Bitcoin Halving Underway: What This Spells For Bitcoin Price

In approximately two years ( 649 days, specifically May 27 2020 and if huge swings in mining hash rate do not occur), the coin reward for mining a new Bitcoin block on the blockchain will be halved that is, reduced by 50%. This represents a drop from 12.5 to 6.25 BTC per block in May 2020.

Bitcoin halving as a fixed event usually occurs after every 210,000 blocks are mined or confirmed on the blockchain and as expected, questions are rife to what effect this reduction will have on the price of Bitcoin.

From expert analysis and in line with historical trends of the previous Bitcoin halvings which occur every four years, 2012 and 2016 respectively; have recorded significant bull runs or high increase in Bitcoin price. However this price increase has not been ultimately specified as a post effect of the block reward reduction.

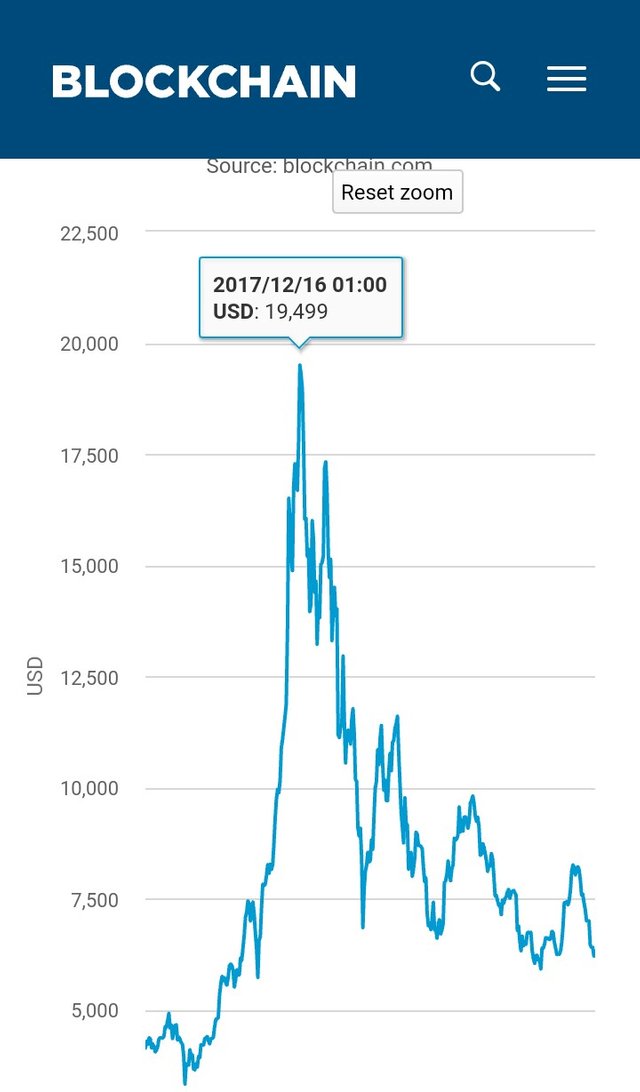

A year after the 2012 halving, Bitcoin price rose to $1000 per coin in November and at that time stood as Bitcoin’s all time high. In similar pattern, one year after the July 9 2016 halving; Bitcoin reached another record milestone of $19,500 in mid-December 2017.

From these historical rise and with Bitcoin prices shooting up one year after the previous halving, it could be theoretical deduced that Bitcoin prices sure follow the increase pattern taking into consideration past price jumps after halving.

In direct contrast however, Cryptocurrency and indeed Bitcoin prices have over time proved volatile with market prices. Notably after the 2017 boom, lots of experts had predicted a further rally in 2018 but the past months have proved most predictions wrong or rather hasty as it follows a trend on decline same as the 2012 fall to $200 per coin after the initial boom and then a pick up leading to the 2016 halving.

Viewing and analyzing the outcome of this halving, its effect on hashrate and stability remain key. With emphasis placed on the halving’s impact on miners rather than prices; as this reduction in block reward represents equal reduction in miners revenue especially as mining difficulty remains significantly unchanged with a rise in cost of mining. Hence, miners will increasingly rely on fees charged as incentive on confirmation of bitcoin transactions.

Experts opine that this boom, spike and dip movement in prices is similar to traditional market changes to relative change in supply of a commodity or interest rates. They reiterate that previous halving’s have negligible effect on BTC price and attribute this to its much anticipated interest rate as users and enthusiasts know the supply is due to be reduced at a certain time, and by what supply hence are forced to buy on the market which automatically adjusts to this effect.

It is also specified that aside halving effect on prices there are a few other factors which come to play on price determination. Ranging from event driven factors, utility as payment tool, users population on the bitcoin network and more.

To this end and as we draw closer to another halving season, it’s left to be seen if halving will have any significant effect on the price of Bitcoin and the fate of miners thereof.

https://btc.ng/bitcoin-guide/bitcoin-halving-underway-what-this-spells-for-bitcoin-price/

Congratulations @stimluv! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOP