwork, have decided that now they have the technology and regulatory compliance to launch their own crypto-crypto exchange.

Paymium, the sister company of blockchain.io has been operating a bitcoin exchange from France and served over 170K customer since inception in 2011. The company has been hacked free since 2013. Their company financial accounts are audited by external auditor with a European title equivalent to the American CPA. It is also fully compliant with European banking requirements for anti-money laundering (AML) and know-your-customer (KYC) procedures. They are also compliance to the latest GDPR regulations.

What sets blockchain.io apart from the tons of other centralized exchange in the market now?

Highest security

Hacking is the biggest worry of the crypto exchange. Since the start of 2018, Hackers have manage to steal $731 Million USD worth of cryptocurrency. With most of the hacking revolving around large amount of cryptos stored in hot wallet of centralise exchange. Blockchain.io values security highly even at the cost of convenience. They will store 98% using a cold wallet where the computer is offline and not accessible via web server. The paymium platform has been field-tested and proven hack free since 2013.

https://www.ccn.com/731-million-stolen-from-crypto-exchanges-in-2018-can-hacks-be-prevented/

Reliability

The exchange needs to have minimal downtime and always accessible even under heavy volume. The team members have strong skills in IT security, cloud computing, trading algorithms and have vass experience in running an exchange. They promise to have dedicated support staff operating 24x7x365 to solve users issues.

Accountability

Unlike some exchange that operate from behind curtain of secrecy without information on it’s jurisdiction, contact details and owner information, blockchain.io aims to be fully compliant to current and future EU regulations. It’s operation shall be audited by independent external auditors to ensure integrity of the exchange. It will be registered to ACPR, France’s premier independent administrative authority which monitors the activities of banks and insurance companies. In addition, the BCIO Token Sale is registered with the SEC and the token sale is open to US accredited investors . Blockchain.io has also registered for a Broker-Dealer license with the SEC following the token sale to enable trading of security tokens. This is a big plus as security token is expected to be the next big thing. In short, it wants to run everything by the book.

Other than that some of the features of the blockchain.io exchange are

High performance matching engine – capable of processing up to 2 million orders per day

Basic & advance order mechanism including market, limit, stop loss, take profit, trailing stop, self cancelling and expiration orders

Transparent auction for price discovery and market making service which is useful to bootstrap new cryptocurrency.

Peer-to-peer lending

Proprietary lending for traders to borrow from its centralized inventory.

Short & long margin trading

Another unique selling point of blockchain.io is the introduction of Decentralized settlement. This allows traders to benefit from the low latency and efficiency order matching of the centralized orderbook while settling trades without giving the exchange control of your private keys using upcoming technology like Atomic swaps, hased timelock contract, lightning nework and etc.

Team :

Subsequent to its hack, Coincheck admitted that its $500 million security breach was a result of the lack of talented and experienced developers working on the platform’s security systems which is why a strong and experienced team is needed to run a crypto exchange. The blockchain.io team is an all rounder with experts from both IT, marketing and finance

Pierre Noizat –founder and CEO, visionary in the crypto world, being one of the first to apply cryptography to payTV subscription. He’s an expert in cryptocurrency and blockchain technology. Author of numerous books and article related to bitcoin and cryptocurrency. Started Paymum in 2011. The CEO believes that there should be a decentralization of exchanges, there should not be only one dominant exchange.

Dominique Rodrigues – CTO, PhD in numerical simulation & high performance parallel computing. Expert in cloud computing and security

Pierre Tavernier – CMO, strategic planner with great experience in financial sector and worked in many countries

Laetitia Zito – CFO, 10 years experience in finance management and control.

Pierre Michard – Lead developer, engineering degree in computer science, electronics and telecommunication. Developed open source trading robot

Anthony Grouselle – Full-stack developer, 10 years of web & mobile development

Paul – Gaston Gouron – Full stack developer, bitcoin enthusiast since 2015, developed own crypto (timecoin rail)

Samuel Bezerra – Mobile developer and product owner

Guillaume Berche – Marketing & business developer

Julien Lee Kien On – Marketing & business developer, 9 years experience in digital marketing

Advisors

Unlike most DApps ICO, starting an exchange requires experts who knows how to deal with government authorities on regulatory, taxation and compliance issues. The advisors for blockchain.io covers all aspects of the crypto exchange business, including taxation, regulatory compliance, operations, fund management and blockchain technology.

Jean Pascal Beaufret who formerly works in the Tax Administration arm of the French Ministry of Finance and now an Advisor in Goldman Sachs.

Muriel Goldberg-Darmon - partner in Cohen & Gresser LLP and has significant experience in dealing with regulatory and compliance issues.

Guillaume Seligmann - partner in Cohen & Gresser LLP and has broad experience advising clients on technology, privacy & data protection disputes and regulator matters.

Fransoics veron – Founder & Managing Partner NewFund, a VC firm focusing on early stage investments

Frederic Krebs - Operating Partner NewFund, a VC firm focusing on early stage investments

Guillaume Arnaud – Director in Tikehau Investment Management

Xaviier Faure – Partner in Spring West, a VC firm

Cyril Mountran – Co-founder & CEO of Friendly & Feedly. He’s a serial entrepreneur and angel investor.

Stephane Philipakis – Co-founder Friendly & Twazzup. He’s a tech entrepreneur and IT architect.

Phillippe Dardier – Senior partner – Avolta Partners, leading European Tech Start-up Investment bank.

Benjamin Grange – CEO Dentsu Consulting, advising top management on complex transformation

Julian Kaljuvee – Director Founders Capital, quantitave analyst with 20 years experience in financial service industry

They aslo just added two more advisors on board on 10 July:

Eric Poindessault - Co-Founder & CEO, Biggerpan Artificial Intelligence Expert. 20+ years in full-stack software engineering

Georgi Georgiev - Founding Partner, Gattaca Digital Asset Management

Partners / Backers :

Newfund – early stage VC which invests mainly in France and USA.

Kima Ventures – invested over 400 startups in 24 different countires.

Avolta Partners – provides M&A and corporate finance advice to companies in Europe. Close over 40 high tech deals

Dentsu consulting – global strategy and consultancy with 5000 employee in 19 countries

Cohen & Gresser – international law firm focussing on Intellectual Property and technology, privacy and data security, white collar defense, corporate, tax and employment law.

Hype

the ICO’s social media activity is quite high and here are some stats :

The telegram group has over 40K users. http://t.me/Blockchain_io

Medium group with 9.8K followers https://medium.com/blockchainio

Reddit group with 14K readers https://www.reddit.com/r/blockchainio/

Twitter account with over 30.5K followers https://twitter.com/blockchainio

Facebook group with 13K followers https://www.facebook.com/blockchain.io/

Use Case :

The token is an ERC-20 utility token and can be use for the following on the blochain.io platform :

Fees – as a method to pay the exchange charges like trading, borrowing, transfers, listing, ICO and others

Discount trading – use to lower platform fee depending on the holding amount on blockchain.io

Survey participation rights – use to participate in polls and surveys on the platform.

Loyalty and reward – use to incentivize the token holders by giving airdrops, early access to ICOS, competitions and etc.

Crypto exchange is lucrative business, Binance (the current leading crypto exchange) is expecting to rake in minimum USD$500 Million in 2018. This has attracted many other company to start their own exchange and get a stake of the pie.

Blockchain.io has learn from the proven business model of leading crypto exchanges and plans to generate multiple revenue stream including:

Trading fees for buying and selling on the exchange. To increase liquidity, market maker fees are lower than taker fees

Lending plaform – generate income from lending it’s centralize inventory.

Withdrawal fee

Payment transactions fee for processing e-commerce and in-store transactions.

ICO consulting service

Coin / Token listing fee

Tokenomics

Hardcap of EUR 60 Million with total supply of 200 Milion BCIO tokens. Price per token is EUR 0.70. The allocation of the token are as follow :

60% token sale contributors

4% advisors

16% team

5% airdrops & ecosystem incentives

15% inventory

Public ICO sale is expected to start in 17 Sep’18 while the whitelisting is still ongoing.

As a comparison, Binance raised only USD 15 Mil in Jul’17 and worth $1.4 Billion now. Kucoin raised USD40 Mil back in Oct’17 and is now over USD$250 Mil, Circle acquired Poloniex (crypto exchange) for $400 Mil in Feb’18.

Timeline :

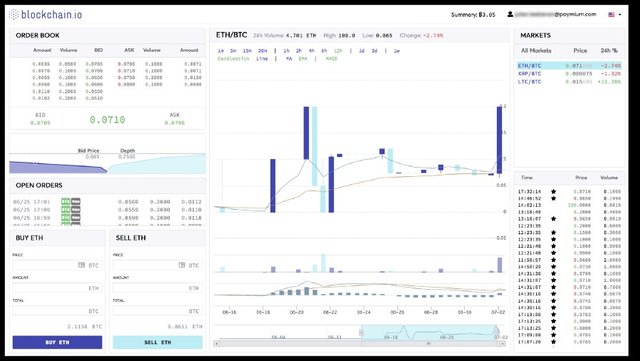

The team is expecting 18 months to fully developed the exchange platform. The Demo MVP launched in 4th July shows wallet supporting different coins, buy/sell page, crypto trading page.

The exchange is expected to launch in Q4’18 with decentralized settlement (cross chain atomic swaps) and lending facility in early 2019

Conclusion :

Blockchain.io is moving in the correct direction by getting the necessary license, accreditation and compliance. The ICO amount raise is decent for a licensed exchange. The team which has been operating paymium definitely knows the business well and has a good track record in running an exchange. The advisor group is great and well rounded. In summary, the ICO has all the ingredients to make it successful.

There’s an ongoing bounty airdrop and whitelist campaign going on. Do visit it’s website or telegram group for more info.

main website : https://blockchain.io/

whitelisting page : https://blockchain.io/token-sale/

airdrop page : https://airdrop.blockchain.io/ - ends 31/July

Links to my other artciles can be found here https://steemit.com/@yzmoney

Disclaimer : I am not a qualified analyst or financial consultant. The contents posted are educational in nature and use for analysing, learning & discussing general and generic information related to cryptos, investments and strategies. No content on the site constitutes - or should be understood as constituting - a recommendation to enter in any securities transactions or to engage in any of the investment strategies presented in our site content. Please do your own research prior to making any investment.

Written with StackEdit.

Nice, informative article about BCIO!

thanks you

@yzmoney you were flagged by a worthless gang of trolls, so, I gave you an upvote to counteract it! Enjoy!!

sounds very promising. i am looking forward to see their progress & development!