Fees Collected on the BitShares blockchain through August 2017

Introduction

To assist BitShares stakeholders with understanding the source and quantity of fees that are collected by the network, a report has been prepared that covers the collected fees since the blockchain's inception in October 2015 through August 2017. Note that the fees collected are the fees paid by users for operations that they submitted. A summary of the report appears below.

August 2017

During the month, 0.80 million BTS were collected for 8.92 million operations (within 2.96 million transactions) on the blockchain. 48% of the operations were due to market order creations, and 43% were due to market order cancellations. However, those operations only generated 8% of the collected fees.

The leading distribution of operational fees paid/collected with BTS were as follows:

| Operation Type | % of Total BTS |

|---|---|

| Asset create | 69% |

| Account upgrade | 17% |

| Limit order create | 7% |

| Account create | 4% |

| Transfer | 2% |

| Limit order cancel | 1% |

All Time

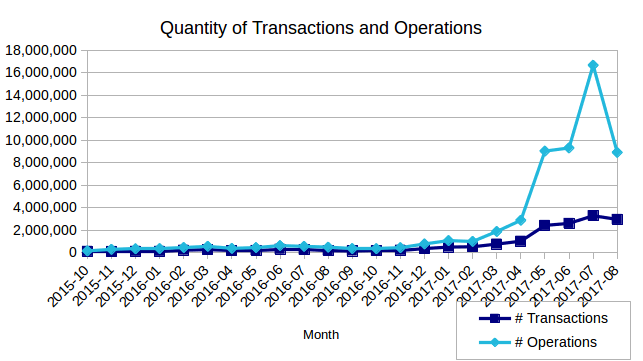

The quantity of operations and transactions, regardless of which asset was used to pay the operational fee, are plotted below on a monthly basis.

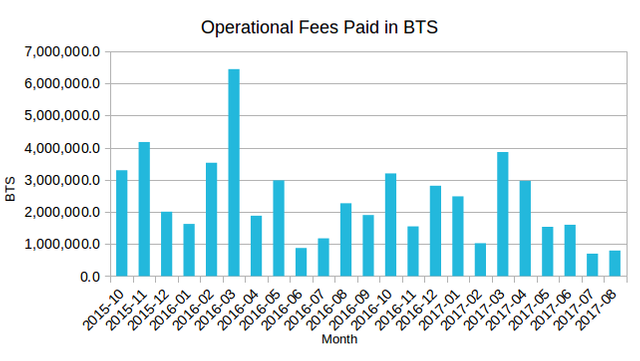

The BTS fees collected since the inception of the blockchain are plotted below. Note that a fee paid in BTS does not necessarily mean that the operation itself involved BTS. For example, the fee to transfer BTS could be paid for in BTS, bitUSD, or any other asset. It just happens to be that the majority of fees are paid for in BTS.

The leading distribution of operational fees paid/collected with BTS were as follows:

| Operation Type | % of Total BTS |

|---|---|

| Asset create | 49% |

| Account upgrade | 25% |

| Account create | 16% |

| Limit order create | 4% |

| Transfer | 2% |

| Asset publish feed | 1% |

| Witness create | 1% |

| Witness balance withdrawal | 1% |

So why are operational fees down so much in the last 6 months? The second chart shows it goign from 4 million to one million?

This is a good question especially because the number of operations has increased so significantly.

Note that the BTS fees are equal to the number of operations multiplied by the BTS fee per operation. Yet, the BTS fee per operation has been reduced by the committee over the 2 years because the USD price of BTS has risen. Consequently, the BTS fees collected has reduced. Eventually, I will produce a version of the report that denominates the fees in another asset such as USD so that the fee profile will be more intuitive.

So those operations that are not transactions are actually things linke canceled transactions as you state (43%)? So could you say that means a lot of people are learning how it works? Who is doing the analytics?

thanks for the report!

I don't know what any of this means, but I'm assuming this means that BitShares is doing really well?

I also see the BTS share price has dropped from .40 in jun down to .08 now. Why the big drop? (I just really started watching BitShares and I have this feeling I am missing out on something obvious everyone else knows.)

The price drop was due to the Chinese lockdown on Fiat exchanges. One of the biggest BitShares exchanges in China had to close and many investors sold their funds.

Thank you. That would be the missing piece. I did notice there was a lot of Chinese volume.

@chris4210

Will hope to get some great photos of steemfest2 events... Danke!

BTS Target $1.10:

What a great post. I follow you now and upvoted you too. @thunderland

Thank you for this report. Good to see operations and transactions increasing.