UniLend AMA Recap in GainsChat channel

Hi Folks!

UniLend Finance had an AMA session on January 27th on the GainsChat TG channel (https://t.me/GainsChat) and Chardresh Aharwar, UniLend's founder and CEO and Ayush Garg, UniLend's marketing & ops lead, participated in this session. Here is the recap of this event.

Segment 1: Introduction and basic questions

GainsChat:

Chandresh, Ayush, Welcome to the GAINS community. We are really happy to have you with us today and really excited to learn about UniLend. Let's start by hearing a bit about you both.

Chandresh Aharwar:

Really glad to be here. Thanks Gains team for Inviting us.

GainsChat:

What did you do before crypto and did you have any other previous venture in crypto? What is your role at UniLend?

Ayush Garg:

I am from Computer Science background with experience working at companies like Uber and Box8 (Indian startup with 700cr valuation)

Have been part of Crypto space since early 2017. I have also with Startup Oasis - Initiated by IIM Ahmedabad and Rajasthan Gov. I have been part of UniLend's team since launch and now leading front in Marketing and Operations.

Chandresh Aharwar:

Many of you probably already know I have been actively contributing to the blockchain space since late 2016, including holding the lead Marketing & Strategy position at Matic Network for around 1 year & actively contributing to the ethereum ecosystem frompast 3-4 years. Last year, around august we started working on UniLend.

GainsChat:

That's some rich background you guys have. UniLend must be really lucky to have you. Let's talk some more about it then. Can you please give us a brief overview of UniLend?How many people are on the team and for how long has the team been working on the project?

Chandresh Aharwar:

Please feel free to go through more details at https://unilend.finance/. UniLend is a comprehensive DeFi protocol with the mission to unlock the true potential of decentralized finance. Essentially, UniLend Finance will offer every DeFi capability imaginable for any ERC20 asset, including the $30B+ of assets which are currently excluded from DeFi. I have heard people say UniLend is like a combination of Uniswap, Compound and Aave. This is one way to think of our protocol. We have been working on UniLend from early 2020 & came out to community in august. Other 2 co-founders were previously working on https://metatransact.com/ Currenty our team is more than 15 members working remotely.

Ayush Garg:

UniLend is picking up the Defi revolution from where Uniswap took it. Our mission is to build a Universal platform for Lending and Borrowing.

GainsChat:

Can you talk some more about that. I'm particularly interested in the fact that UniLend is like a combination of Uniswap, Compound and Aave. Additionally, there are a lot of DeFi products out there, what sets UniLend apart from the rest of the products on the market.

Chandresh Aharwar:

So, if you take examples of aave & Compound, they are dependant on other dexes for liquidation like uniswap etc.. one of the major reasons they are not able to allow more ERC20 assets in their ecosystem as many are highly illiquid or volatile. UniLend is coming up with an approach, where Trading & Money markets are integrated with each other. So, we are not dependant on other DEXes for liquidation & hence will be able to allow all assets on our platform. UniLend is targeting the huge market of 6K + tokens which are not supported by any money market currently.

Ayush Garg:

That's true that there are many DeFi products out there, its very exciting to see so much energy in the ecosystem. A lot of very good projects are still left out of the real proposition. Major protocols are still not allowing more than 30 tokens.

GainsChat:

That's really cool. Congratulations on the launch of your protocol’s Alpha release! How about we delve deeper into that, and maybe you can share a little about some recent partnerships and news you've released?

Ayush Garg:

Thank you for your positive words, I would be happy to share. I think everyone should be excited for our upcoming roadmap goals and the many collaborations with the projects we’re working with. Like stated above, we’ve recently launched our Initium community testing event. We believe we’ll receive great feedback, since our early access program community testing initiative was very successful. In addition, Q1 of this year has officially kicked off, so expect to see new releases on the horizon. Specifically, the next big release will be the Beta release of our protocol. There are many additional milestones coming soon after, such as liquidity mining/staking features to be added to the mix. In regards to our partnerships, everyone probably noticed that we recently strategically partnered with Mirror Finance to enable decentralized lending and borrowing of synthetic stocks via UniLend. Yes, we’ll be the first protocol to offer this type of functionality. Get ready to lend and borrow the world’s major stocks (including the FAANG tech giant stocks). Also, we’ve recently entered into another cutting edge partnership with Nord Finance, who’ll be integrating UniLend Finance into the Nord Advisory portion of their tech stack. This will enable new DeFi investing strategies for the DeFi community. Nord Finance’s community will be introduced to the innovative features of our protocol, thus helping to further enhance our future growth as well. All this is just the beginning, many more collaborations and unique protocol functionalities are yet to be announced.

GainsChat:

This all sounds exciting! Security-wise, how can users be sure they are safe while using such a new protocol?

Ayush Garg:

Great question ! I would say we are much more secure than other money market protocols. For instance, current protocols are dependent on other DEXs like Uniswap etc. for liquidations (which is a major concern for adding illiquidity & more volatile assets). Nobody has any sort of control on these DEXs, whereas in the case of UniLend, we are deriving the lending/borrowing capacity of assets based on the liquidity available on our trading platform. Hence, we are not dependent on any other protocol for liquidation & everything is handled within the UniLend ecosystem. The problem we are solving is quite large and it requires a complete ecosystem to be built for catering to such a problem. Progress on this front is going strong. Also like our roadmap suggests, during Q1 of 2021, we will have proper audits in place from a variety of the best industry players to make sure our protocol is safe for users. https://t.me/UniLendAnnouncement/78

GainsChat:

Talking about your roadmap, what stage is the project at? How far along are you and what should we expect in the coming months?

Chandresh Aharwar:

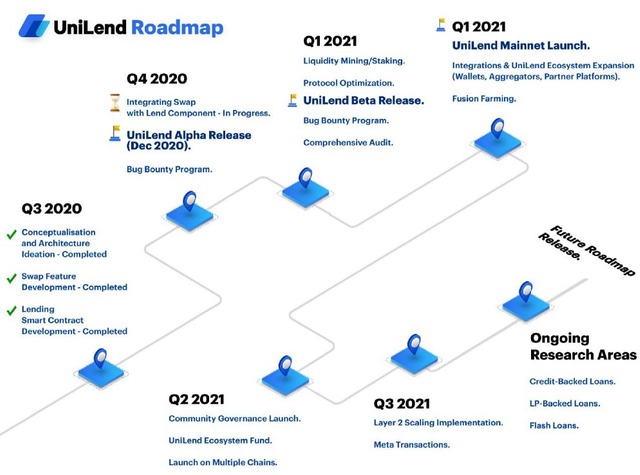

Though our Alpha was a monumental event in our journey, there is so much more in store for 2021. Above we stated that Q1 has many exciting roadmap milestones on the horizon, including our Mainnet release coming in Q1. Additionally, Fusion Farming should also go live during the first quarter. This is an innovative feature which will allow UniLend liquidity providers to attain two different tokens at once by providing liquidity. Again, this is just the first quarter of 2021. In the future, UniLend will implement community governance, the UniLend Ecosystem Fund, launch onto multiple chains, layer 2 implementation for a superior user experience, and even metatransactions. We’ll also bootstrap new projects in the UniLend ecosystem with full DeFi functionality right from their token launch. Empowering brand new tokens with comprehensive DeFi functionality is a concept completely new to the crypto space, and something which is extremely valuable to new tokens looking to establish a user base and solid use cases for their token. Therefore, we anticipate that listing on UniLend (in addition to traditional platforms such as Uniswap) will be standard procedure for new token launches. In fact, we recently launched a poll on Twitter regarding this, and the crypto community echoed our sentiment strongly. You can see the full roadmap outlining our plans up until Q3 of 2021 here: https://unilend.medium.com/presenting-unilends-roadmap-gearing-up-for-alpha-launch-in-december-2020-89ff10805bcd

These are all things that we can confidently say we can fulfil based on the dates shown via our roadmap, though there are many other items we are also working on/researching in the background.

Ayush Garg:

In case anyone to test out Alpha, please check this link. https://t.me/UniLendAnnouncement/150

GainsChat:

That sounds great. Did you raise funds so far? If so, how did you handle them? And are you planning to do any future raises?

Chandresh Aharwar:

Yeah, we have raised $3.1Mn in Aug 2020 from well known investors in the space. Funds we have raised are majorly being used for operation activities & marketing. We are progressing as per our plan on this 🙂 We are not planning for any future raises atm & totally focused on delivering what we promised to our community.

GainsChat:

Final question before we move on to the Twitter questions, What role will the $UFT token play in your ecosystem?

Ayush Garg:

$UFT is a governance token for the UniLend Finance platform when our permission less listing will be live. But apart it will be used in meta transactions for paying fee and using UFT the fees will be reduced to 40-50%. Also many tokens are coming like Polka cash where UFT holder will added benefits of staking and earning rewards. In Future we will come up with UniLend Launch Pad where projects can build on our platform, so $UFT will be used in development there.

Segment 2: Twitter Questions

Q1. The risks related to lending platform is the smart contract risk. Has your smart contract been audited by any blockchain system ? How does UniLend apply for a witness node or deploy/manage a smart contract ? Why should we feel safe when lending assets from UniLend ?

Ayush Garg:

This is a very pressing question for many projects. To begin with, we are build on Ethereum and with this comes the security of Ethereum Block chain. I would say we are much more secure than other money market protocols. For instance, current protocols are dependent on other DEXs like Uniswap etc. for liquidations (which is a major concern for adding illiquidity & more volatile assets). Nobody has any sort of control on these DEXs, whereas in the case of UniLend, we are deriving the lending/borrowing capacity of assets based on the liquidity available on our trading platform. Hence, we are not dependent on any other protocol for liquidation & everything is handled within the UniLend ecosystem.

Q2. Many defi projects try to offer Lend - borrow features but most of them haven't fully implemented this feature on their platform even when their project has been launched? Is this feature fully usable by the user on the Unilend Finance platform now?

Chandresh Aharwar:

Yeah. That's what the major difference is with us. We already have our alpha live & the complete code on github open sourced, for anyone to verify. We are planning for a guarded launch initially & already onboarding our close partners for early access but ultimately our platform will be permission-less working through governance https://app.unilend.finance/

**Q3. UniLend is going to have Permissionless listing where Any ERC20 token will be able to list without any entity controlling the listing process. How does UniLend protect users against scam project or rug pulls since anyone can list anything? **

Chandresh Aharwar:

Yeah. Just imagine UniLend like uniswap with added functionality of lending & borrowing. Similar way, permission-less listing works on Uniswap, it wil work on UniLend too. We will have some scam tokens also getting listed, but again the corresponding base token liquidity will also have to be provided by ILP. It will be smooth expereince like uniswap only, where you get a list to choose tokens you want to interact with.

Segment 3: Quiz

Q1. In what Quarter UniLend Mainnet Launch projected to happen?

- Q2 2021

- Q1 2021

- Q4 2021

- It is already launched

Answer: Q1 2021

Q2. Which of the following tokens are going to be listed on UniLend for Lending and Borrowing

- Synthetics off major stocks of FAANG(Facebook, Amazon, Google, Netflix) and Tesla

- Synthetic tokens of Gold and Silver

- All ERC20 Tokens

- All of the above

Answer: All of the above

Q3. Which DeFi capabilities are live in the Initium v1 (Alpha)?

- Permissionless listing of any ERC20 asset

- Lending & borrowing using UFT tokens

- Governance

- Spot Trading

- Tokenization of assets

- All of the Above

Answer: Lending & borrowing using UFT tokens

Q4. In which quarter this year (2021) will our Liquidity Mining/Staking to go live?

- Q1

- Q2

- Q3

- Q4

Answer: Q1

Q5. Which Leading Korea-based exchange has now listed UFT with our first-ever KRW trading pair?

A - CoinDCX

B - MXC

C - Probit

D - UniSwap DEX

Answer: Probit

Segment 4: Live Questions

Q1. We are in DeFi mania currently and even NASDAQ mentioned that UniLend, a lending protocol, raised $3.1 million. How will this amount be utilized and when can we expect your public token distribution event and platform launch?

Ayush Garg:

Yes our fund raising was covered by NASDAQ,part of your question is already answered above, our IDO was done in oct 2020, and after Alpha we are now focused on our Beta Launch!

Q2. Defi untapped market stands at over 20B$. How will Unilend tap into this huge market opportunity to be one of the Frontiers in the Defi space? What is your go-to market strategy?

Ayush Garg:

The untapped market is actually much larger than this and permissionless listing will be in DNA of UniLend. just like how today protocols use Uniswap for IDO, similarly everyone will be tempted to choose UniLend to instantly unlock lending and borrowing. But before all this UniLend will have a guarded Launch with our partners where a glimpse of UniLend's capabilities will be showcased to users. Next whole month will be covered with some exciting partnership with major Defi projects, join our announcement channel so dont miss them!

https://t.me/UniLendAnnouncement

Q3. Any asset can be listed on UniLend platform, but once it does, what trading pairs are created? Is it an automatic feature or the owner has the possibility to decide it?

Ayush Garg:

This is good question! We will start with Ethereum as the base pair for the listing. Moving ahead based on governance we will keep adding more tokens to the list.

Q4. From where you get the project name? What does it means to you? And why you choose this name for your project?

Chandresh Aharwar:

So, actually UniLend stands for Universal Lending. When we started working on the idea, major aim was to built universal protocol which caters to major requirements of money market. UniLend makes everyone understands, what we are working on also.

Q5. I understand that more than 6000 assets are not integrated into markets, how does Unilend integrate it and cover this demand?

Chandresh Aharwar:

If you take example of major assets in top 200. it covers major market cap currently. If you crunch the numbers in further details, you will realize if we supooort intial 200 tokens on our platform, it will bring more than 70% market cap & also around 80% of the community effects. So, overall we will be able to tap into major crypto ecosystem with top 200 tokens only. What we are more interested is in the other markets we are adding like stocks, commodities, oil, real estate etc.. that ultimately makes the market much bigger than anyone could have imagined.

Q6. BRIEFLY EXPLAIN THE features/improvements you are planning to add to your products in the near future and the Ecosystem?

Ayush Garg:

We are building our project from scratch and UniLend is not a fork of any other project. Our platform will Lending/Borrowing, Swap, Redeem feature in build. Also there will be technical features to improve the UX of the trading and lending for extensive usage. We did partnership with CyberFi who will be building automated features on top of UniLend's platform. UniLend Ecosystem is already a power packed arsenal, but coming weeks are launching major Defi projects with more utilities added to our ecosystem.

Q7. In addition to the planned features of UniLend, what else will be so amazing, but we can only guess about it? What is there in UniLend that other exchangers do not have?

Chandresh Aharwar:

Multiple things, I would say.

- Arbritage opportunities our protocol will offer ( Imagine holding your tokens in wallet vs. earning some apr by lending it on our protocol. You can even use it as collateral)

- Markets opening to other than crypto assets like stocks, commodities etc..

- Birth of totally decentralized launchpools for exciting upcoming projects & the list goes on

Q8. Can Unilend be an investment for all users, whether they are young, beginner or already familiar with crypto?

Ayush Garg:

Our major focus is to build our protocol for lending/borrowing. We will enable major features to the platform for quick and easy listings. Our platform will also have yield farms for stacking which will also help in increasing liquidity. Once these are done, we will be launching UniLend Launch Pad, for building on our platform.

Q9. I’m a developer, and I’m interested in contributing to your project alongsides earning, Do you have any Bug Bounty to check for vulnerabilities ?

Chandresh Aharwar:

Yes there will be bounties once we launch our beta and before Mainnet. Also we encourage Etherium development, recently Eth India we sponsored do check our twitter for regular updates.

GainsChat:

It was a pleasure having you join our community today, Chandresh and Ayush! It was great learning more about UniLend. Congratulations on your listing on Probit and we wish you the very best this 2021, as you launch some of the major functionalities of your platform. Anything else you'd like to say? Where can we follow you?

Chandresh Aharwar:

Thanks a lot team for inviting. Great experience.

Ayush Garg:

It was great to be here. Loved the technical knowledge and energy of the community! Anyone can join our community for answers our Admins will help you https://t.me/UniLendFinance