The Future of Blockchain: 9 Forecasts

Interest in Blockchain technology has hit the mainstream. According to Gartner, "In February 2017, 'blockchain' was the second most searched term on Gartner.com, a 400% increase over the last 12 months. Between 2015 and 2016, the number of inquiries from Gartner customers grew more than 600%. "

For those who have not yet heard of hype, "blockchain" is a type of distributed database designed to record Bitcoin's encrypted currency transactions, so that it is impossible to change or delete once they have been written (although it is possible that versions Blocks can be editable in extraordinary circumstances). In other words, it exists because it is extremely safe and highly resilient.

These capabilities have some obvious applications related to banks and finance, but many other industries are also investigating the blockchain. Technology could someday be used, for example, for smart contracts that would allow companies to pay for each other without an intermediary payment processor, track digital rights to movies and music, record patient health data, or monitor supply chains and shipments Of goods. In fact, there are so many potential uses for Blockchain technology that the World Economic Forum (WEF) regards it as the second generation of the Internet and "the fundamental platform of the Fourth Industrial Revolution," so important to the world's great powers.

Yet even Blockhain's toughest advocates admit that it will probably take a long time for technology to become pervasive in society as a whole. In this respect, the Datamation website has risen 9 predictions about how the Blockchain market is likely to evolve over the next few years:

#1. The financial market will adopt Blockchain first

The roots of Blockchain in cryptography make it inevitable that banks, insurance agencies and other financial companies are among the first to use blockchain technology. The PwC Global IQ Survey in 2017 found that only 9% of the financial services companies surveyed were already making substantial investments in blockchain, while 36% expected to do so in the next 3 years.

Blockchain could drastically reduce the amount of time it takes to settle transactions, jumping from days to mere seconds, while at the same time adding an unprecedented level of security. In addition, some research indicates that it could also reduce costs by billions of dollars. Many within the banking industry believe that the blockchain will enable entirely new business models, and in this race the industry is among the first to successfully implement the new technology. As a result, Accenture predicts that Blockchain will be considered mainstream throughout the financial sector by 2025.

#2. More use cases involving Blockchain should emerge

Financial firms may be the first to try the blockchain, but they are far from the last. A survey by PwC found that 11% of hotel and leisure companies and 6% of automotive companies have invested in the technology. In addition, 12% of healthcare companies, 7% of energy and mining companies, 6% of retailers and 7% of technology, media and telecommunications companies plan to invest in the next three years.

Experts say that Blockchain's ability to manage smart contracts may make it suitable for managing digital copyrights and can also be particularly beneficial to streaming services. In addition, many types of companies are considering how blockchain can be useful for the Internet of Things (IoT), perhaps by allowing secure payments directly from consumer devices or even allowing machines inside factories to order and pay for their own spare parts when required.

# 3. Countries are considering regulating Blockchain

Most national governments have yet to establish rules regulating encrypted currency or other blockchain applications - and this is a blessing and a curse for blockchain advocates. On the one hand, startups are free to innovate as they see fit, but on the other hand, more established companies hesitate to adopt the technology until they know exactly how it will be governed and especially how much risk it will be involved.

Some government agencies and international organizations have already begun preliminary work to regulate technology. Earlier this year, for example, Japan began to recognize bitcoin as a legal currency and the World Economic Forum published a long study on the likely impact of various blockchain governance methods. In the United States, some agencies, including the IRS and the Federal Electoral Commission, have virtual currency policies, but the nation does not have a global policy. It seems extremely likely that international efforts, as well as the US, to regulate the blockchain chain will continue, perhaps with more legislation being passed this year.

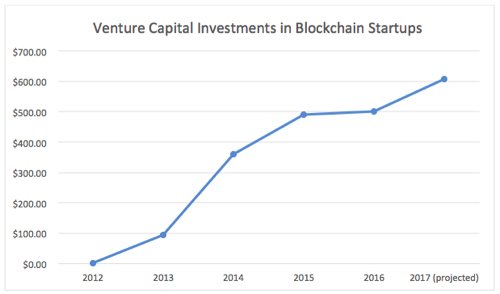

# 4. Investors to Continue to Fund Blockchain Startups

Venture capitalists are poised to fund startups related to the new technology. According to Coindesk, investors have already injected about $ 1.8 billion into this market. In 2016 alone, blockbuster startups secured more than $ 501 million in funding, and the total for 2017 already exceeds $ 303 million.

Of course, startups are not the only ones in blockchain. Many well-established technology companies have already announced projects in the area. IBM, for example, recently launched a new mainframe designed to handle blockchain and encrypted transactions, and Microsoft Azure offers a cloud-based blockchain service. Many others have joined industry organizations focused on improving and standardizing technology.

# 5. Ethereum will grow in importance

One of the most interesting projects in the blockchain spectrum is Ethereum. A bit confusing, Ethereum is the name of an encryption that competes with bitcoin and an open source development platform to create blockchain-based applications such as smart contacts and smart wallets. In CoinDesk's State of Blockchain Q1 2017 report, 94 percent of tech enthusiasts said they are optimistic about Ethereum's current status, about twice as high as reported on Bitcoin. The report also pointed out that the market limit for Ethereum encryption increased by 499 percent between the fourth quarter of 2016 and the first quarter of 2017, reaching a staggering $ 3.6 billion.

While bitcoin can only be used as encrypted currency, Ethereum has many other uses. In addition, being open source is attractive to many organizations. And leading companies like Accenture, BP, Credit Suisse, ING, J.P. Morgan, Intel, Microsoft, UBS and many others joined the Enterprise Ethereum Alliance.

# 6. Companies and regulatory organizations to boost Blockchain interoperability

An important focus for the Enterprise Ethereum Alliance, Hyperledger, the Wall Street Blockchain Alliance (WSBA) and similar organizations is the development of standards that will enable blockchain interoperability. If companies can unite around a specific standard, this can help accelerate the acceptance of bitcoins-based payments and other solutions.

The CoinDesk's State of Blockchain report states that "as more and more blockchains, encryption, tokens and distributed payment systems are released and thrive, it is becoming [increasingly] obvious that we have created a new network of decentralized technologies, forming The backbone of a whole new Economy, information network and source of credibility. We saw momentum and trends for 'interoperability' in order to make the most of the various innovations across the ecosystem. "

# 7. New technology will make Blockchain faster and more scalable

Many of the tech companies currently working on blockchain projects are looking for ways to make blockchain transactions even faster and scalable. Two of the most notable efforts in this space include Raiden, which enables very fast asset transfers, and Lightning, which focuses on scalable instant transactions. Many other projects are also focused on improving technology.

# 8. Demand for talent at Blockchain will skyrocket

IT unemployment is perennially low, and the demand for developers and other workers with blockchain experience is likely to increase very rapidly as the technology takes off. However, few universities offer courses on technology in their computer departments. Exceptions include prestigious institutions known for computer science research, such as Stanford University, the Massachusetts Institute of Technology, and the University of California at Berkeley. In addition, some online education sites offer training in encryption or blockchain. However, these opportunities are greatly reduced when it comes to meeting the demand for trained professionals. Some say that experienced blockchain engineers are already getting salaries around $ 250,000 per year.

# 9. Blockchain may become particularly important in emerging markets

Another prediction for the future of the blockchain is the impact it could have on emerging markets. In an article for the Harvard Business Review, Vinay Gupta and Rob Knight theorize that the blockchain and the encrypted currency could help the developing world overcome the more developed economies. A similar phenomenon has occurred in many parts of Africa when cellular technology has become common in areas without fixed telephone service. The thinkers hypothesize that the blockchain could help the banking sector move forward in areas that are undermined by traditional financial services.

If these theories will or will not materialize, it seems likely that the blockchain will have a major impact on the global economy. For now, his future looks exceptionally bright.

If you liked Upvote, it will help me bring more content like this. :))

Congratulations @jrfantasma! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP