[ICO Review] Ceyron Token (CEY)

- Project overview

The concept

So basically the idea is to have service like Coinbase and Mastercard combined together with the concept of Proof of stake.

CEY tokens holders will have:

Easy access to spend 20 fiat currencies + supported cryptocurrencies via The CEY Card (a physical, virtual, and debit MasterCard with a mobile application for convenience) with competitive fees compared to the current international debit card.

Annual dividends (might have, not guarantee): from a portion of potential periodic income earned by the Fund — from their financial investments, to be exact.

Last but not least: a high in value token — CEY token — with a stable and high-ROI-potential portfolio of credit assets

with great integrity, safety, security, anonymous-secured and transparency in a high-performing decentralized system thanks to all the world-changing technologies: artificial intelligence, machine learning and, of course, blockchain.

What are Ceyron tokens (CEY)?

Ceyron Tokens are Ethereum-based smart contract digital token representing beneficial ownership in non-voting shares in issuing company — Ceyron Finance Ltd. (CFL)

CEY Tokens are non-refundable and they are not for speculative investment.

Some definitions to understand:

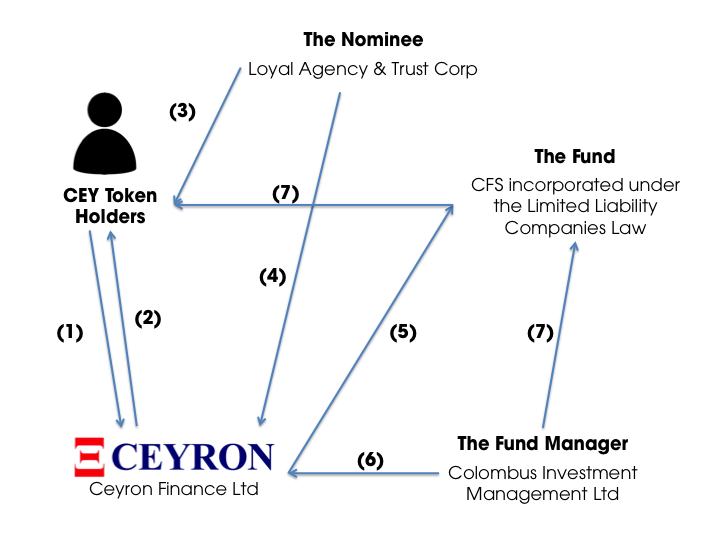

The connections between those defitions

The investor or CEY Token holders pay their money to buy the tokens from CFL (1)

CFL issue CEY tokens to their investors and provide services as well as distribute annually the dividends (2)

The “Nominee”: Legal title of the tokens will be held by Loyal Agency & Trust Corp (“LATC” or the “Nominee”) for the token holders (3) for transparency and being trust-worthy since it is independent of and not involved in the management or operation of “the Fund” or “Fund Manager” (4)

The “Fund”: Ceyron Finance Sarl (CFS), is a Limited Liability Company incorporated under the Limited Liability Companies Law, (the “Fund”), and is wholly owned by Ceyron Finance Ltd (5). Participation in the Fund will primarily be conducted through the CEY Token. The Fund will be managed and advised by Colombus Investment Management Ltd

The “Fund Manager”: Colombus Investment Management Ltd, is a British Virgin Islands registered as an independent alternative investment management company (6) specializing in alternative assets and global asset allocation. The Fund Manager will be responsible for the Fund’s operations and will perform all services and activities relating to the management of the Fund’s assets, liabilities, and operations. (7)

The Fund's Investment Objective and Strategy

Investment objective: is to provide the highest ROI (return-on-investment) through a proprietary quantitative approach to underwriting credit assets, to be provided by Colombus Investment Management Ltd.

Investment strategy: driven by data science where they apply machine learning within fully non-parametric statistical models to gain expected returns on financial investments.

The net income earned by the Fund during any given month will generally be retained for reinvestment. A portion of potential periodic earnings may be used for distributing annually dividends approved by CFL’s board and voting shareholders to CEY Token holders as mentioned above.

The market and the problem

There are lots of problems they want to solve, here are some I outstanding one summarized:

Cryptocurrency world's problem: Cryptocurrencies are growing at a rapid rate. Booming exponentially, you might call.

Total Market Cap from 1/1/2017 till now

That could be both good and bad signs for investors. Early birds get lots of profits thanks to the mooned prices, that's the good sign. On the other hand, growing at a fast pace like that makes new, and even some experienced, investors worried a lot since most cryptocurrencies are not backed by any assets — that’s really risky and concerning to them.

- The traditional banking service's problem

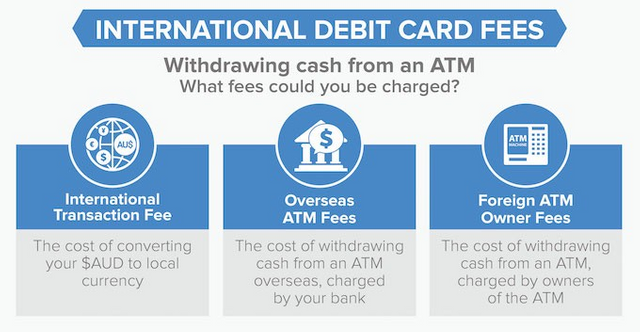

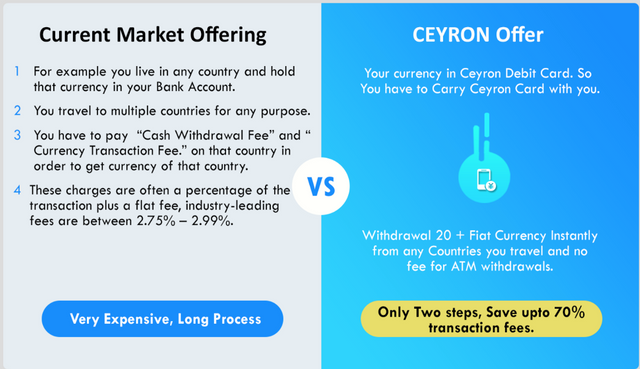

Coming back to the traditional banking services like MasterCard. This is a huge market with lots of potentials to gain returns in this wave of blockchain hype. Let’s say you are traveling to other countries where their national currencies are being used. You bring along your “convenient” international debit card. That would be the ease like normal right?

Yet you are gonna pay for that service 2 kinds of fees: “Cash Withdrawal Fee” and “Currency Transaction Fee.” and sometimes, even a fee called “Foreign ATM Owner Fee". These charges are often a percentage of the transaction plus a flat fee, industry-leading fees are between 2.75% — 2.99%.

And that is not gonna be a small amount like you imagined once you combine all of the times you went abroad using that card.

- The problem in the area between 2 worlds

Using Coinbase-like services, you can get your desired cryptocurrencies from your fiat. Yet this market has only been operating for a few years. Illustrative of the current level of maturity of the industry are the relatively large differences between prices in fiat currency of Bitcoin on the various major exchanges.

Due to the irony, the best prices come from vendors with the lowest liquidity where the order may not be realized quickly or at the price it was placed. Even the largest and most established providers charge fees as high as 7% for fiat transactions

Another problem: Volatility and Cash Flow. Crypto investments or non-crypto ones, there are tons of sub-investment and if you are confident with your investing skills, you’re gonna be overwhelmed and your assets might drop in its value drastically or have a poor cash flow — making it a “dead” investment, not to mention gaining any return. You gotta need a strong portfolio with a well-balanced budget to secure your investment.

TLDR: their kinds of services are still young, not flexible and high in fees operating in a worrying market where your assets’ values can drop dramatically after 1 night.

In a wider view, at a macroeconomic vision and particularly in the market of Africa, the Ceyron team identified those problem:

Low Bank Rate :The economy of third-world countries like ones in Africa is highly liquidated and has a very bad financial footprint: Less than 10% of adults have bank accounts and more than 85% of trade is cash.

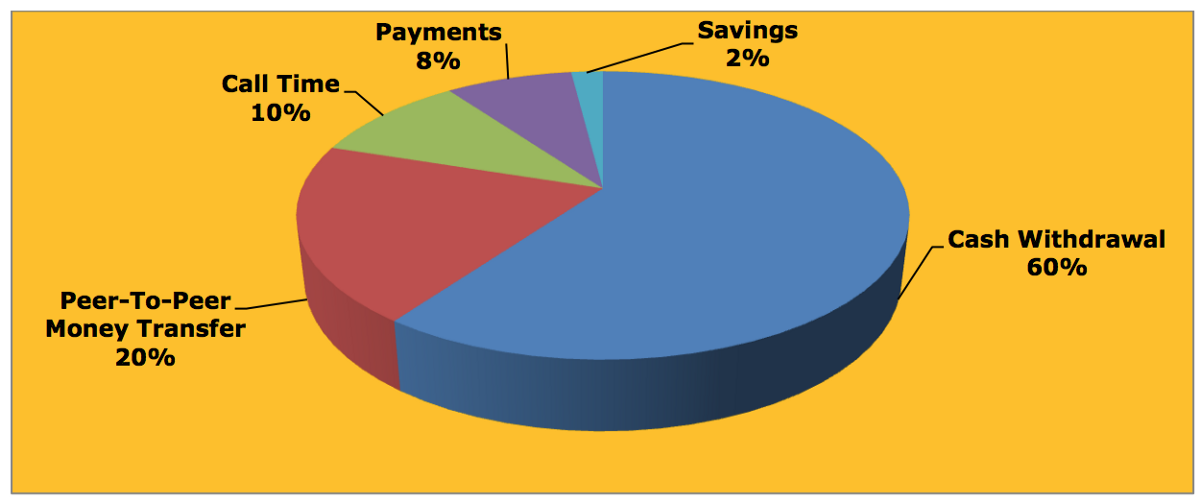

Very Low Usage Rates: In the world, 12% of account holders are in Africa. However, the level of inclusion in the financial system is very low. The behavioral analysis of the average paying user is similar to the general trend: the payment is equal to at least 60% of the transaction volume; Peer-to-peer transactions 20%; 10% call duration, 8% payment and 2% savings.

A highly competitive market: The mobile money environment in Africa is increasingly competitive. This increased competition means that consumers have more choices.The Ceyron’s solution

Use of low debit cards: Prepaid debit cards are only used for point-of-sale purchases and services (rarely). CEY Tokens holders, however, have the privilege of receiving an annual dividend on a CFL card, which would be a huge motivation for people to use the card.

Lack of credit that is safe and precarious as well as stable and sustainable income for credit applicants: In Africa, most applicants lack credit. CFL wants to solve this. More specifically, the CEY Tokens can be considered as a source of income distributed to entrepreneurs because it deserves credit. Besides, loan applications have a stable and sustainable income deficit.

The CEYRON solution

Not to mention those “standard" offers a blockchain-based project gives like integrity, safety, security, anonymous-secured and transparency in a high-performing decentralized system, CEYRON offer great solutions for the problem identified above:

CFL Credit Portfolio

To minimize the volatility of the CEY Token, CFL supports its value through a portfolio of secured credit assets. In turn, the yields of the portfolio’s credit assets will be then retained for reinvestment back into the portfolio of credit assets to attempt to increase the underlying fundamental value of each CEY Token.

The portfolio of credit assets, which is built by applying artificial intelligence and machine learning, will further be secured by a surety wrap to enhance stability and returns.

To be exact, The Fund has a highly diversified alternative investment portfolio with global coverage aiming to deliver stable high single-digit returns with very modest short and long-term volatility. Diversification is achieved by combining selected alternative funds with very different strategies and locations, managed by established and leading asset managers within the specific investment style or market.

CEY Card

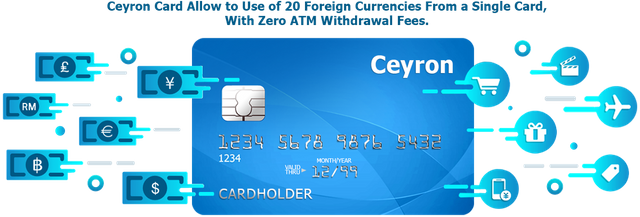

The CEY Card: a physical, virtual, and debit MasterCard with a mobile application which will allow for the use of 20 foreign currencies and leading cryptocurrencies from a single card.

Using this card, you can spend, exchange and send and receive money internationally with the same anonymity as Bitcoin without any third party involvement in a most secure and fastest way.

CFL may save customers up to 70% on those mentioned fees:

Currency Transaction Fee: Currencies can be exchanged both at the point of sale through an app with 3% fee for CFL compared to 3.75% of industry average.

Cash Withdrawal Fee: CFL charges no fee for ATM withdrawals at all (the traditional standard fee for ATM withdrawals is 1.5%).

Money Transfer Fee: The CFL mobile application will contain additional functionality to transfer funds in any currency between merchants, as well as friends and family accounts, for free.

Together with the CEY Card, The Private Ceyron Exchange Site lets you buy and sell CEY and other cryptocurrencies.

Besides, The CFL Card plans to have a Partner for expense management. This will allow integration from a mobile application to facilitate management of travel itineraries and links to many travel partners for e-receipt management.

CFL Security Token

1. CFL intends to provide but does not guarantee, the token holders with an annual dividend, which must be approved by the Board of Directors and holders of voting shares.

2. CFL intends to invest eighty-five percent (85%) of the proceeds received by CFL from this Offering in the Fund, and the Fund, in turn, will invest in credit assets, thereby seeking to create a stable, growing cash flow yielding base for the CEY Token (Cash flow yields cannot be guaranteed, and may be impacted by both market and regulatory conditions).

3. CFL intends to use modest leverage to further enhance the returns from its credit portfolio to facilitate ongoing and continued reinvestment to grow the credit portfolio underpinning 15 the CEY Tokens (Enhanced returns cannot be guaranteed, and may be impacted by both market and regulatory conditions).

4. CFL will enhance its ability to establish its credit portfolio with leverage by providing its warehouse lender a credit surety bond.

5. CFL intends to maintain a cash, securities, and token reserve at all times to ensure liquidity for CEY Token holders (Liquidity of assets cannot be guaranteed, and may be impacted by both market and regulatory conditions).

6. CFL will enter into alliances with surety wrap providers that will be used to mitigate the risk of total capital loss. However, use of these financial instruments does not constitute a guarantee against any and all eventualities.

Strategic Alliances

CFL’s strategic alliances are well-established and experienced leaders in the field of blockchain technology, finance, and banking.

Coinfirm.io: CFL intends to enter into a service agreement with Coinfirm.io — a market leader in KYC/AML (Anti Money Laundering) checks for each token holder application.

Ambisafe is a blockchain technology pioneer and ICO offering company helping the world become more decentralized since 2010. Their work has been critical of projects such as Tether and Bitfinex. More recently Ambisafe is behind such ICO successes as Polybius, TaaS, and Chronobank. CFL and Ambisafe plan to jointly develop a wallet management tool, which CFL will use to facilitate token holders’ ability to manage their digital wallets.

Loyal Bank is a bank registered under the laws of Saint Vincent & The Grenadines and is the debit card provider having one of the most competitive fees across several fiat currencies in the industry. -> this partnership might allow CFL to maintain a low rate of 1% for transactions charge.

TLDR: Ceyron is creating multiple business lines and will be reporting financials to investors.

Firstly, they will have the Ceyron Funds, a secured portfolio built by a seasoned financial management team.

Secondly, Ceyron will also offer you the opportunity to spend, exchange and transfer cryptocurrencies and fiat currencies with their Ceyron Debit MasterCard and exchange site.

Finally, with so much market uncertainties, Ceyron is here to offer you one of the only private security tokens representing an equity portion of Ceyron with the intent to offer security, transparency and dividends — The CEY Token

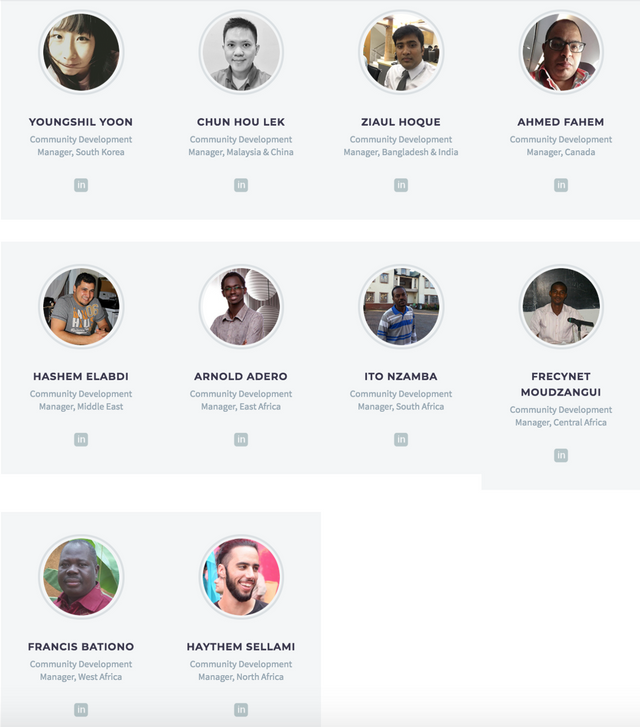

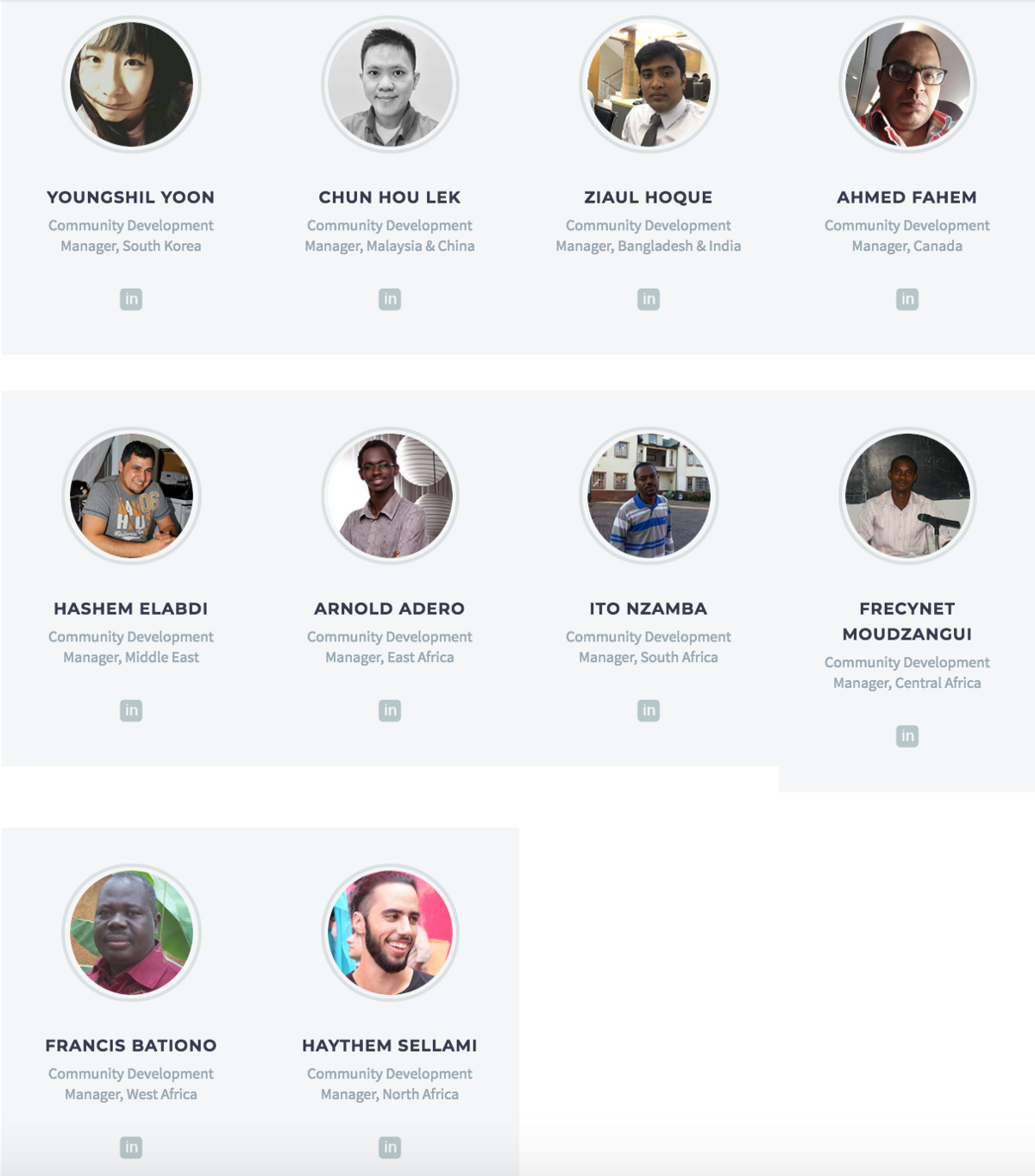

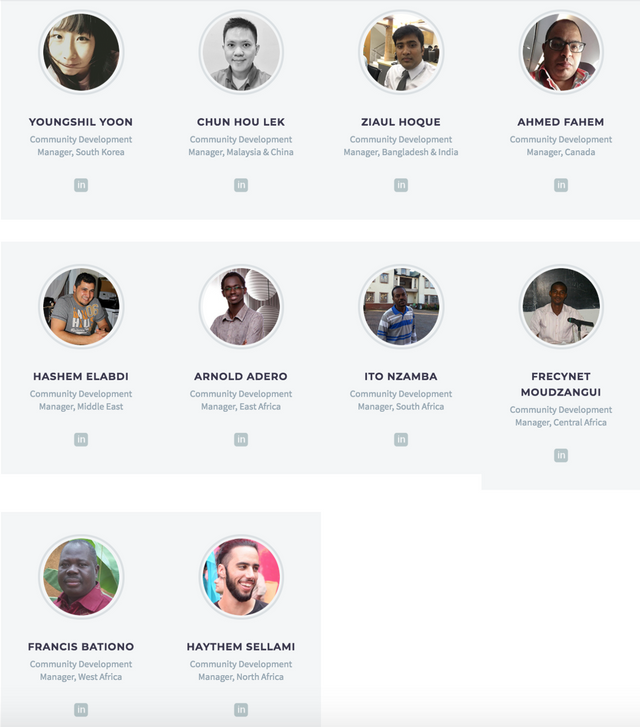

- Team

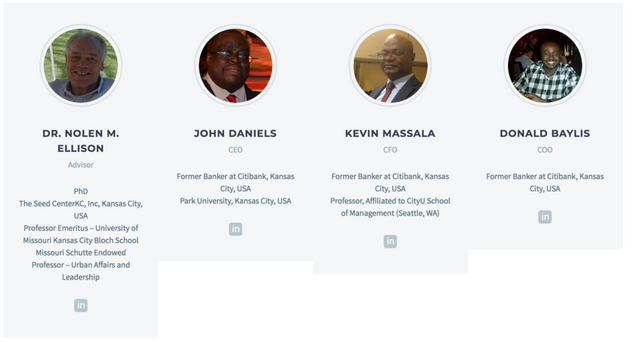

Ceyron Finance Ltd was created by a seasoned team of former Bankers from a reputable USA Bank.

Executive board

The EB consists of talents experienced in the fields of banking, business and financial investments, which is a strong point for the team on the implementation of project's idea.

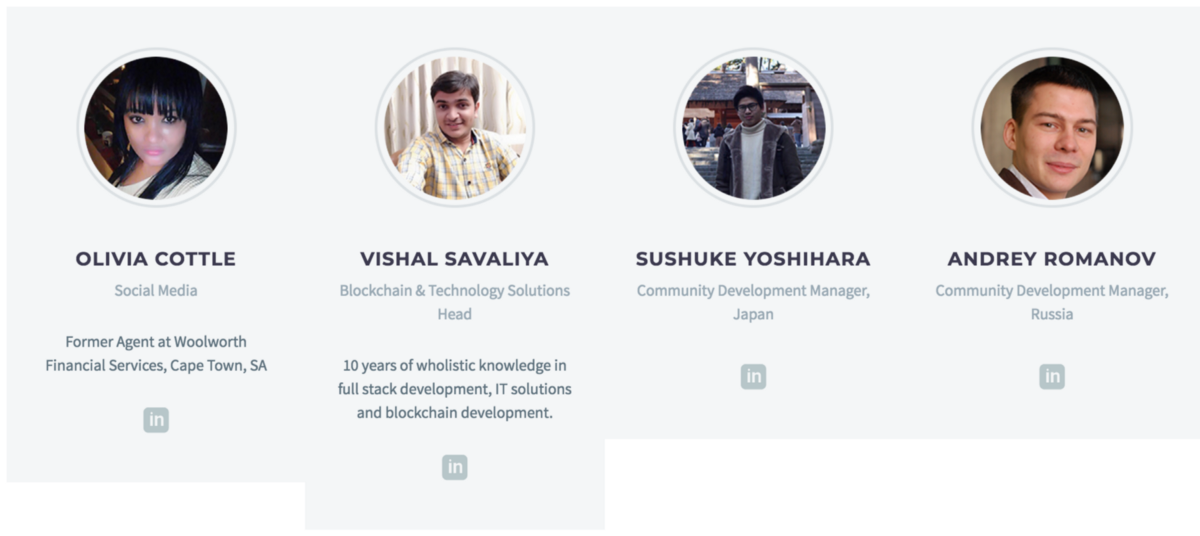

One thing made me concerned is the Dev team. Since normally when ICO, the project managers would showcase their genius developers (together with the talents in the service field, as they did show above). Yet this ICO I can just see their Blockchain & Technology Solutions Head. One reliving point is that this guy ( the IT Head guy) has 10 years of experiences in full stack development, IT solutions and blockchain development.

They have quite a number of resources for marketing activities, which is kind of a good move in this stage of cryptocurrency world since people are extremely sensitive and crowding effect can lead to lots of good pumps.

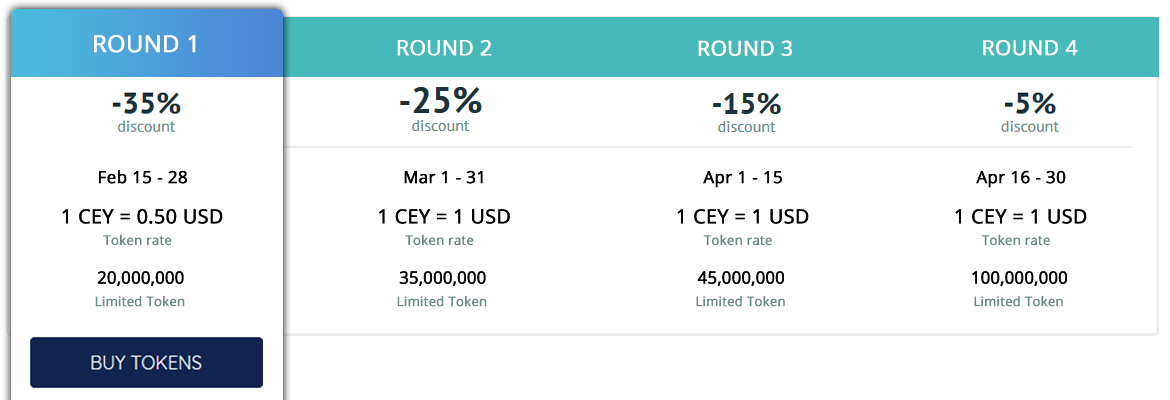

- Crowdsale information

Token Name: Ceyron

Token Symbol: CEY

Contract Address: 0xebc71036a37451e87cc43af8ae7ac123aa750dcb

Decimals: 8

Price Per Token: $1.00 USD

Currencies Accepted: BTC, ETH, LTC and USD

Number of Tokens for Sale: 250,000,000

Pre-Sale: 2/16/18–3/15/18

Pre-Sale Discount: 30%, 25%, 15%

Start of Token Sale:3/16/18

End of Token Sale: When Hard cap is reached

Soft Cap: TBA

Website : https://ceyron.io/

Whitepaper : https://ceyron.io/wp-content/uploads/2018/02/White-Paper-ICO-CEY-Token-UPDATED31012018.pdf

Telegram channel: https://t.me/joinchat/HlFUXhLIUYQL88_NtoM4sA

Author : rueisnax

BTT URL : https://bitcointalk.org/index.php?action=profile;u=1793711

Disclaimer: Statements on this site do not represent the views or policies of anyone other than myself. The information on this site is provided for discussion purposes only, and are not investing recommendations. Under no circumstances does this information represent a recommendation to buy or sell securities.