BitShares Improvement Proposals

Introduction

BitShares Improvement Proposals and Polls (or BSIPs) are a sub-category of workers. They mostly put forward new design ideas, features, or logic enhancements for the BitShares blockchain. Beside regular 'Workers', core token holders are required to explore and vote on them, or in some cases, even write BSIPs personally.

Polls can gather opinions or sentiment by consensus and consequently record them on chain. Don't confuse BSIPs with the main Workers such as the Reference UI. However, what they can and do, is to drive core blockchain feature requests and enhancements that can only be undertaken by worker funding. For instance, the Core Worker undertakes the approved BSIPs requiring core development. They're added to the BitShares BSIP GitHub repository for deployment. As example, you can take a look at the first ever BSIP written for the blockchain.

How Workers and BSIPs differ

One thing making a BSIP different to a worker is that it often doesn't request additional funding. Also if it is not requiring any development it becomes a poll instead, however this does require a core developers estimate and participation before any actual implementation/approval can be done.

"A BSIP is a technical document describing the process of updating and improving the BitShares blockchain and technical ecosystem .. " (GitHub).

To summarize, only blockchain consensus (votes) can determine if a BSIP goes ahead. In other words, they're another way core token holders make decisions about the running of BitShares. Just like a worker, BSIPs go ahead when they receive enough votes to activate them. Unlike a worker, BSIPs do not necessarily have any budget associated with them. BSIPs also let consensus decide on new features for the blockchain, whilst the core worker handles cost and delivery. In other words, the BSIPs can also be for a worker to get consensus on the work they will fulfill.

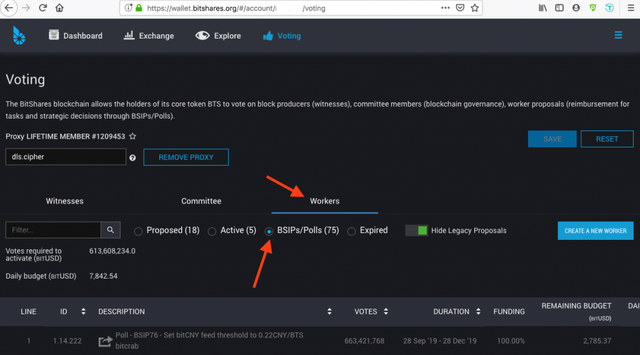

Viewing BSIPs/Polls on the Reference UI Wallet

Login to your BitShares account and from the main menu (top right corner burger icon) select 'Voting'. From the page which loads (seen below), you can locate the tabs for 'Workers' and the sub-categories Proposed, Active, BSIPs/Polls, and Expired.

When you select Workers, BSIPs and Polls to approve, click 'SAVE' and you will be prompted to confirm your transaction plus a very small fee in BTS.

BitShares UI BSIPs voting screen

Current BSIPs

Note: This list might be updated from time to time, which is to be noted here.

BSIP 86: Share market fee to the network

This BSIP proposes a protocol change: Every time a trade is executed (limit order is filled) and if there are market fees generated, a portion of the market fees goes to the network.

Example: The network percent of market fees is set to 50%, and 0.2% of trading volume is the set as market fee. Then 0.1% of trading volume goes to the network.

BSIP 85: Maker Order Creation Fee Discount

This BSIP proposes a protocol change so that the committee can define different transaction fee rates for maker orders and taker orders.

BSIP 81: Simple Maker-Taker Market Fees

This BSIP proposes a protocol change to enable asset owners to specify different market fee rate for maker orders and taker orders.

BSIP 77: Require Higher CR When Creating / Adjusting Debt Positions

This BSIP proposes a protocol change which aims to improve overall collaretal ratio (CR) of smartcoins.

BSIP 74: Margin Call Fee Ratio

This BSIP provide a solution to charge a fee from margin call trading.

BSIP 73: Match force-settlement orders with margin calls and limit orders

Force settlements are the last resort measure to guarantee Smartcoin holders to obtain the underlying collateral, this happened often at a price below market price. With this change, force settlements are matched dynamically for best price under certain conditions.

BSIP 72: Tanks and Taps: A General Solution for Smart Contract Asset Handling

Introduction of simple and ready-to-use interface for dapp developers to allow rapid development and a reduced time to market. Dapp developers don’t need their own infrastructure or complicated smart contracts, they can utilize the proposed infrastructure and will share a consistent, secure and easy-to-visualize asset handling model. This will become increasingly familiar to users of dapps based on BitShares, giving the developers and users confidence.

BSIP 70: Peer-to-Peer Leveraged Trading

Introduction of peer-to-peer lending markets that allow borrowing and margin trading on the BitShares DEX, while the lender gets paid interest and is protected by automatic margin call mechanisms.

BSIP 62: Close margin position

Closing a short position comes with a risk of getting margin called if no spare funds are available to buy the long and reduce the debt to zero. This BSIP introduces a way to put the short position directly on the market.

BSIP 64: Optional HTLC pre-image length, HASH160 addition, and memo field

Extension of the HTLC operation to directly include the most common hashing algorithm, make the pre-image length optional and introduce an optional memo message. This is standardizing our HTLCs inline with other blockchains.

BSIP 69: Additional Assert Predicates

Enables operations for conditional validation of transactions for various use cases, including safety of transactions that depend on recent prior transactions. Paves the way for Payment Channels and the Interledger Protocol.

Older BSIPs

BSIP 57: Managed Vesting Balances

Managed vesting balances allows the user to realize several use cases, among them are a savings balance, purposeful staking of assets and non-custodial on-boarding into centralized services.

BSIP 47: Vote Proxies for Different Referendum Categories and explicit voting operation

For each vote category (witness, committee and worker) you may need quite specialized knowledge into the matter to come to an elaborate voting slate. Thus, this BSIP introduces the ability to set a proxy for each category, instead all for one like currently. On top of that, it introduces a new operation tailored for voting, enhancing user security and reducing blockchain bloat.

BSIP 45: Add BitAsset as Backing Collateral flag/permission

Asset owners should be able to decide if their asset may be used as collateral for a new SmartCoin.

BSIP 39: Automatically approve proposals by the proposer

This facilitates elaborate use-cases for proposals, e.g. involving 2FA, by allowing the creator of the proposal to implicitly give approval to the proposal as well.

BSIP 22: Vote Decay for Witnesses, Committee members & Proxies

Encourage an active voting population by introducing a sophisticated vote decay scheme. Those that seek to be voted into power will need to actively campaign in order to stay within approval.

Conclusion

These are some interesting and crucial BSIPs and most importantly they harbor some excellent potential innovations for the direction of BitShares. So be sure to review the above BSIPs carefully, and follow the instructions to cast your votes. More voter participation is one of the keys to making BitShares a great place to be, however careful diligence on your voting also ensures this is the case. Not all BSIPs are good, as anyone can propose them - everyone benefits when we as individuals make sure to engage in the community groups, and do some due diligence of our own before voting!

Posted from BitShares News using SteemPress, see: https://news.bitshares.org/bitshares-improvement-proposals/

Congratulations @bitsharesorg! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!