Aventus vs Eventchain, differences between two upcoming cryptoprojects aiming to fix the ticketing industry

I think you are already familiar with the countless number of problems and issues afflicting the centralized event ticketing industry globally. The main issues are ticket counterfeiting, ticket scalpers, instant sell-outs and overpriced resale tickets on secondary markets.

Two upcoming projects are aiming to solve these problems by disrupting the ticketing industry with blockchain technology: Aventus and EventChain. In its core they are competitors, both trying to solve the main problems harming the ticketing industry and using the Ethereum blockchain to build their project on.

A quick overview how they both shortly summarize their own projects:

Aventus

EventChain

As both projects have similar goals and similar ways to reach it, it should be interesting comparing the ICO numbers given.

Aventus ICO details

19th july – 24th july

Minimum cap: 24000 eth

Maximum cap: 60.000 eth

Constant price of 92 AVT per ETH (which I read they were altering, clarification given at the end of the article)

• Pre-sale to strategic partners and corporate partners will be 20% discounted (max 27,273 ETH accepted).

• 60% of the total AVT supply will be sold in the crowd sale (the pre-sale will be capped at 30%, e.g. 50% of the total crowd sale percentage).

• The hard cap of total supply of AVT of 10,000,000.

Max cap for 100% of the tokens would be 100.000 eth, which at the moment of writing is about $28 million

EventChain ICO details

The ICO will take place ‘this summer’.

Pre-ICO 11.000.000 @ $0.7 = $7.700.000

Phase-1 ICO 16.000.000 @ $0.87 = $13.920.000

Phase-2 ICO 7.000.000 @ $1.74 = $12.180.000

Total 34.000.000 = $33.800.000

“If a specific phase of the ICO isn’t fully subscribed or Eventchain decides to close the phase ICO offering, the tokens will be allocated to the next phase.”

Take note, tokens which aren’t sold at $0.7 thus can be sold for a higher price, thereby making the maximum market cap potentially higher.

As only 34 million of the in total 84 million are being sold, the maximum market cap – if sold out in the way is explained above - would be:

Max cap for 100% of the 84.000.000 tokens would be $83.505.882,35

As we see above, there are huge differences between the projects. Aventus has a maximum market cap of 100.000 ether, which is about 28 million dollars at the time of writing. EventChain has a maximum market cap of about 83.5 million, with the chance of it turning out even higher if earlier ICO phases don’t sell out - but will sell out at a higher price. That’s a huge difference and worthy of looking into some more.

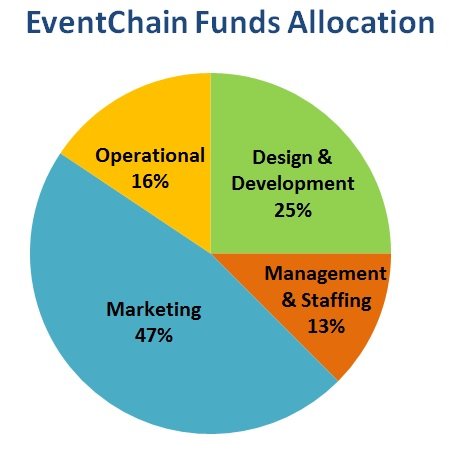

Also alarming is the difference in the % tokens sold and kept behind by the team. EventChain sells 34 million out of 84 total tokens, which means about 40.48% is sold during the ICO. It is not clear what is happening with the rest of the 59.52%+ tokens. They do give an oversight of what happens with the funds raised by the ICO.

source

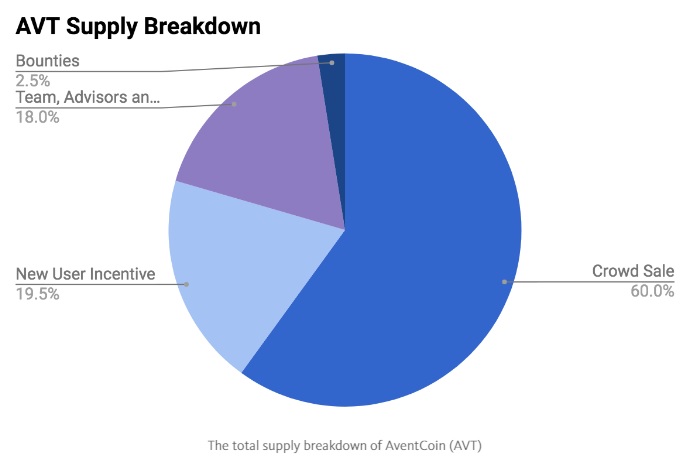

Aventus sells 60% of its tokens. They also give clear information about what happens with the tokens.

- 60% (6,000,000 AVT) will be sold in the crowd sale. Liquid immediately after crowd sale end.

- 19.5% (1,950,000 AVT) will be distributed over 3–5 years as new user incentives, to applications building atop the protocol, event organisers, and promoters.

- 2.5% (250,000 AVT) will be used for social bounties (50,000 AVT) and bug bounties (200,000 AVT). The 0.5% of total supply corresponding to social bounties will be liquid immediately.

- 18% (1,800,000 AVT) will be distributed to the Aventus team, advisors, and corporate partners. Of this, 1,550,000 AVT (15.5% of the total supply) corresponding to the team and advisors will be locked for a year. The remaining 2.5% of the total supply to the corporate partners will be liquid immediately.

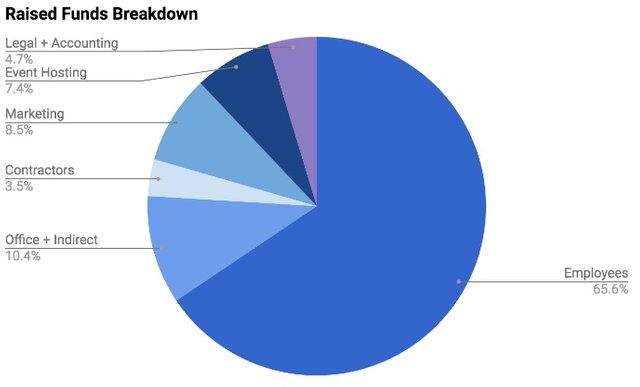

The funds of the 60% sold will be spent as seen below:

source

The huge difference in caps and the enormous amount of tokens which remain in the hands of the team of EventChain raises a lot of questions. Better research has to be done into the differences in roadmaps, teams, goals to be fully able to compare the projects. A simple comparison in numbers does not look too good for EventChain. On the basis of ICO details given out in the whitepapers, I’d have to say that Aventus is looking better than EventChain. Just to check things out I decided to confront the teams and ask it themselves on their slack. I started out with asking the big questions in the EventChain slack, afterwards I went to Aventus and confronted them with some questions and a statement made by EventChain.

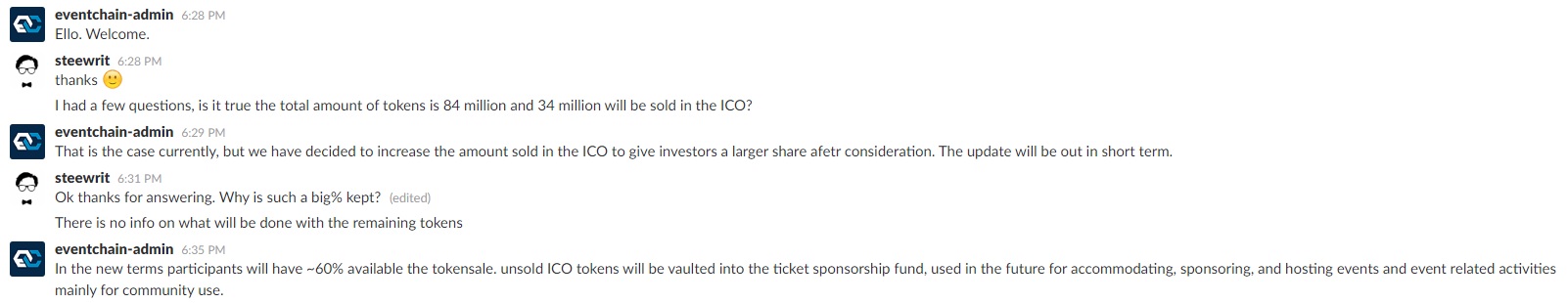

Questions asked in EventChain slack, with an interesting statement made in the end:

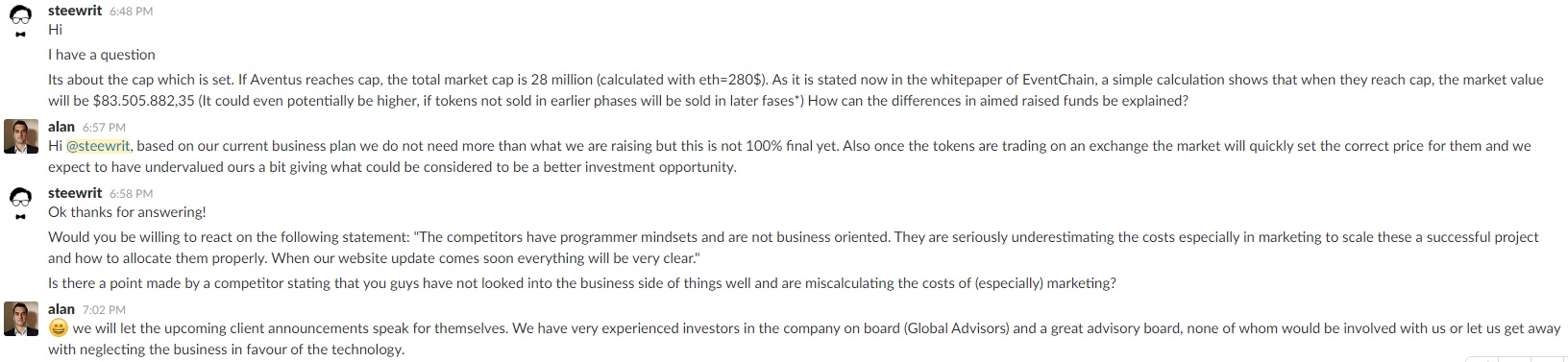

Questions asked in Aventus slack + a reaction on the statement made by EventChain:

Since changing the ETH/AVT ratio was something to keep our eyes on, I asked Alan to comment on the altering of this ratio and if I could post that to create clarity. The answer was as follows:

Conclusion

I think based on the little info presented here, a pretty clear picture can be made of the way both projects are presenting themselves. The problems in the ticketing industry can be solved with blockchain technology and therefore presents a huge potential use-case for blockchain technology by an upcoming crypto project. As stated before, more in-depth research has to be done in the ways this can be done, thereby maybe explaining the differences between the way funds will be spent by both projects. Based on the numbers and the questions asked, I do wanna state concerns about the EventChain project. The Aventus project on the other hand seems to be on top of things, presenting everything in a clear way.

For more info:

Aventus

Website

Whitepaper

Twitter

ANN thread

SLACK

LinkedIn

EventChain:

Website

Whitepaper

Twitter

ANN

Slack

Blog

LinkedIn

Facebook

Youtube

Medium

Reddit