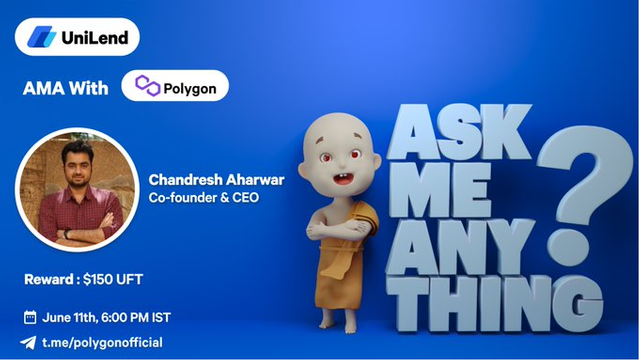

UniLend AMA in Polygon TG channel

Hi Folks!

UniLend Finance's CEO, Chandresh Aharwar participated in an AMA session on June 11th on the Polygon TG channel (https://t.me/polygonofficial) and Below a recap of this event.

Segment 1: Introduction and basic questions

Polygon:

👋Hello @ChandreshAharwar, Welcome to the Polygon community🙂

Chandresh Aharwar:

glad to be here.

Polygon:

🙌Pleasure to have you! Could you please tell us a little about yourself and how UniLend Finance came into being?

Chandresh Aharwar:

sure. Before we get started I would like to thank the Polygon team and community for graciously welcoming me back into the Polygon family. It’s good to be back! For those who aren’t yet familiar, I’m Chandresh Aharwar, the CEO & founder of UniLend. Prior to founding UniLend, I was the lead of Marketing & Strategy at Matic Network, which is now known as Polygon. The idea for UniLend came about when I realized how difficult it was to get the MATIC token listed on AMMs, DEXs, and lending/borrowing platforms. I thought DeFi was supposed to be permissionless, but without including every token people want to exchange, it just isn’t. We were seeking a solution, and so UniLend was born. In regards to UniLend, it’s a comprehensive DeFi protocol with the mission to unlock the true potential of decentralized finance. Again, the concept for UniLend came from the simple idea of allowing every token to access DeFi. Essentially, UniLend Finance will offer every DeFi capability imaginable for any ERC20 asset, including the $29B+ of assets which are currently excluded from DeFi. Many DeFi users say UniLend will be a combination of Uniswap and Aave. It’s true, that’s one way to think of our protocol. In addition to an intuitive UI, we’ve recently expanded to work on multiple chains. Currently, our Permissionless Flash Loan and lending products are live on three networks: Ethereum mainchain, BSC, and now on Polygon. We encourage everyone to look over our links to better familiarize themselves with any further questions they may have about UniLend Finance.

Polygon:

Wow, this seems interesting,🙌it’s been an amazing journey🙂

Chandresh Aharwar:

App: https://app.unilend.finance/

Litepaper: https://unilend.finance/docs/unilend_lightpaper.pdf

Telegram: https://t.me/UniLendFinance

Twitter: https://twitter.com/UniLend_Finance

Reddit: https://www.reddit.com/r/UniLend/

Linkedin: https://www.linkedin.com/company/unilend-finance/

Facebook: https://www.facebook.com/UniLendFinanceOfficial/

Medium: https://unilend.medium.com/

Polygon:

Amazing! Can you tell us a bit more about UniLend and its features?

Chandresh Aharwar:

Yeah, sure. You can imagine UniLend as a combination of Uniswap & Aave. We aim to provide permission-less lending & borrowing for all the ERC-20 assets & more. We also have a lending & flash loan version already live & recently launched on polygon too https://app.unilend.finance/

Polygon:

Amazing stuff! Super excited for the recent launch!

Chandresh Aharwar:

Yeah. It's so great to see the amazing support for UniLend from polygon community & ecosystem.

Polygon:

It always feels great to support such innovative projects! What are the major milestones UniLend has achieved so far and what can we expect from you guys in the future?

Chandresh Aharwar:

Lately, we have been talking to so many polygon ecosystem teams & so many upcoming projects too. It's just amazing to see how polygon supporting Ethereum. Well, we have the most affordable flash loan product available in the ecosystem curently. We have also received huge traction for our $1 Mn grant we launched recently & many new projects are building on our flash loan solution. Our community has grew to more than 100K+ with amazing support of more than 40 UniLend Ecosystem projects & ot keeps growing. We have also focused on providing the good environment for traders on $UFT & we are also available on binance with BUSD & ETH pair. Our roadmap is huge & we have so many things coming up in next few months. Our Community will be in for big surprices soon.

This image does give some idea of how we have grown in last few months

Polygon:

🙌WoW! Looks like the Ecosystem is growing at a fast pace!

Chandresh Aharwar:

Yes, it is. Our team has some of the most hard working folks in the eco-system I came aceoss.

Polygon:

Indeed! Can you shed some light on UniLend’s features, and how to get started with UniLend?

Chandresh Aharwar:

This video should give good idea to users about our recent product. https://app.unilend.finance/ You can start lending your $MATIC here along with some other tokens & earn some APR. https://t.me/UniLendAnnouncement/346 If you are looking to use flash loans for on-chain liauidity, collateral swap, liquidation optimization or arbritrage opportunity you can take flash loans at a minimal fees of 0.05%

Polygon:

WoW! Sounds like an amazing opportunity for MATIC holders. As we have already touched upon Polygon, Can you tell us a little bit about how your experience was building on Polygon and what are the advantages of UniLend working with Polygon?

Chandresh Aharwar:

This tweet says it all. Do watch the video

https://twitter.com/chandresh1091/status/1391786085978546179?s=19

Polygon:

🙌Awesome! This tweet says it all. Moving ahead, can you tell us what will the future of UniLend in the decentralised finance revolution look like? Can you talk to us about your roadmap?

Chandresh Aharwar:

So, as our community has been asking to add suppport for polygon & other major chains. We moved this up from our roadmap & focusing on growing continuosly with more tokens as an options for flash loans & continuosally drive innovations in this area & hence the $1 Mn grant. Going forward our focus is on delivering the flagship product of permission-less lending & borrowing. This will be the game changer in industry & no other team is working towards solving this problem. Apart from this our research team have been working on something to benefit the complete DeFi ecosystem & we will be sharing more information on this soon. This was not the part of our roadmap. Things are going to get exciting for UniLend community. Stay tuned🙂

Polygon:

That’s awesome to hear And I’m sure there’s so much more to come!

Chandresh Aharwar:

Indeed!

Polygon:

Great! Before we conclude, I think there are many in the community who would love to join UniLend and stay up to date with all the news. What’s the best way to keep in touch?

Chandresh Aharwar:

👥Join us on social media: Telegram / Announcements / Twitter / Reddit

Polygon:

Polygon Fam, do show some love to UniLend here!

Chandresh Aharwar:

We keep on sharing all the updates on every platform. Twitter & Telegram community are most active

Segment 2: Live questions

Q1. Being an ex-Polygon employee, how did your experiences there shape your journey with Unilend?

Chandresh Aharwar:

I was part of Matic for more than an year & having worked with amazing team did help a lot. Overall, UniLend was totally new experience with doing things from scratch & taking the role of CEO was specially very challenging with managing all the different verticals of company. Leaned a lot & still learning daily from the amazing folks in this ecosystem.

Q2. how can users be sure they are safe while using your protocol? Is it audited?

Chandresh Aharwar:

Yes. Our protocol is audited by certik & is live from more than 2 months without any issues till now. https://docs.unilend.finance/the-protocol/audit-reports

Q3. UniLend is global project or local project? At present, which market are you focus on, or is it focused on building and growing to gain customers, users and partners?

Chandresh Aharwar:

Permissionless feature of our protocol gives lot of control in the hands of our community through governance. We are definately a global project & our community comes from all the regions. That's why our team has also translated docs to multiple languages for supporting global community. We also have many global communities growing continuosly

Q4. Many new projects initially developed well but were suddenly abandoned. How will UniLend manage the project to maintain its position in the market and become a good project in the blockchain world?

Chandresh Aharwar:

Well, we are backed by some of the well known investors in industry. Also, our team has a past track record of delivering products like metatransact & I was also a part of Polygon previously. So, the trust is already there. Also, our product is live & growing daily. We are listed on Binance also. And we are continuosly delivering on our promises & will keep doing it👍

Q5. Can you indicate a feature or features that you like best about the platform so that it can compete with other competitors? What are you most confident about for your platform? Do you have plans to get users to choose your platform?

Chandresh Aharwar:

Our current version offers permissionless flash loans with best fees in the industry. We are also leading from the front, driving the innovations in flash loans area & on our lending & borrowing protocol. We are one of the unique team solving problems in the industry, no other team focusing currently Thanks a lot @Cryptotechn & complete polygon team for inviting🙏Great expereince🔥

Polygon:

Thank you so much for joining us today @ChandreshAharwar, it was awesome having you! All the best for the awesome roadmap ahead🔥