Greenwash, naivety or scam?

The number of environmental projects on blockchain is growing exponentially. It is substantiated by the reasons including those described in “That’s where public blockchain is indispensable”. The least evil is that the projects are not interoperable and ruthless competition for one and the same limited circle of addressees makes them largely inefficient. Evolutionary selection will do the job. It would be much worse if the process was centralized and channeled by “higher authorities”.

The major issue is that the integration of environmental markets and blockchain means introduction of the new economic paradigm, which became practical, thanks to public blockchain. Many of the project are still trying to reproduce conventional schemes on the basis of new technology just putting old wine into new bottles.

Observations on the vices characteristic for many of the environmental programs including those that are being transferred to blockchain make one ask if it is green wash, simplicity or scam.

A commonly spread concepts that individual has to make effort to change their lifestyle to reduce environmental footprint are well intended but might be actually harmful. They distract attention from far more efficient market solutions and the fact that individual efforts are economically wasteful. The individual costs of substituting one’s car for a bicycle or a subway or abstaining from eating meat may be excessive but actually would be worth a few tons of CO2-equivalent reduction a year at maximum. At the same time, buying out the rights to pollute the environment from large emitters or paying for actual mitigation outcomes is much more efficient and subjectively much less costly.

The only institution that makes such comparison of costs and such choice possible is environmental market. But markets are not an ideal construction they are created by people, and here is another catch –they might be created poorly. In fact, numerous offers to offset environmental footprint are minimarket solutions to reimburse environmental damage in-kind. To be considered as fair these solutions have to be justified on both ends, on the demand side, i.e. in terms of calculation of environmental footprint, and on the supply side, i.e. in terms of quality of offset credits. In many cases calculation is not just too approximate but straightly fraudulent. Calculating specific personal carbon footprint is a complex endeavor. The methodologies used should be transparent and at least reviewed and endorsed by the expert community. Selection and quality of offset credits are even more important. People, who pay to offset environmental damage would expect that offset credit are worth the name. Offset credit should be real, absolute, permanent, verified, enforceable and measurable. At the minimum, there should be an adequate and traceable selection of standards applied, project types and prices to make a choice.

Not a day passes by without a technical panacea proclaimed to resolve global or local environmental problem. And who could say, maybe those engineering solutions or technical standards are a universal remedy. However, correct judgment requires complex expertise non-achievable in most cases. That’s where prices come in. Prices essentially communicate information. They bring the information necessary to make a decision to a minimum and solve the problem of integrating knowledge on complex issues. Unfortunately, if it is not a market price, it would distort the result and its’ communication function dramatically. Besides, in many cases promoters of technical solutions tend to seek government or other authority arbitral support rather than compete.

There is also a widely accepted concept of the importance of co-benefits of any enironmetal activities and projects. While primum non nocere (first, do no harm) is in fact the primary principle, once no one can serve two masters principle is breached, the most effective solutions become least competitive. Sometimes it is true that Bolivar cannot carry double.

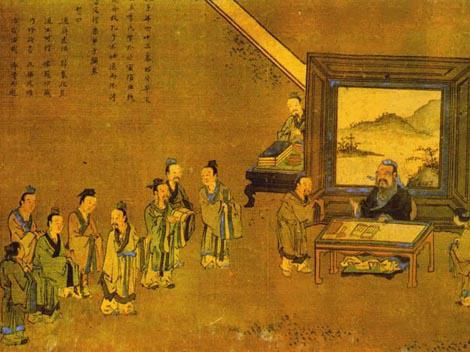

The last but not least of the observations to mention here is that the terms and wordings used are often obscure to the extent that opponents might use same words with opposite meanings. One of evident examples is carbon pricing. It looks like recently in most cases the expression means “carbon tax”, which is not exactly an economic but rather administrative regulatory measure, coercion. People may appraise it or criticize the inefficiency of carbon pricing but the arguments are hollow until they cover truly market prices. The difference between tax and market price, between communication signal sent by the government, an instrument of expropriation, and a communication signal sent by free market, is huge, mixing them together in one clumsy expression is more than confusing. Confucius advised to rectify names in the first place to make words correspond to the meaning. It is especially important in the matters, where people tend to trust and rely on the words pronounced by the opinion leaders.

It is probably not the prevailing case, when these vices are actually a green wash or a scam. More often, it is a result of simplification. But as an old Russian proverb says, “Naivety is worse than theft”.

Anton Galenovich, PhD, DAO IPCI co-founder