Part 2: Consensus

“What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party. ” - Satoshi Nakamoto

Bitcoin was released as an open-source software by the anonymous Satoshi Nakamoto back in 2009. He introduced this peer-to-peer electronic payment system as a solution to the economic instability caused by Fractional-reserve spending. This would be the first project to be built on top of an actual blockchain.

Mining is the method used to distribute the Bitcoin network worldwide. The Bitcoin token is the incentive to secure the network. The higher the price (demand) reaches, the more profitable it is for a miner to secure the next block. This encourages miners to compete with one another to mine Bitcoin since the reward is 12.5 BTC for mining the next block. This is no easy task since mining requires a lot of computational processing power, which can be pricey, but can you imagine getting 12.5 BTC for mining a block onto the Bitcoin blockchain?

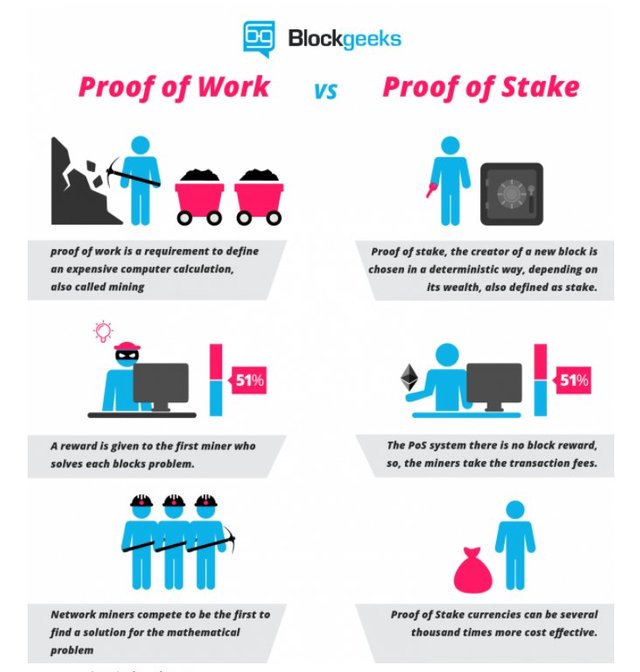

This Proof-of-Work consensus mechanism not only ensures the decentralization of the Bitcoin network but also makes it extremely difficult for the blocks to be altered by an attacker. Once a transaction is confirmed onto the block, it is considered irreversible.

Proof-of-Stake

We have seen Bitcoin grow exponentially since 2009, which has led to an increase in the resources required to maintain the Bitcoin network. Late last year, it was estimated that the Bitcoin network consumes just as much electricity as 2 million U.S. homes. Many critics believe this is unsustainable in the long run.

In 2013, Peercoin introduced the first ever implementation of the Proof-of-Stake consensus mechanism. In order for a validator to be chosen to secure the next block, they must first put up the required stake to do so. If a stakeholder attempted to validate a fraudulent transaction with his/her stake, they would lose their stake and the ability to participate in validating transactions onto the blockchain. Rather than relying upon miners using high amounts of computational processing power to secure the network, Sunny King and Scott Nadal (Writers of Proof-of-Stake whitepaper) suggested that staking would be a more efficient option for nodes (stakeholders) to secure the network and waste fewer valuable resources while doing so. (See chart below)

The costs associated with mining are significantly higher than staking, which is considered to be the more eco-friendly alternative. Staking makes it is easier and more affordable for participants wanting to join in on the action, thus encouraging a truly decentralized network.

In the following post, I will introduce some problems with the current proof-of-stake model, DPoS (an advanced version of PoS), and why it is the most efficient consensus mechanism model to exist. Hasta Luego!

Note: The intention of this series is to simplify Blockchain technology for those who are new to this market. I will do my best to avoid lengthy and super technical details that create confusion. I hope that I am able to help, so feel free to chat me up. I also want to encourage blockchain enthusiasts or lovers of any kind who have suggestions on my descriptions to help me edit this post. I can only hope these posts will encourage others to do their own research before investing into this space.

Please don't forget to do your own research

Authored by Thomas Culia

Looking forward to your analysis of DPoS. Been reading through the whitepaper for EOS and interested in hearing what others think of it.

By far my favorite project along with Bitshares and Steem, which also run under a dPoS model. I am fully behind the EOS team and what they promote. I believe they will revolutionize this space!