The crazy world of blockchain and crypto

[originally published January 20th]

Why we do this

The idea behind this newsletter is to share with our friends and partners relevant information and quality news. Things like this 8-minute article explaining the basics of how blockchain works, or this cool article explaining the value of cryptocurrencies as medium of exchange.

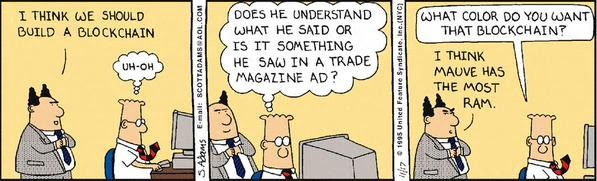

We also do this because there is so much noise and hype and scams out there that it’s more and more difficult to see what’s real and what’s fake. We believe in the future of blockchain and the opportunities it brings, but we also remember the cypherpunk motto: “Don’t trust! Verify!”

News that matter

European Central Bank is asking: “Could bitcoin offer a viable alternative to traditional currencies?” Keep printing euros, and don’t you worry about it!

Tether (an unaudited stable-coin creating company) issues hundreds of millions of tethers every week. Total tethers in circulation: over $1.6 BLN. When this bursts (either exposed as a fraud or shut down by the government), expect a serious price correction for crypto-assets.

As the Lightning Network (more on this in future letters) is picking up steam, Blockstream just launched Lightning Charge, a micropayments processing system.

1.000.000 Ledger Nano S hardware wallets sold so far. Millions more own Trezor. More and more people caring about the security of their crypto.

Bitconnect scam went down. Will it be a lesson not to invest in obvious scams? Probably not.

Radar Relay integrated with Ledger, now supporting wallet to wallet trading. Plug in a USB dongle and safely send money to anyone else in the world, with 0 risk. This is just the beginning.

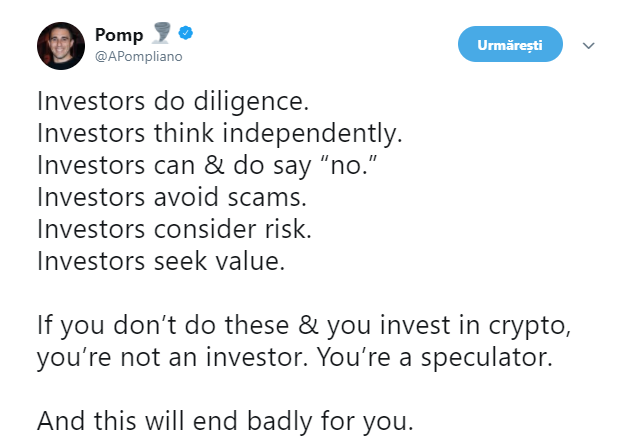

Nugget of wisdom

— Pomp (@APompliano) January 10, 2018

2018, it’s on!

2018 started with a pretty standard correction. Bitcoin crashed to levels unseen… since December. 2017 had five 30% corrections. So this is (still) normal.

We didn’t really watch the prices, but what’s worth remembering is that bitcoin is becoming less and less volatile. When other crypto-assets were dropping (and then bouncing back) by 40–60%, bitcoin was in the 20–30% range. This is really good news! Besides network security and liquidity, price stability is the other important factor in bitcoin’s institutional adoption (by funds etc). These sort of crashes are also good at showing which crypto-currencies are mostly held by long-term investors and which are held by short-term speculators.

Predictions are difficult, but we’d venture and say that in 2018:

blockchain as a industry will continue to grow,

crypto- will establish itself as an new asset class

more money coming in from individuals and institutional

overall returns will decrease, less speculation

more regulation (especially for exchanges)

rise of decentralised exchanges

more miners moving out of China

more hacking causing major losses

less illegal ICOs (some people will go to jail)

legal security tokens (great opportunity!)

micropayments feasible on several top currencies

and yes, Bitcoin price will keep going up! :)

We are in crypto to learn how this technology will change lives and economies. Thank you for joining us in this journey!

Takeaway

Call it shameless promotion, but have a look at Tudor’s article on the 20 most interesting crypto-people to follow on Twitter.

Help us improve.

Please tell us what you would like to read in this newsletter.

You can subscribe here to our bi-monthly newsletter. No bullshit, only relevant news and information.