HOMELEND INTRODUCING

A MORTGAGE CROWDFUNDING PLATFORM

Homelend is building a platform for blockchain loans

Today's Mortgage Lending Industry

Mortgage loans are at the core of the society

Having a home is one of the basic human needs - a need most people can only afford by taking out a mortgage loan from a bank. In the US alone, more than 8 million mortgage loans are issued each year.

An industry worth $ 31 billion of ancient learning for disruption

The US mortgage market is worth $ 14 trillion and the global market is expected to reach $ 31 trillion by the end of 2018. However, although this market is socially and economically centered The traditional mortgage lending system is still extremely primitive.

The system is based on long and complex paper-based processes involving various intermediaries - very inefficient processes and investment costs for both borrowers and lenders. In addition, mortgage loans are largely unattainable for the new generation of young borrowers, not counting the millions of trusted individuals from mortgage loans due to outdated rating criteria. .

Homelend Mortgage Crowdfunding Platform

Homelend is Developing a Decentralized, Peer-To-Peer Mortgage Lending Platform Serving Two Purposes

Modernizing the age-old mortgage lending system in order to make it efficient, cost-effective and customercentric.

Expanding home ownership opportunities for a new generation of borrowers, meeting their distinct lifestyle and needs.

How does it work?

By leveraging distributed ledger technology (DLT) and smart contracts, Homelend brings together individual borrowers and lenders on an end-to-end platform that streamlines and automates the entire mortgage origination process.

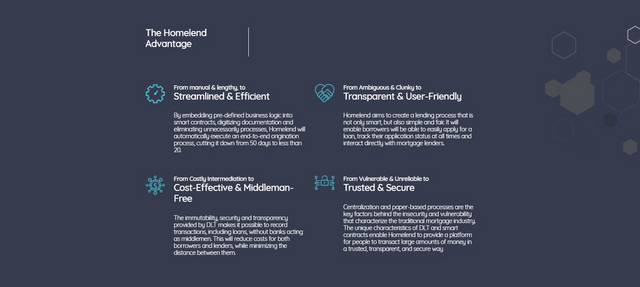

The Homelend Advantage

Streamlined & Efficient

By embedding pre-defined business logic into smart contracts, digitizing documentation and eliminating unnecessarily processes, Homelend will automatically execute an end-to-end origination process, cutting it down from 50 days to less than 20.

Transparent & User-Friendly

Homelend aims to create a lending process that is not only smart, but also simple and fair. It will enable borrowers will be able to easily apply for a loan, track their application status at all times and interact directly with mortgage lenders.

Cost-Effective & Middleman-Free

The immutability, security and transparency provided by DLT makes it possible to record transactions, including loans, without banks acting as middlemen. This will reduce costs for both borrowers and lenders, while minimizing the distance between them.

Trusted & Secure

Centralization and paper-based processes are the key factors behind the insecurity and vulnerability that characterize the traditional mortgage industry. The unique characteristics of DLT and smart contracts enable Homelend to provide a platform for people to transact large amounts of money in a trusted, transparent, and secure way

The Homelend Token (HMD)

The HMD token is the fuel powering the Homelend peer-to-peer lending platform. It's main functionality is to grant access to the Homelend platform.

This utility token also plays an instrumental role in enabling a fast, smooth and user-friendly workflow that is unified and secure.

Token HOMELEND (HMD)

Toner HMD is fuel that feeds Homelend's single-user lending platform. The main function is to provide access to the Homelend platform.

This utility token also plays an important role in providing a fast, smooth and user-friendly workflow that is unified and secure.

And all the tokens can be converted to and from HMD.

Characteristics

Symbol .............................. HMD

Total supply ... 250,000,000

Standard ............................ .ERC-20

Nominal value ........................ .1 ETH = 1600 HMD

Accepted currencies ......... .BTC, ETH, USD

Softcap ................................ US $ 5,000,000

Hardcap ............ $ 30,000,000

schedule

Advance sale ..................... .. March 1, 2018

Crowdsale .................. .TBD

Closure ........................ TBD

For bonuses, if you want to buy a HOMELEND marker (ETH / HMD)

Week 1 ........................... .. ..20%

Week 2 .............................. ..15%

Week 3 ........................... .. ..10%

Week 4 and after ............... ..0%

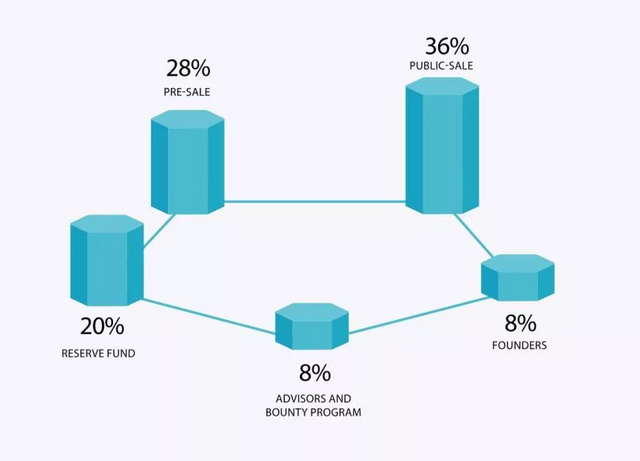

Distribution TOKEN

TOKEN ALL HOME

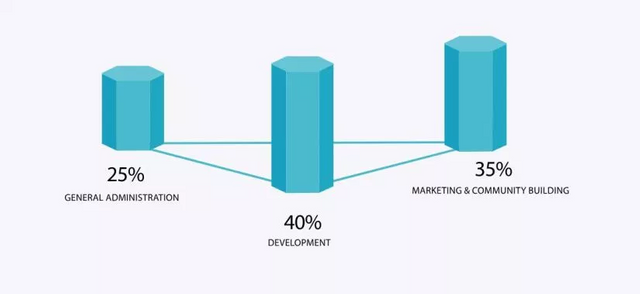

Revenue Usage

ROAD MAP

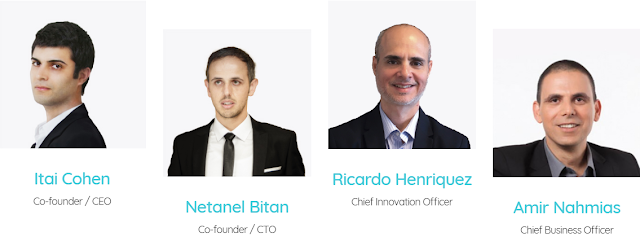

TEAM AND CONSULTANTS

Executive Team Itay Cohen: Chief Executive Officer

Netanel Bitan: Chief Technical Officer

Ricardo Henriquez: Chief Innovation Specialist

Amir Nahmias: Business Development Manager

Michael Tanfilov: Strategic Planning Director

Kanat Tulbasiyev: Lead Developer of

Ram Stivi Blockbacks Backend: developer

Sol Alvarado Quijano: Graphic designer / Community assistant

Vinod Morquile: Blockade DeveloperAdvisory Board

Eliran Madar: Business development / investor relations

Entrepreneur Joram Uzan

Moti Friedman: consultant ant on marketing

Evaluation of Danny Coddy

Raghuram Bala; Head of Analytical Technology

Ido Samuelson: Blockchain expert

Mark Koenigsberg: Tokenomics and data management

counselor

Adina Haham: Business Growth Advisor

Finally, I can say that this is a huge potential of this company. The comprehensive ICO is very impressive. This is an excellent open road to enter the world of ICO.

If you know how to improve our community.

If you know how to spread information about us in this world.

If you have ideas for other improvements, it's a privilege.

If you all participate in our generosity.

More information Visit the HOMELEND link:

Website: https://homelend.io/

Technical documentation: https://homelend.io/files/Whitepaper.pdf

ANN Subject: https://bitcointalk.org/index.php?topic=3407541

Telegram: https://t.me/HomelendPlatform

Facebook: https://www.facebook.com/homelend.hmd.35

Twitter: https://twitter.com/HomelendHMD

Medium: https://medium.com/homelendblog

Author: adam sukses

Bitcointalk profile: https://bitcointalk.org/index.php?action=profile;u=1958433

ETH: 0x5f3f4Bb6EA24D1B188Ee0457a5B807D5fbf043A0

telegram : @Adam sukses

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://coins.newbium.com/post/18378-homelend-project-a-mortgage-crowdfunding-platfor