LIBRACREDIT - PERFECT LENDING ECOSYSYTEM

In a developing society there is always the need for loans and credits to expand business, or solve urgent problems. But the problem of legal and financial risks is always faced. Along with the development of blockchain technology, Blockchain brings security, liquidity, high speed. Libracredit takes advantage of the superiority of block chain technology to create a decentralized lending ecosystem. A more complete lending ecosystem, overcoming most of the existing disadvantages of traditional lending ecosystems

SO...WHAT IS LIBRACREDIT ?

Libra Credit is a decentralized lending ecosystem that facilitates open access to credit anywhere and anytime based on the Ethereum blockchain. Libra Credit is a global initiative with a mission to provide financial inclusion and lower the cost of financial services. Powered by its proprietary big data, AI-based credit assessment technology and existing global partnership networks, Libra Credit has the expertise and capabilities to realize its mission.

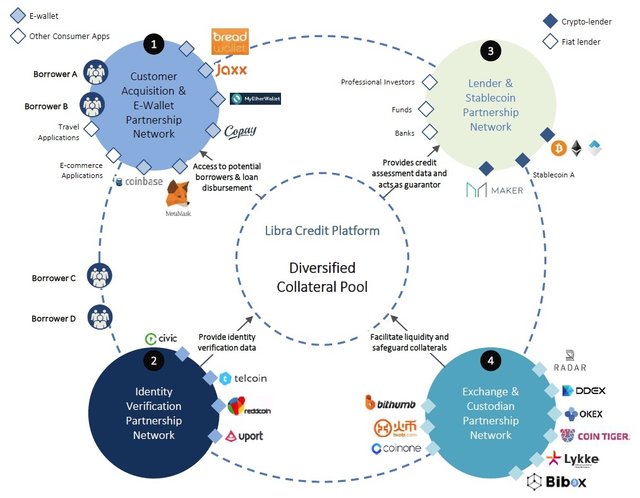

A diagram representing the Libra Credit ecosystem:

COMPARE LIBRACREDIT

With traditional credit markets:

- Lending has many lengthy, complex paperwork

- Can not get the loan right

- Incorrect costs can be up to 10% of total loans

- Records lack transparency

With the crypto market

- The altcoin lack of liquidity

- It is difficult to convert the coded currencies into traditional asset classes such as gold, stocks, real estate ...

- Missing payment method devices.

- High volatility and little guarantee.

With Libra Credit users can get legal and pre-encrypted loans by working with financial and crypto partners. In addition, the versatile Libra Credit allows users to obtain a cash loan by pledging or converting altcoin to stablecoin at a rate that is favorable to them.

ICO INFOMARTION

Token symbol: LBA

Hard cap: $26,400,000

Price: 1 LBA = $0.1

Maximum market cap at ICO: $66 million

Bonus structure: 20%

Countries excluded: USA, China

Timeline: Crowdsale from May 1 to 14, 2018 (please refer to Libra Credit’s website for the most up-to-date information)

Token distribution date: 5 days after ICO

TEAM

Libra Credit was founded in 2017 and operates out of San Francisco, USA. They are backed by investors such as FBG Capital, GBIC, DHVC, Dekypt Capital, Crypto Parency, and others.

The biographies of key team members are listed below:

Lu Hua, Co-Founder & CEO – Lu has experience in the payments, financing, and risk management industries. He was previously the CEO of moKredit, one of China’s top digital credit servicing companies. Lu was also the Head of Core Payments for PayPal China and the Head of Global Banking Platform for PayPal US.

Dan Schatt, Co-Founder & COO – Dan previously worked as the Chief Commercial Officer at Stockpile Inc., a leading fintech company, and as General Manager of Financial Innovations at PayPal.

Howard Wu, Chief Scientist – Howard is a blockchain and cryptography expert who is a Founding Partner of Dekrypt Capital, Advisor of Blockchain at Berkeley, and Software Engineer at Google. He advises the project in a technical capacity and has received a Master’s degree in Electrical Engineering and Computer Sciences from UC Berkeley.

Advisors for Libra Credit include Shuoji Zhou, Founding Partner of FBG Capital, Kenneth Oh, Senior Partner with Dentons Rodyk & Davidson’s Corporate Practice, and Shoucheng Zhang, CEO of Danhua Capital & Physics Professor at Stanford.

ADVANTAGE OF LIBRACREDIT

- The team leading the project is extremely strong, with senior executives from PayPal and successful entrepreneur in the credit space

- Project is powered by blockchain platform & AI. two advanced technology

DISADVANTAGE

- Libracredit will face the traditional financial systems and a few blockchain lending project

- The roadmap is rather vague.

CONCLUSION

A decentralized lending ecosystem - Libracredit has a great future with its concept, features, and technologies. is a potential project with a great idea and available. In addition, with a extremely strong team, founder, advisors with lots of experiences in finance, Libracredit is expected to be a good choice to invest

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.trackico.io/ico/libra-credit/