For those who want to make money on the popularity of mine 4 shares

Mining is a profitable business, but not for everyone, fortunately, you can not do it yourself, but buy shares of relevant companies. There are four stocks in this industry that reflect the degree of sale, the rise and fall of sales in this industry.

Mining is a profitable business, but not for everyone, fortunately, you can not do it yourself, but buy shares of relevant companies. There are four stocks in this industry that reflect the degree of sale, the rise and fall of sales in this industry.

NVIDIA and AMD Perhaps the most prominent names in the interest group of us are NVIDIA (NASDAQ: NVDA) and AMD (NASDAQ: AMD), which are known as video card makers and PC processors. None of them expressed their sales related to how much mining, but both of them obviously benefited from selling graphics processors over the past few quarters. As a result, NVIDIA sales last year increased by 41%, and AMD - by 25%.

Perhaps the most prominent names in the interest group of us are NVIDIA (NASDAQ: NVDA) and AMD (NASDAQ: AMD), which are known as video card makers and PC processors. None of them expressed their sales related to how much mining, but both of them obviously benefited from selling graphics processors over the past few quarters. As a result, NVIDIA sales last year increased by 41%, and AMD - by 25%.

The demand for graphics processing is so beautiful that the cost of video card, both new and used, is inflated, and this, oddly enough, creates problems for the creators. Traditionally, the main customers of both companies had gamers and corporations, and if the video card was torn from the mines crowd, it would be very unfortunate for other buyers if Nvidia and AMD created a separate device for mining, the profit margins of the video card fall Will be

On the other hand, for both companies, not a major part of the mining market, it is likely that their shares are able to bear all the ebay and tide related to the price increase in crypto-currencies.

How NVIDIA and AMD Will Survive Without Mining

Taiwan Semiconductor Manufacturing Company This company is also not allocated to mining, and it is not allocated within the framework of profit. Last week, TSMC (NYSE: TSM) reported strong operating results in the first quarter: the transaction increased 6% compared to last year, and March was the best selling month of history. TSMC President and Co-Director Charles Wei said:

This company is also not allocated to mining, and it is not allocated within the framework of profit. Last week, TSMC (NYSE: TSM) reported strong operating results in the first quarter: the transaction increased 6% compared to last year, and March was the best selling month of history. TSMC President and Co-Director Charles Wei said:

"THIS RESULT IS MAINLY DUE TO STRONG DEMAND FOR HIGH PERFORMANCE COMPUTING, INCLUDING CRYPTO CURRENCY MINING."

In addition, the TSMM client, the Chinese developer of Bitman equipment, based on Enterprise E3 technology initiates the next generation of a special ASIC computer and intends for atheroma mining in early April. The device will cost $ 800, and the shelves will appear on July. Possibly, it was bought chip for Antminer E3 and plummeted in sales from TSMC in March and as a whole to the first quarter.

However, Bitcoin and 2018 may not reduce the price of other crypto-coins but the industry can influence. TSMC forecasts sales growth at 15-2018% at 10-10, and now lowers forecast 10%. If the value of the crypto currency continues to fall in Nvidia and AMD, then it may not be the best way to influence the share capital.

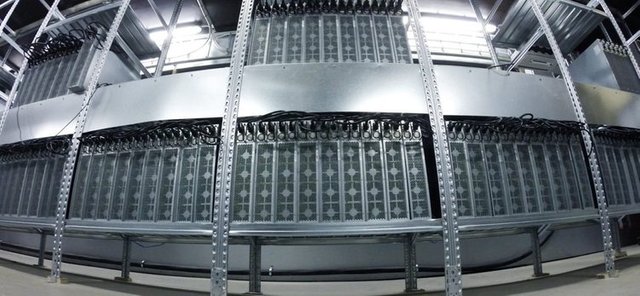

Highway BlockChain Technologies If you want your investments to reflect the success of the mine business as much as possible, but it is not ready to deal with yourself, you can buy trading shares of the company's Hayawab Blockchain Technologies. This company continues to increase the mining capacity of Sweden and Iceland (in this country it is cooling, which is capable of saving cooling power, as well as cheap electricity), and an estimated 150 million dollars of operating income.

If you want your investments to reflect the success of the mine business as much as possible, but it is not ready to deal with yourself, you can buy trading shares of the company's Hayawab Blockchain Technologies. This company continues to increase the mining capacity of Sweden and Iceland (in this country it is cooling, which is capable of saving cooling power, as well as cheap electricity), and an estimated 150 million dollars of operating income.

It is also interesting that this young company has already got its first profit. Yes, this is just $ 149 724, that is, zero dollars per second, but it's a significant profit with a turnover of $ 3 million! It is believed that when HIVE comes with full power, the quarterly profit can be more than 10 times.

No one knows what the price of the crypto currency will be. The truth is that highway blockchains do not sell all erected tokens, Atmarm Classic and Jacks - some of them are in the hope of rising prices. In this way, the company's share price does not depend solely on the success of the mine, but also depends on the behavior of the crypto-coin market.

Here, in the case of the company described above, there is a risk. Investors should consider that HIVE is only engaged in mining, so that the value of the crypto currency will dramatically decrease, their investment may be reduced. In addition, the company's capital will be required, and it is expected that existing investors will be shocked by further transactions in the shares. Unfortunately, these risks are the exchange of investors that the company pays for access to shares.

I will upvote and resteem your last blog post free to my 35,000+ followers if you reply with the word, "free".