From $2.9 Billion in a Month to Hundreds Dead: Trends of the Rollercoaster ICO Market in 18 Months

Around a thousand cryptocurrencies are considered deceased recently. it was connected to Bitcoin’s drop inprice and was hinting toward a complete cryptocurrency bubble.

However, the cryptocurrency ecosystem may be a very little more complicated than that, and one of the most attention-grabbing and staggering facets of it all has to do with the Initial Coin offering (ICO) marketplace. it's seen as a region of cryptocurrency that's aimed toward both disrupting traditionalventure capitalist economy as well as expanding the broadness of cryptocurrency beyond that of justBitcoin.

This boisterous side of cryptocurrencies has a lot of telling statistics that are price delving into — particularly over the last eighteen months, which have seen a huge boom in new coins also as a steadygrowth in capital raised for brand new cryptocurrency comes.

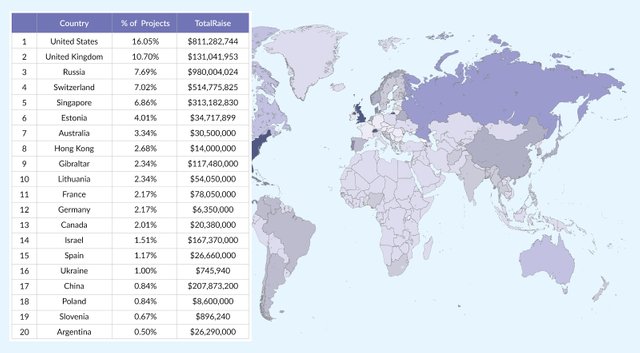

Best Countries for ICO

In the latest trends, it's still the united states that leads the way, followed by United Kingdom and Russia.

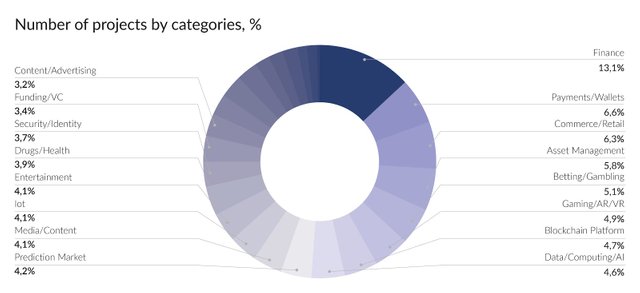

When it involves the sectors that these ICOs are targeting, it is expected that finance is at the highest, due tothe cryptocurrency nature of the comes. but what's shocking is that finance isn't where the most cash is going — that belongs to blockchain technology itself.

Total Amount Raised By All Icos In Total($mln)

It would not be hard to estimate that a good time for ICOs would are in 2017, especially toward the top of the year. Cryptocurrencies were the talk of the whole globe and interest in them was being picked up in terms of Google searches — also as in the value of things like Bitcoin in what has been referred to as a ‘Satoshi Cycle.’

However, while there was so a boost toward the latter months of 2017 and into 2018, March 2018 has been far and away the most effective month on record for funds raised by ICOs. the maximum amount as $2.94 billion was raised in March alone, that is over the next 2 best months (Dec. 2017 and jan. 2018) combined.

This however did have tons to do with 2 specific ICOs, the telegram ICO — raising $1.8 billion in total, as well as $850 million in its second spherical of ICO on March thirty — also because the Petro of venezuela— which raised $5 billion with its presale starting on Feb twenty.

Sorting out the scams

The data indicates that there are many huge issues with the ICO space in terms of not delivering on projects once investors have taken part in ICOs. This part comes right down to failing ICOs, but also right down to variety of scams.

ICObazaar includes a system of rating ICO comes that consists of a weight-adjusted formula with 5 issues — a sixth factor consisting of the particular score — that is all related to by their blockchain and finance professionals. Their information shows some attention-grabbing trends. Firstly, they state that, in their rating system, only seven percent of projects area unit rated on top of four.5 out of 5.

The majority of the remainder of the comes — up to fifty eight percent — score lower than four out of five. the reason for this, according to the site, is as a result of a “lack of data regarding the corporateand it’s team, as well as an unsatisfactory description of the product within the Whitepaper.”

“This happens when the team hurries to get listed on ICO trackers but doesn’t pay enough attention to their documentation, social media or the size and quality of community supporting the project.Which force ICos owner to run one the way of scam.”

nice content

Very nice content, I have upvoted and will redeem.