Blockchain Innovation & Disruption. Should You be Concerned?

Introduction

The world is changing, and with today's pace of innovation and technology it can be really easy to get lost in it, which is why I am writing this. I hope this will show you a very surface level knowledge of blockchains and its application to different industries. This writing will only go over a couple of examples as the true utility of these blockchains in my opinion are limitless and many are still undiscovered. My personal opinion is that disruption and innovation is always going to be a good thing, and I hope this article can help prove that.

I would like to point out that I am not an expert in blockchains, it is simply a hobby for me, and something I genuinely believe in. Therefore a lot of this information is a cultivation of my understanding from books, articles, blockchain conferences, and other sources of information.

Blockchain - Spark Notes Edition

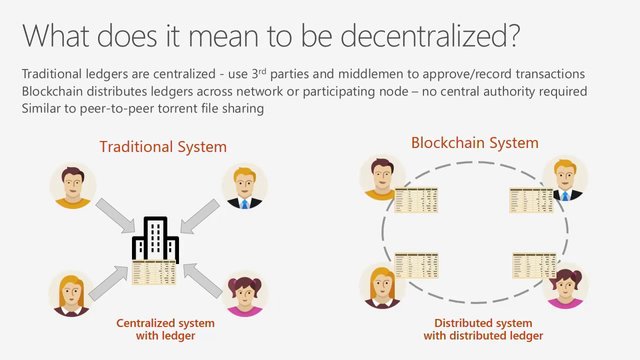

A blockchain in its most raw form is just data. It is data that is not stored centrally anywhere, but rather across a network of computers. What this allows is that no one person can go in and edit/ manipulate the data or information. Every change must be essentially approved by the network, which consists of a number of different computers. This allows information on blockchains to be irrefutably true, since a network of computers comes to a consensus before making any edits. The data itself is open to the public and anyone can look it up, this is whats being referred to as "The Distributed Ledger". The distributed ledger has no one central area of storage, but like I mentioned is stored across a network of computers. The fundamental design of this makes data stored in it much safer, and trustworthy.

Although this definition leaves a lot of other important technical aspects such as mining, and security/encryption features, and smart contracts out, it provides for a good starting point for the purposes of this writing. The main issue that blockchains address, are that of trust. Trust is the lifeblood of an economy. When conducting a transaction online at amazon for example you trust that amazon will send you what you paid for. When you buy coffee from a coffee shop that advertises "free trade " coffee, you can only trust that its in fact true, and not a sham to increase sales and allow the coffee shop to charge a premium. You need a trusted third party to do virtually everything in the economy. Buying, Selling, reviewing. Accounting firms, which I go more in depth on later, are in the business of trust. So much so that PwC's, one of the big 4 accounting firms, slogan is "To Build Trust in Society".

This is one of the biggest revolutionizing aspects of blockchains. It will allow the removal of trusted third parties and open up a world of safer and more reliable global commerce. This will eventually lead to decreased costs, more innovation, and give the consumer more power than ever. A good example that I heard of was Airbnb and Uber. Both companies were marvels of recent technological innovation, and streamlined the process of traveling while dramatically reducing costs and offering very personalized experiences. However these corporations still are inefficient as the act as trusted third parties who connect you with a service provider (car service or home owner). Imagine if through the power of blockchains we did not need a 3rd party service to connect us to a trusted services. It would eliminate costs even more dramatically and allow for consumer to pay less and for the service provider to keep more. Lets take a look at some examples and industries.

Accounting and Financial Reporting

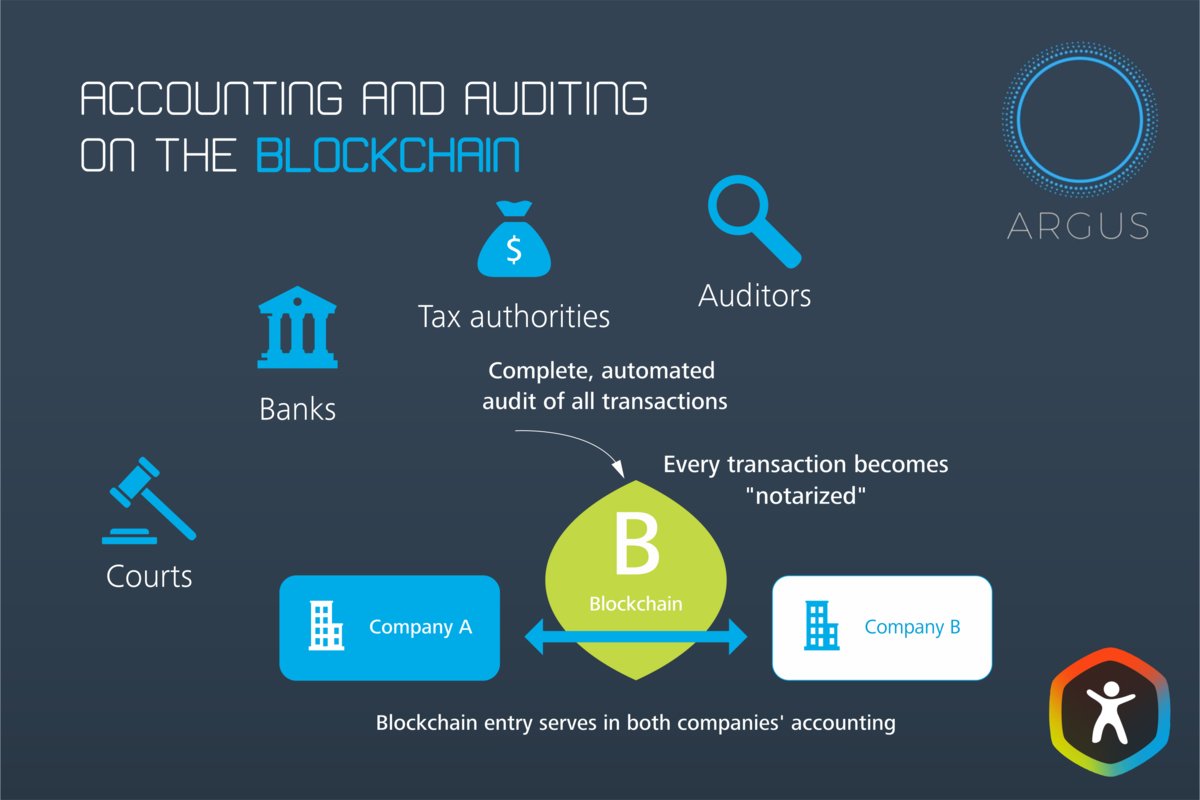

Perhaps one of the biggest changes to come is the effect blockchains will have on accounting firms. Personally being in the industry I know the impact it can have if properly adopted. Audits make up a large portion of an accounting firms jobs. The goal of an audit is to have an unbiased third party validate the financial information that a company issues, so that stakeholders can properly rely on those issued financials to make decisions. A part of the audit is to perform testing procedures that validate transactions the company has reported have actually happened and whether they are accurate. This can be a very time consuming and expensive process. If companies were to adopt a blockchain which would be irrefutably true, it would eliminate the need for such procedures in an audit. This would make the process overall a lot more efficient and quicker.

A very important thing to understand though, and also what I tell myself, is that this does not mean there would be no need for auditors anymore. What should happen is that resources that were originally used on the repetitive and outdated procedures should now be allocated to more important functional aspects of the audit. Auditors would be able to spend more time analyzing appropriateness of financial decisions and presentation, which would directly benefit consumers of the information(Shareholders & and others). All this could be done while greatly increasing the quality of life of auditors in the form of requiring less repetitive tasks year over year, and in theory requiring more expertise in certain functional areas, which should lead to higher salaries.

This example is a walk through of the beneficial impact on one industry I am familiar with. The following examples will not be as much in depth but will provide a quicker view of some surface level benefits and efficiencies to each industry

Credit Cards and Banks

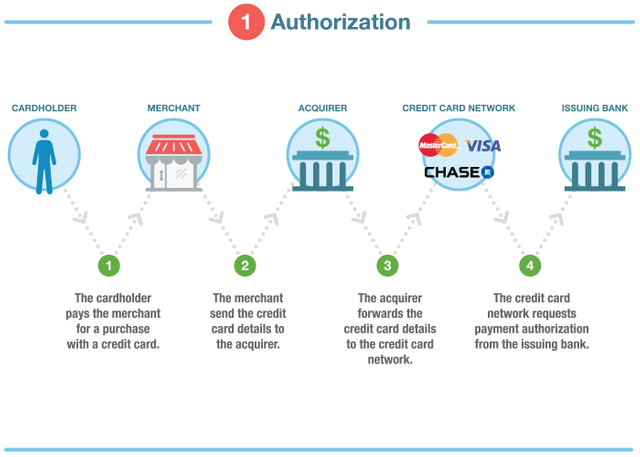

Undoubtedly the biggest application of this has been the creation of cryptocurrencies like Bitcoin. Bitcoin was created out of the same principle of eliminating trusted third parties, in this case banks and credit card companies. People who see the utility in cryptocurrencies are the same people who are fed up with the financial system especially banks and credit card companies who charge 1-2% transaction fees just for using your own money. A good example is when your swipe your credit card for a cup of coffee, that transaction goes through a multitude of agencies and clearing houses, to prove that you are actually good for your money. Its ,in basic terms, giving the coffee shop a confirmation that it can trust you to pay for that. As the authorization process happens each intermediary, which can be usually 7-16, takes a small fee. As the consumer you may think you do not see that fee, but it would be a mistake to think you do not pay for it. Merchants are usually charged for those fees and those are usually passed on to the consumer via higher costs and annual credit card fees and so on. This system has made credit card companies and banks some of the most influential and lucrative industries in the world. It's no surprise that credit card companies generated $163 Billion from fees and interest alone this past year. That is money we are paying each year to essentially use our money. Its only natural that this industry like many others are ripe for disruption and innovation for the better.

Pharmaceutical and Medicine

Historically pharmaceutical companies who develop big brand name drugs would conduct trials on the drug by conducting business arrangements with doctors who then select patients based on patient medical history and records. Often times the drug issued is a placebo, meaning its not actually even a drug its just a sugar pill and gives patients the illusion that it is a real drug. Doctors are usually compensated selecting patients in drug trials.

Blockchain is going to change this approach by allowing patients to take full ownership of their medical records. It puts the power back in their hands to make decisions for themselves. If a patient decides to partake in a medical study he/she can allow pharmaceutical companies to access their medical records and approve them for a study, and be appropriately compensated. There are currently many companies trying to make this a possibility by making the industry more ethical, efficient, and private. This is actually a large theme in blockchains. Blockchains are allowing people to be in control of personal data they generate in order to monetize it for financial opportunities. Similar to medical records, this is also starting to happen in advertising, where advertisers who need demographic information would buy data from miners, they now can request information from consumers themselves.

Take a look at this quick video by MedicalChain to see how they are solving the medical record dilemma:

Cyber Security

I will say this is an industry I do not know much about, but learned about through an interview with the head of PolySwarm's CEO Steve Bassi. I included this section because based on what I heard I truly thought this was an innovative concept. PolySwarm is a cyber security firm that wants to break from the tradition of large cyber security firms such as McAfee. Based on my understanding cyber-security under large firms is limited to identification of malware by their experts. However there are plenty of areas that require expertise in certain areas. Once a malware is detected in a area that requires expertise, the large company will usually contract with an expert in that field to solve the problem. As you can probably see this is a pretty inefficient way to prevent hacks and breaches if you attempt to solve a problem once it has already affected a computer.

PolySwarm's vision (from my very basic understanding) is to allow every cyber security person in the world running security services to be on one platform. Every malware and virus detected across the globe will be on one blockchain and everyone will have protection who uses the service. Not only does this allow for security from virtually every security expert in the world, but it also utilizes an easy payment system though cryptocurrency, allowing it to be easily utilized by everyone.

I highly recommend giving a listen to the interview, because Steve puts it in very basic terms and its very interesting.

Forecasting

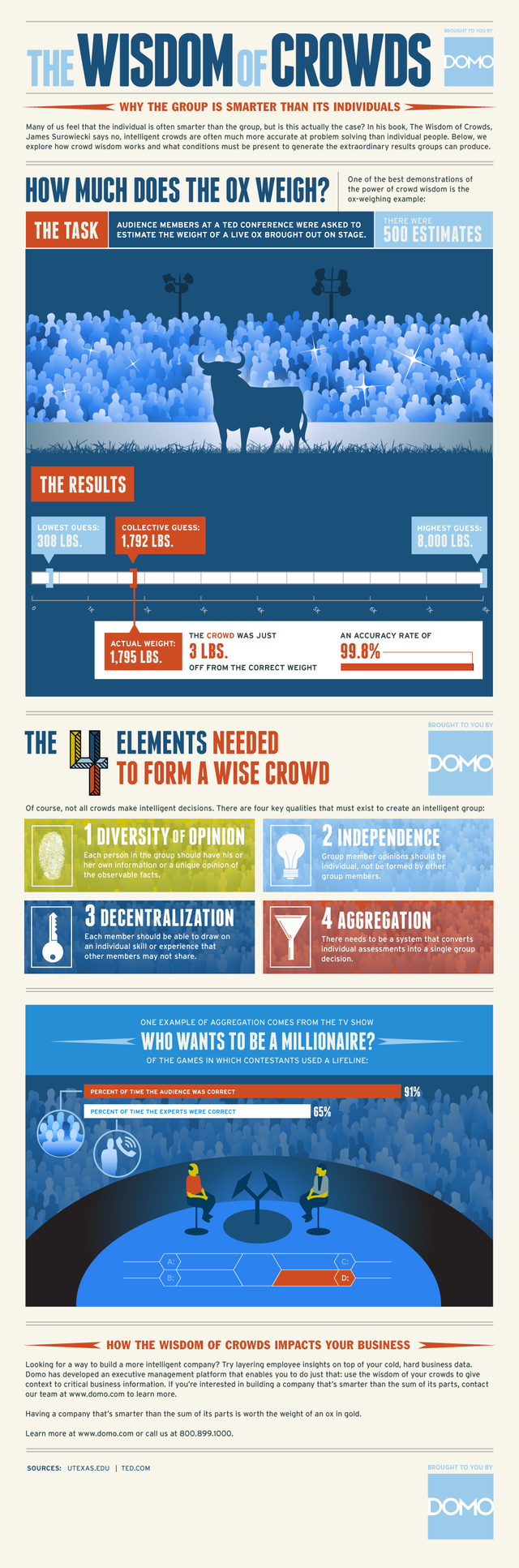

Blockchains like Augur, allow people to bet on anything from sports events to political elections. Doing so takes advantage of a principle called "Wisdom of the Crowds" which shows that large amounts of people are better at predicting future events than an one person.

This actually leads into a another important area which are political elections. Through blockchain people can directly vote for political leaders with convenience and confidence that their vote was counted and not misrepresented.

Charity and Non Profit Organizations

One of the biggest setbacks of charities non profit company donations was the trust that the money donated was actually being used for a good cause. Blockchain based charities allow people to publicly track money that was pledged for certain causes, which eliminates charities with bad intention and straight up fraudulent charities that are fronts. A good example is the notorious charity known as Cancer Fund of America (CFA). CFA over the years raised nearly $100 Million, and over the same period of time patients received less than $1 Million in direct cash aid. This is unfortunately only one of the few major charities that made headlines in recent years.

Music Industry and Other Art Industries

The music industry is one that has long been need of something like a block-chain. Currently large music labels and distributors like Spotify reap most of the benefits of musical artists leaving them with very little return on their creative efforts. Spotify takes 30% of revenue before paying the major labels and producers their royalties. This leaves musicians with very little at the end of the day. According to the graphic below, artists (Songwriters and Recording Artists) take home roughly 22% of total revenue generated from their work when people buy from iTunes, while Apple and the Label take home a majority of revenue.

Blockchain based music services can give power back to the musical artists, allowing them to have control and rights over their musical property and allowing them to license out the music. This can have a profound impact on the industry allowing for a better relationship of musical creators and consumers. It also allows amateur artists to be better recognized without the backing of major labels who demand a large cut of revenue. Blockchain can change the industry to make it more authentic and promote art the community values.

Conclusion - Change is Natural There is no Need to Fear

These are only a few examples of some of the industries that are most likely going to be effected by blockchains, and although it may seem intimidating at first especially if you are in position that could be taken over by blockchain, I think its very important to understand that this is only a natural process in technological evolution and its best to understand and ride the wave than to stand against and oppose the force of nature. The biggest argument against automation is usually that it leads to a loss of jobs, however my personal viewpoint is that this a skewed way of thinking. Automation causes the loss of repetitive jobs, and ones we no longer have a need for. Although this causes job loss in the short term history shows that this eventually leads to more and better job creation that come with a better quality of life. Economists at Deloitte have reviewed data over the last 100 years and concluded that technological advancements have created more jobs than it as actually taken away. Advancement and job shifts are a natural process, its up to individuals to harness to the power of disruption and be on the right side to take advantage of it.