Mentality of the Masses

One of the largest flaws of modern media outlets, at least I think, is their bias towards following popular opinion. That isn’t limited just to media, but how human's think in general. People find great comfort in conforming to trends and would much rather fail with a group than as an individual. In order for significant change to arise, the first pioneers will face a number of setbacks and be on the minority side of many arguments. So, with Bitcoin’s significant pull back in price over the last twelve months, many spineless journalists have been quick to join the death of cryptocurrency movement and waning interest in blockchain trends.

I am critical of the journalists that do not add much value to the conversation other than point out so of the obvious flaws of blockchain- this article for example (https://www.forbes.com/sites/enriquedans/2019/02/22/blockchain-back-to-the-drawing-board/#45fc4d752e15 ).The comment about Vint Cerf’s tweet discredits most of the article, at least for me, as his masterfully crafted flowchart is:

He also highlights a consistently overused point about energy consumption by the consensus algorithm from Bruce Schneier’s article, “There is no good reason to trust blockchain technology.” It is certainly a legitimate problem that needs to be solved before mass adoption can occur, but a number of blockchain projects have made significant strides in remedying the problem; for example, IOST (iost.io).

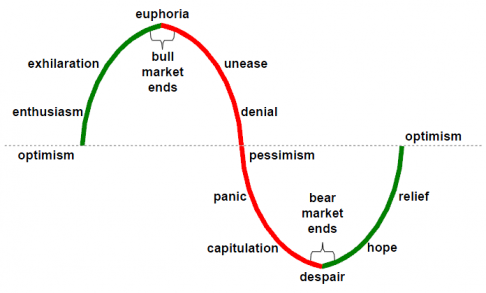

The other point about blockchains being vulnerable to exploitation is true, yet it is less vulnerable to exploitation than the current standard of centralized authority. While there are bound to be problems with any sort of large scale change, it is important to keep options in perspective. If society, and in large part the media, were to be less influenced by emotion (see the chart below) , we would find a more stable middle ground for the outlook of blockchain. The hype phase in which BTC ran to $20,000 a coin would not have lead seemingly every business model to incorporate blockchain in some fashion. On the other end of the spectrum, the lows would be less extreme and the technology would not be completely written off at the first signs of difficulty.

, we would find a more stable middle ground for the outlook of blockchain. The hype phase in which BTC ran to $20,000 a coin would not have lead seemingly every business model to incorporate blockchain in some fashion. On the other end of the spectrum, the lows would be less extreme and the technology would not be completely written off at the first signs of difficulty.

Lastly, I would refute the claim that a growing number of people think that blockchain needs to be “taken back to the drawing board.” While I was working in the blockchain industry this summer, I saw a quantifiable increase in blockchain business proposals despite the decline in BTC’s price. I think this is solid evidence that people are still optimistic of blockchain’s potential. If society could view blockchain and other new technologies with a more balanced outlook, it would be easier to spur meaningful change as people would be more concerned advancing the technology rather than just riding the waves of extreme euphoria and despair.

Check out this website for a list of every time Bitcoin has been declared dead. Given the open-source ethos of the cryptocurrency project, I believe it will take plenty of time for these technologies to reach a point of mass adoption...if they ever do. I totally agree that journalists like the author of the article you shared are simply adding to the noise and confusion. Anyone who repeatedly uses the term "blockchain technology" comes across as not particularly well read in the space. If that author actually did his research he would not that plenty of development has taken place in the cryptocurrency world: decentralized finance, privacy coins, and on-chain governance have seen advances in the past year. I'm particularly bullish on privacy coins.