What a Facebook Blockchain Token Might Look Like

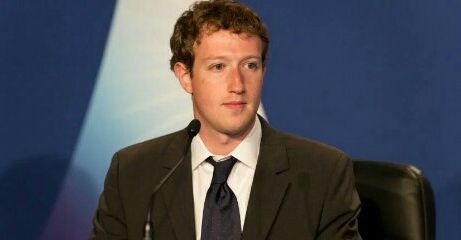

Mark Zuckerberg, worth $71 billion at just 33,

Mark Zuckerberg, worth $71 billion at just 33,

has done rather well by Facebook's centrally

managed system.

Over the past decade and a half, the social

media behemoth's closed-source algorithm

has quietly manipulated its millions of users'

news feeds to capture maximum ad dollars

and steer them all to Zuck and his

shareholders.

So, why is he exploring a more decentralized

model? And what role might crypto

technology play in that?

In a New Year's post to the platform, the

Facebook CEO noted (with zero irony, it

seems) that

"With the rise of a small number of big

tech companies … many people now

believe technology only centralizes

power rather than decentralizes it."

And he vowed, on that basis, "to go deeper

and study the positive and negative aspects"

of decentralizing, people-empowering

technologies such as cryptocurrencies and

encryption.

It was followed by another post telling users

that upcoming changes to their news feeds

meant they "can expect to see more from

your friends, family and groups" and "less

public content like posts from businesses,

brands, and media."

It remains to be seen whether this bet in favor

of "meaningful social interactions" over higher

traffic content is, as Zuckerberg said, "good

for our community and our business over the

long term." The immediate reaction on Wall

Street was harsh: Facebook’s shares fell 4.5

percent last Friday following the second post.

It was a predictable response: if Facebook will

no longer curate new feeds to emphasize

strong, ad-attracting content, then revenues,

and returns to shareholders, will decline.

Threats to Facebook

So, why'd Zuck do it?

The prevailing wisdom is he wants Washington

off his back.

The Russian political investigation has shone a

light on how Facebook uses its proprietary,

closed-source algorithm, the core instrument

of its centralized power, to deliberately

package "like audiences" for advertisers.

More important than allegations that Russian

operatives used Facebook to spread

disinformation and influence U.S. elections is

the fact that Facebook has become so

powerful a force that this kind of meddling is

possible.

What's more, its algorithm effectively

encourages it, if unwittingly: it naturally

creates echo chambers of commonly minded

people who will happily re-share and

redistribute content they agree with, creating

a sticky audience to sell to advertisers.

This happens even, or perhaps especially, when

the stories they are sharing are demonstrably

fake .

But Zuckerberg is clearly also bothered by

rising disaffection among his users, a group

to whom cyber security guru Bruce Schneier

once offered this warning: "Don't make the

mistake of thinking you're Facebook's

customer, you're not – you're the product."

It took a while, but many now understand the

bum deal they’re getting: they produce and

distribute the content that drives traffic on

the site, as well as delivering attention to

advertisers, but aren't compensated one penny

for it.

To make matters worse, they're forced to look

at content they don’t want to see. (Who else

is in the crypto community is sick of James

Altucher's "eccentric bitcoin expert" ads in

their Facebook feed?)

The problem is that under the current

business model, the more Facebook

decentralizes – either by being less

interventionist in news feed curation or by

following YouTube's lead and sharing ad

revenue with traffic-driving users –

shareholders will either get a smaller pie or a

smaller piece of it, or both.

On the other hand, if user discontent leads to

attrition or even an all-out exodus, it matters

not that shareholders are protecting their

margins – advertisers will leave, revenues will

slide and, eventually, the platform could die.

The rise and fall of MySpace, the once

ubiquitous platform that Facebook displaced,

is a reminder that the latter's dominance is

not guaranteed.

A token solution?

The resolution of this dilemma may lay with

the very technology Zuckerberg has vowed to

explore: a crypto-token, call it FBCoin.

To be clear, I have no inside knowledge on

Facebook's plans. This is pure speculation.

But, given the company's past forays, later

abandoned, into digital money and payments ,

I think it's worth speculating on, especially

with the context the CEO has laid out.

It also offers a window into how the center of

gravity might move from tokens produced by

decentralized app producers to those of

established enterprises – for better or worse.

Here's an admittedly very rudimentary model:

Facebook would pre-mine a large pool of

tokens, distributing a significant number to

shareholders and holding the rest in reserve to

distribute to users based on some reliable

metric of the traffic their original content

generates. Facebook would then mandate that

on-platform advertising must be paid for with

those tokens. A market would then emerge,

into which users could sell, giving them a way

to monetize their content creation.

The value of the tokens would float against

the dollar, based on demand and supply.

This, I believe, is how Facebook could best

resolve its dilemma, giving both shareholders

and users a valuable stake in the future

growth of its platform under a more

decentralized set of rules.

Of course, crypto folks accustomed to

thinking of attack models will immediately see

dangers here.

There are ways to game traffic data –

something that Brave is trying solve with its

browser and BAT token – and how does the

algorithm know whether something is

"original" and not just copied and pasted from

someone else?

Ideas for reputation tokens , proof-of-work

models to disincentivize the creation of

traffic-generating bot armies, and other skin-

in-the game solutions will be needed to

encourage honesty.

And who would run this? It's hard to imagine

Facebook choosing not to control the market

for its own tokens or to centrally run the

ledger.

Yet if it wanted to truly unpack the expansive

power of network effects, opening up the

tokens to a true, decentralized blockchain

system and, eventually, a decentralized market

could result in far more explosive growth –

and, by extension, token-based returns for

Facebook’s shareholders.

If Zuckerberg really wants to experiment with

decentralized systems, a publicly issued

crypto-token would be hell of a way to do it.

Personally, I would much prefer someone else

creates a scalable decentralized social media

solution to replace Facebook’s insidious

centralized algorithm – to do to it what

Facebook did to Myspace. Social media badly

needs a model that puts control back in the

hands of people.

But who knows? Maybe Mark Zuckerberg, who

has vowed to give virtually all his wealth away

to charity, will recognize that perhaps the

most powerful gift he can make to the world

is a platform for creativity that empowers

people by fairly rewarding their ideas and self

expression.

at first shareholders will indemnify the lion's share of their assets. then when the company does not cost anything it will be possible to sell for 33))