BLOODY IMPORTANT QUESTION: should we consider STEEM-ENGINE tokens a security or utility?

| Many of us, more or less are familiar with Steem-engine.com and the concept of TRIBES. That being said, today I would like to ask one hell of an important question related to those topics. |

|---|

INTRODUCTION

.... So, this publication is directed to those of you, dear readers, who have some decent knowledge or have your own opinion/idea of launching your own token on SE.

Lately, we’ve all witnessed a new and interesting trend of so many new tokens being launched left and right on Steem-engine.com and currently there is no way to recognize even half of them. Last time I’ve checked I counted over 400. Most of them completely meaningless, without any sensible business model and sustainable economy that could create and support demand.

IMPORTANT QUESTION

I can hardly imagine that we would stop at this current stage, so there is surely more to come. And part of me believes that launching your own token may be more risky than most of us want to admit. It is really important to ask the question which seem to bother me a lot lately:

Up until a week day ago I didn’t even think about it and I’ve been excited to join PALnet and SteemLEO tribes, investing some of my resources (time and steem) into those two tribes. However, last week a good friend of mine (with years of experience as an investment banker) mentioned that some of the current Steem-engine tokens are nothing but security and the best way for founders to avoid trouble is to stay low under “the radar” and avoid raising to much funds (that could bring unwanted attention).

He also mentioned that the founders/team members who initially would be rewarded with part of a newly launched token would have to pay taxes for receiving them. Which kind of make sense. However, should we pay any taxes if we wouldn’t cash out all those tokens to FIAT currency? I’m not really sure.

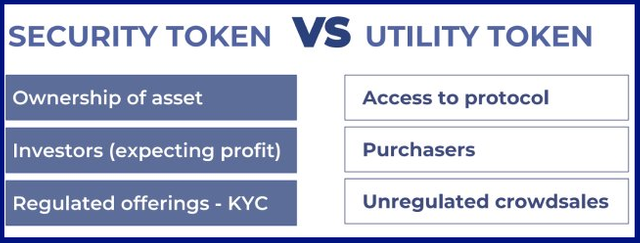

SECURITY OR UTILITY TOKEN?

As far as I know, by launching an ICO and having one purpose – to raise money in order to set up a business – we would have to consider it being a security offering. Adding some utility (as most ICOs tried to do) may help and keep us safe, but I wouldn’t rely on it.

Now how would it look like if one of us would come up with some business idea, would create and launch his own token on Steem-engine and managed to attract solid investors. Some decent amount of STEEM would be raised (let’s say 100k) and it would be used to start up this business.

Should we consider this token to be security at this stage? Or should we not, since we would be receiving STEEM token, which is not a currency in the name of the law. STEEM is a utility token, so in theory receiving this kind of support shouldn’t be a problem. After all we wouldn’t receive any FIAT currency from our investors.

Also should founders be taxed if they initially received large amount of PAL/LEO? I can imagine that if they cashed it out and exchanged to FIAT, then taxes surely would have to be paid. But if they keep those tokens (or exchange to STEEM) and use them within STEEM blockchain (powering up or promoting posts, steem-bounties etc) then should we feel safe?

Source: https://www.coinreview.com/security-vs-utility-tokens/

SHARE YOUR OPINION

So far, those are some of the opinions and very important questions I have. I hope some of you are able to share your views and opinions with me. I fully understand that this industry is not fully regulated and the approach to currently discussed topics can differ depending on which country we’re living in. However, I would still love to hear what you all have to say, and hopefully other readers will benefit from this topic as well.

Note: I read/reply to all valuable comments. Thank you.

Yours,

Piotr

cc: @aggroed, @steemleo, @khaleelkazi, @organduo, @isaria, @neoxian, @bitcoinflood, @asgarth, @chesatochi, @ edicted, @neal.leo, @ cryptopassion

@crypto.piotr has set 5.000 STEEM bounty on this post!

Bounties let you earn rewards without the need for Steem Power. Go here to learn how bounties work.

Earn the bounty by commenting what you think the bounty creator wants to know from you.

Find more bounties here and become a bounty hunter.

Happy Rewards Hunting!

The security question is pretty simple, Piotr. There are 4 questions the SEC is allowed to ask given the result of the SEC v. Howey case:

That being said there are some S-E coins that would fail this test, I think, though I prefer to keep them nameless here.

Excellent.. finally someone referencing to the Howey test:

https://www.investopedia.com/terms/h/howey-test.asp

Another test is in simplified terms this:

If it looks like a dog, behaves like a dog and smells like a dog - it is a dog.

So actually you would have to consult a lawyer in the jurisdiction where you want to incorporate your venture and also a lawyer in every jurisdiction of a person living in you want to sell your token to.

Else you would not be able to get a reliable statement..

Having said this, this is what most likely will happen if you actually do this:

You will incur enormous bills from lawyers and you will get totally contradicting statements of those lawyers because this whole complex is still so new and fresh that there are no precedents or cases at superior courts you can reference to and also no clear cases of the big watch dogs as of this very moment.

So the only reasonable advice a non lawyer could give is:

do not do it!..

.. and if you still want to do it and take the possible risk, IMHO: abate the risk as much as possible.

Those abatement measures could be:

1.) Do not scam or mislead people! (this should be self explaining)

2.) Do not sell tokens for fiat

3.) Do not sell to people in certain jurisdictions as the likes of US/ UK / Japan / China / Kanada etc.

4.) Do not promise any "investment returns"

5.) Do not offer asset backed tokens but only utility tokens and explain the utility use of the tokens

6.) Stay small in regards of numbers of people you are selling the token to and in regards to overall volume raised

etc. etc. etc.

Dear @solarwarrior

Wow. This is obviously one of the most valuable comments I've read so far.

I absolutely appreciate your time and effort. RESPECT.

Yours, Piotr

Dear @shanghaipreneur

I cannot find a way to express how grateful am I for your comment.

I've been thinking: what if someone would like to create token on steem-engine, which would allow him to raise funds (STEEM tokens). Then he would use those tokens to grow his influence within STEEM blockchain and monetize it later on (by starting up digital marketing company).

And later on on monthly basis he would use part (let's say 20%) of real income in FIAT (taxed) to buy-back created token and burning it (decreasing supply and eventually buying back all previously "sold" steem-engine tokens)

Any thoughts on that kind of business model?

Yours

Piotr

Two questions I have there:

Dear @shanghaipreneur

Not by me. However let's I would use those raised steem for promoting purposes (mostly steem-bounties), perhaps to reward few people supporting my growth on daily basis (to avoid transfering funds I would bost their publications with upvoting-bots).

I would have my business legally registered and I would offer my services to Polish IT businesses looking for forign exposure (in english language). Those companies would receive invoices, taxes would be paid. And I would use part of profit to buy-back earlier realeased tokens and burn them.

This way whoever would purchase my token, would know that supply is constantly shrinking.

Yours

Piotr

Knock knock @shanghaipreneur :)

Hey there dear @Crypto.Piotr,

I do like the idea , yet personally I think You should have into consideration a way of making profit parallel that could allow some stability in a "down phase", but that might be me thinking ahead of time..About the %, maybe burning a lot less, making the burning phase last longer, allowing for more people to benefit of, both the tokens and the digital marketing company services, again, this is just my very limited view on the subject, there are many variables to take into account that are not known to form a better opinion, still, the idea doesn't seem bad at all..Ok, maybe a small percentage could be redirected to a trading bot, or traded manually to raise some of the overall profit instead of burning it at the ratio mentioned, I don't really know, just throwing out an idea =XAll the best,CyP.S.: Yes, I'm still awake x_D_

Dear @cyberspacegod

Thank you for your prompt reply. However I'm not sure what do you mean by "down phase"

ps. hope you rested a little bit. don't be a robot! :)

Yours

Piotr

Ohh, I mean, all tokens/coins are affected by some sort of inflation/deflation, according to what they are based upon, all of them are a form of exchange.. Pretty much like STEEM, with the ups and downs of BTC, the contracts in which it is used.. Something like that ^^)

All the best,Cy

Respectfully, I strongly disagree with your application of the Howey test.

Each coin and token is being treated by the various departments (SEC, FinCEN etc.) differently depending on how the coin or token is used. It doesn't matter how you or I view STEEM, it matters how the governmental department we are dealing with views it.

STEEM is used like money on a daily basis. STEEM is used to buy and sell things and on Steem Engine it is not SBD that is used but STEEM to buy and sell tokens. It is most certainly being treated as a "virtual currency" according to FinCEN.

This is shaky ground. I really don't know what to say on this one. There are lots of ways to buy "influence" on a network that does not result in you earning anything. That is not how the reward pool/inflationary model works exactly. While it is true that it does have the utility of providing increased visibility to you via self-voting, which is often looked down upon in the community, the cost vs. visibility ratio is terrible.

Additionally, it cannot be ignored that investment terms and suggestive concepts related to investing is all over the place on the Steem blockchain and the Steem Engine platform. Terms like "staking", "vesting shares" do appear like financial terms speaking to the investor mindset.

The Proof of Brain approach of "mining" for coins by curating content is not in itself any indication that a coin must be a security. And token sales make logical sense even by a project that is centralized so long as the token has an essential function for the product/service or ecosystem. However, arguing that "influence" is the utility of the token very much depends on how that token provides utility.

For a token to not be a security it needs to be a utility token, commodity or currency. If it is a currency then you must familiarize yourself with FinCEN and other currency managing departments and their policies. If it is a utility token that use of the token needs to be essential and its use in the ecosystem or product/service needs to be clearly conveyed.

Why can they argue "no" here?

That entirely depends on how the token is structured.

That’s why you have lawyers, bud.

Posted using Partiko iOS

Yes, having lawyers is nice, but those departments also have lawyers, many. My point is that you are making bold claims that are clearly not accurate. Why do I say that? Because I am familiar with the guidelines and the no-action letter cases by both the SEC and FinCEN.

The response:

Is a poor reply, considering the fact that what you are telling people can most certainly be construed as financial advice. You're playing a dangerous game telling people that STEEM doesn't count as money while FinCEN views cryptocurrencies as convertible virtual currencies.

It is not that I don't want to agree with you, but the problem is that I know that your opinion doesn't match with the positions of these departments. That means you either plan to take the SEC and FinCEN to court in order to establish the appropriate standards like DefendCrypto.org is trying to do now, or you don't mind letting people believe you and get into serious trouble.

I’m not a lawyer and this is not legal advice. It’s pretty clear I’m just offering my opinion about the law, which in the US is open to interpretation and based on precedent. In other words, the whole point of the law is it should be debated. I am looking forward to a new and updated version of Howey from the Supreme Court as it relates to digital assets. But for now, we are using a dull knife to deal with some very specific instances. But it is all that we have in the cupboard.

Posted using Partiko iOS

Indeed @shanghaipreneur

It's very clear that you're not providing financial advice and you're simply sharing your own knowledge and experience with us.

I absolutelly appreciate it.

Yours

Piotr

Dear @blake.letras

In my own opinion @shanghaipreneur isn't really "telling people". He is simply sharing (in form of comment) his own knowledge within discussed topic. That's very different.

Either anyone here is right or wrong - time will tell.

Yours

Piotr

Wow. What a mindblowing comment @blake.letras :)

Seriously I appreciate your time and effort. One of the best comments I've read in this topic; without any doubt.

Yours

Piotr

As someone from the EU, and thus who have a slightly different law to work under, the questionnaire for security would be:

There's also the thing with how important is it if it's security? Or a company share? In the US everyone will make a big fuss over it. From the standpoint of most of the world, it's "only troublesome for those who want to implicate the US" aka, for everywhere in the world, it just means they have to avoid the US. So I can understand that since you are in the US, it's a big difficulty for you, but I'm not sure about how it would go if you did that under your personal name since I don't know if the SEC consider people as capable to issue securities.

Yours,

@djennyfloro .

Thank you @djennyfloro for this amazing comment.

Your knowledge is simply mindblowing.

Yours

Piotr

Have you thought of doing an offshore company, and simply avoid the US? There's English-speaking business all over the world, and having that translated in spanis &/or french isn't that costly of an issue too.

What... I think people invest real money and expect them to rise to profit! lol Everyone buying these coins must be expecting them to go up, or at lease some of them right? As soon as the Gov decides to crack down you'd be surprised at just how many will fail. All we need is one big scandal and then we might all get in trouble? We'll see, time's a ticking!

beer!

!BEER

First thought coming to my mind: ...and so begin the cyberpunk wars.

I was considering these questions when I read the article of Dan Jeffries about Libra, Facebook's new coin in partnership with other corporations. The complexities we will facing with these new crypto-economy and its juridical & social implications are so new and big that they blow my mind.

Although I agree with the libertarian ideal against taxes and government control, I do understand that these issues cannot be simply overlooked. They will explode in the face of every person who wants to ignore them.

I think you briefly said the main things to be said about this. It is a game of interpretations, and this game will be played, as always, by big fishes and regulators.

We play this game analyzing the ways to validate our crypto-economy under the established rules. But, as history shows, when that happens regulators simply change the rules, and everyone will have to adapt to those new conditions and situations.

It's an everlasting game... a neverending story.

Some weeks ago, my country's government published an announce, expressing that it will accept the incoming transactions in cryptocurrencies to Venezuelan residents, but that they will have a limit and they must be made by means of the government's platforms.

That's because half the country already fled and those Venezuelans are sending money to their relatives using crypto, so that they could survive. That announce made me laugh. They destroy the whole economy and afterwards pretend to control every way created by the people to give themselves some freedom...

But, as old people say, that's the way of our world.

@spirajn:

Very interesting. So this shows several things:

1.) There is no way a government can control the flow of crypto

2.) Crypto flows into Venezuela are already meaningful and making an impact into the economy

Can you tell a bit more about this complex?

Any idea how they will try to implement the government crypto clearing platform and how they will force people to use it?

Sorry for the late response. It's difficult to stop and make time. Yours are very good conclusions: Governments cannot control the crypto economy, but the sad (and dangerous) thing is that they try... they'll keep trying and that means persecutions and abuses of authority.

When these laws didn't exist they put in jail so many friends because they were mining cryptos.

Now they cannot get all the Venezuelans into this... but they will try: if I would speak with the wrong person (an agent of government) about my way to manage the little money I can get, soon they'd send some agents for me, as if I am at the same scale of a scammer or a robber, though I am only an artist and intellectual.

But that's the nature of government. That's why I think this kind of subjects brought by @crypto.piotr are so important.

By the way, I like your account's name: @solarwarrior. It's cool.

!tip

Posted using Partiko Android

🎁 Hi @solarwarrior! You have received 0.1 STEEM tip from @spirajn!

@spirajn wrote lately about: Memories Of Ecstasy Feel free to follow @spirajn if you like it :)

Sending tips with @tipU - how to guide :)

Late thank you @spirajn for such an amazing comment.

God bless Venezuela

Have a great weekend ahead,

Piotr

Interesting this topic that you have chosen today, dear friend @crypto.piotr.

The conformation of tribes would allow Steemit users to access a specific content trend, where it is assumed that the publications would facilitate the attention of a qualified audience that could better appreciate it and contribute valuable feedback, rather than being accessed by simple users "curious" that perhaps would not add value to the development of the subject.

Being able to support more strongly the content creators of a tribe with a particular token would be at first sight a useful function. Since it would serve for growth and greater influence (power) within the niche or tribe.

Generally utility tokens fulfill a specific function within an escosystem and allow access to advantages or privileges.

So far the tokens in Steem-Engine only allow you to increase your "steem power" within the tribe. I have not seen any other application so far, so its useful feature is very limited.

Then maybe we should see them as security tokens as they are interchangeable in internal DEX. What would allow the investment and get ROI.

Maybe they are hybrid tokens?

You are incorrectly assuming that current SEC interpretation:

The law is very different in different countries and there are many different types of Steem-Engine tokens.

It is pointless and bad legal practice to make generalisations.

For example @jpbliberty's SUFB tokens on Steem-Engine are completely exempt from Australian securities law and are issued by an Australian company.

Hey my friend @crypto.piotr

The idea is to feel secure in this kind of business, So. I think regulations are coming with some different rules, and regulators and investors were asking the same questions and hesitant about this business.

But if any regulations change a little, it doesn´t mean to be scare about it, it means that something will change for a good one because regulators and investors are working and investing their own money.

I think that if your are thinking in investing 100k will be great for you and your business, because everything is a business here and you can obtain your contract very easy.

Another point and I´m pretty sure that it is about the content in your white-paper and the token you want to create... The explanation and description you give to your investors ....

If you know about it, some tokens have more value than the Steem, So, how is that...!!! ..? question on the air....!!!

Have a great time....!!!

Late thank you @edgarare1 for such an amazing comment.

Have a great weekend ahead,

Piotr

I think that is still a very early stage to no in which way that will go

I think if you use fiat to buy tokens to give to an entity for the express purpose of getting a return (whether over time or at some future time) that is greater than what you invest, then convert that back to fiat, it would be hard to claim it is free from taxes. But I believe you are asking about the case where you have accumulated tokens (in this context any cryptocurrency) with no clear traceability to fiat, invest those tokens, receive a greater amount in return, and retain the value in tokens without converting it to fiat. At this time, I do not believe there is any accounting mechanism available to a government that could assess you with a tax liability.

Assuming that such an ability does or soon will exist, it begs the question of where does mining crypto fall in to this, especially when it takes the form we have on steem (leomm, palm, etc). That is much harder to clearly track!

Dear @jdkennedy

I just realized that I never thanked you for your valuable comment.

Exactly.

ps. I've noticed that you didn't post anything in a while. Hope you're not giving up on Steemit.

Cheers

Piotr

I’m still here, just a run of activity the has been consuming my available time. I like my posts to be more thoughtful than not, but that presumes you first have time for thought! :)