A basic guide to Margin trading (Or leveraged trading) #1

The global crypto market reached its peak on 8 January 2018, and then fell by a huge margin. People reacted in three ways.

a) Those who HODL’d (i.e. nearly everyone) lost 70%, assuming they matched the market. Most traders under-perform the market so they lost more than 70%.

b) Those who sold for USD in January did well — they preserved their portfolio value measured in USD and increased it in BTC.

c) Those who sold their portfolios for USD and shorted Bitcoin and ALTs though the first Half of 2018 made an additional fortune to the one they made in the run-up to 8 January.

While we do believe we are in a bear market, no market stays in a bear market forever.

Similar case for a bull market as well.

Enter leveraged trading or margin trading.

(This is where, you can trade with more than what you have (yes! Actually), with an additional risk of losing your entire capital in case the market turns against you.)

Taking High leverage is risky, so we urge people to do some research before starting leveraged trading.

Ideally, you should initially try with very less margin, and increase margin once you are comfortable with this market.

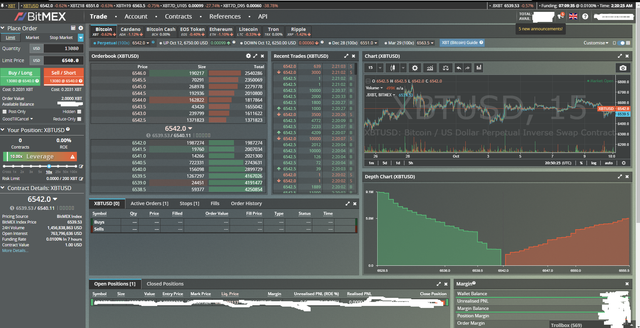

Set-up to buy 2 Bitcoin ($13080) with 0.2 BTC ($1,308) Margin i.e. 10x Leverage Long

Assumption:

You have 0.2 BTC in your wallet,( you may have more or less than that. Scale down or up figures accordingly)

Setups are same for 2, 3, 5x or 20x long/short, and I have covered one example in depth. I have also covered cross margin example in a little bit of detail later on.

If I missed out any point, I request you to add in the comments section. I'd be very happy

Have a look at the screenshot below

(I have intentionally blurred the available balance and stuff, and my name to protect privacy, but anyway, dont worry, I dont have enough capital to move the markets yet :D )

Place your order through the order box:

Quantity: The quantity of the trade is $13080. This is your position. But the money you place at risk is less than this, depending on what leverage you choose. The higher the leverage, the less you place at risk, but the greater the probability of losing it.

Cost: The cost is 0.2031 BTC i.e. $1,328.

Cost = Initial Margin+ (2 x Taker Fee)Cost = (1/Leverage x Position) + (2 x Taker Fee).

This is the maximum you can lose. You lose the entire amount should the price fall by 10%. If the price was to crash to $5,000 your loss is still limited to $1,167 which is the value of your Initial Margin.

Order Value: The value of your position is 1 BTC i.e. $11,670. (0.9889 BTC to be exact.) Fees are calculated on this amount.

Available Balance: This is how much you have available for trading.

Cost must be lower than Available Balance to execute the trade.

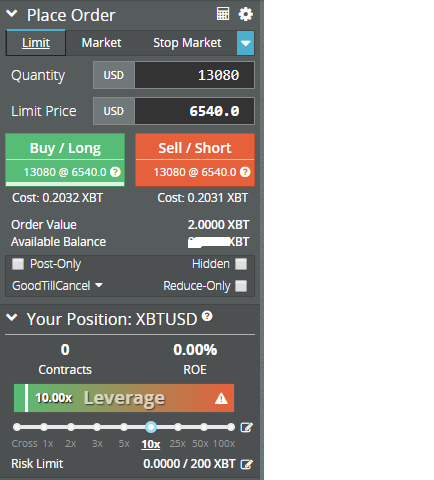

Buy 2 Bitcoin with 0.2 Bitcoin Initial Margin: Example of Cross Leverage

(Cross leverage is actually risky, so dont take cross leverage with a huge amount of contracts like this, unless you know what you are doing)

You can buy 2 Bitcoin ($11,670 at time of screenshot) with 0.2 BTC ($1,167) by buying a 10x leveraged cross position. You pay only 10% Initial Margin. You can also short the Bitcoin price (profit from a fall in its price) by Selling the Contract. The most you can lose is Everything. If you take a cross margin.

Cross margin is dynamic, so you may take up to 100x leverage through cross margin. It adjusts automatically depending on the number of bitcoins you have, and the amount of contracts you are taking long/short.

Let's clear this with a simple and hypothetical example:

Let's say, you have 0.02 Btc. And the current market price of 1 Bitcoin is $10000.

It means:

Your value in dollars is 200.

If you take 200 contracts long/short,on cross leverage, you are basically taking a 1x long/short, or 0.02 btc by risking your entire capital. Of course your liquidation levels will be far away from the current market prices. So if you can determine where the market will move by considering a buffer time, its good, provided you use proper stop loss, else you will lose out on funding and stuff. Remember, its never a good idea to HODL contracts on Bitmex. Close and hold your bitcoins instead. They are cruel, they will charge you fees, and sometimes you may get liquidated as well due to violent market swings.

Now lets say you take 2000 contracts long/short on cross leverage. So basically you are taking a 10x long/short by risking your entire capital. Your liquidation levels will be nearer to market prices, than the 1x leverage, but still you can play safe here if you can manage your capital well.

Now lets come to the extreme point: you can take the maximum of 20000 contracts based on the holdings you have in your account.

That will mean a 100x on your position, or 2 Btc!

So with just 0.02 btc, you are taking a position worth 2 btc.

This has the greatest risk, and we never recommend it unless you really know what you are doing.

Most of the 100x ers get 'REKT' by doing so, as the liquidation levels are dangerously close to the market prices, so you may get liquidated very early on an event of a slight noise.

We recommend taking a max of 20x on btc, and 10x on alts, and never more than that.

It's always safe to play with 2-5x margin, and with patience.

Now comes about the three Limit, Market and Stop market.

1) Limit orders: Here, you set a price at which you want to enter.

Example scenario: Lets say BTC is trading at $6200. You want to take long from $6100. This is the thing for you then. The trade will be executed once the price you mention in the "Limit Price" reaches. In that case, if the price falls at 6100, or below 6100, the trade will be executed.

Same scenario for short. Here, if you want to enter short at $6300, the position will be entered once BTC reaches 6300.

2) Market orders: If you want to enter at whatever price BTC is trading in, this is the thing for you.

Example scenario: Lets say BTC is trading at 6211. You believe BTC will go up in short term, and want to enter immediately. go for the market buy, enter number of contracts, and your order will be filled immediately. LEts say during the process, price changes to 6214. Your order will be executed at that price.

3) Stop Market: This is a good practice. Lets say, you identify a trend in the market.

Example scenario: Lets say price is $6200.

Let's say, you identify trend change like, if BTC falls and closes below 6100, it may go down till 5800.

Or lets say, if BTC rises above 6300, it may go up till 6600.

Case1: You are long at 6200.

In this case, you can set your stop loss at 6100. So, if the price hits 6100 or below, sell order will be triggered immediately and you exit your position. you do this to avoid further loss, as you may see a trend change, where btc may fall back till 5800.

There is a catch. You can manually set the number of contracts. You may choose to exit a part of your position as well. So if you are long with, lets assume 200 contracts, you may set a Stop loss with 100 contracts as well.

One more catch: Set stop loss a little below the identified trends, as the space is a bit manipulated, and some big players intentionally dump and hit stop losses of other people to generate a liquidity pool when they can enter with big bags. (This is a part of institutional flow order book, and I'll cover it in details in another article, so stay tuned!) Ideally, you may set stop losses at 6088 or 6078, after doing some research.

Case 2: you are short at 6200.

In this case, you may set a stop loss at around 6300. Like, 6317, or 6327. Because you have identified a trend where BTC may reach 6600, which will result in more significant losses if it closes above 6300.

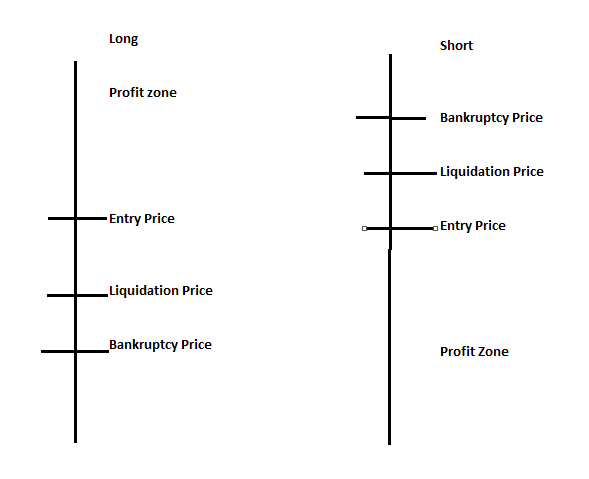

Rule: If you are long you want price to go up. an if you are short, you want price to go down.

I found an image on the internet, which I feel may be helpful to get a brief insight.

I hope I could clear about the setups, explaining the basics on margin trading on Bitmex.

This is the first article.

I'll come up with many more articles and eventually turn this thread into a tutorial explaining how everything works.

Do follow us so that you dont miss out on updates.

I'll cover about liquidation, capital management, orderbooks, in the upcoming articles.

If we helped you in any way, show us some support by upvoting and sharing this!

And/or signing up with our affiliate link:

Sign up with the link below and get flat 10% off on all trades!... :D

https://www.bitmex.com/register/2hquvK

And dont forget to follow us on telegram .

We share some of our trades for free in our channel. So follow us to get a rough idea on trades we open/close. We are a team of 2 individuals managing the channel, with some additional help of some people, who are playing in the market for quite sometime. Before opening trades, always DYOR.

We maintain professionalism, and we dont give out any legal financial advice, but we are transparent about the entry/exit points we follow and share them in our channel. We hate pumps and dumps, and we declare proudly we are not a part of such groups.

You may follow the calls if you find them useful, and backtest our previous calls in the telegram channel.

Here are a few tips:

#Tip1: Never chase a pump/dump in a market. enter using dollar cost averaging, or ladder your buys and shorts.

#Tip2: Set targets always. Small targets are good. Because you are taking leverge, your risk:reward ratio will be scaled up according to leverage. 1% gain on a 10x leverage means almost 10%.

#Tip3: I have seen some people taking positions according to the "Buy/sell walls". This is the worst a person can do IMO. I used to do this when I was a noob initially. I got rekt once, so take this as a lesson. Buy/sell walls are fake and are there only to confuse people

#Tip4: Take less leverage. 3-5x is fine. Dont ever be greedy and go for 100x, as chances are, you may get rekt.

#Tip5: Never HODL contracts once you gain significant amounts in greed. If you plan to HODL, use stop loss. But remember, a trade executed on stop loss will have more fees.

#Tip6: Never ever believe people in the bitmex trollbox. Thats the worst place a person can look for help related to trading.

#Tip7: Dont try to catch every trades. Trade in a disciplined manner, secure less profits, but consistent profits. It's absolutely okay if you miss out a huge price movement. Such opportunities come and go often. If not today, tomorrow, there may be another opportunity. :D

#Tip8: Dont become greedy and go all in at 100x. you may lose all.

#Tip9: Use capital management, if you have lets say 0.2 btc, enter with an isolated margin of less than 0.02 btc, or less number of contracts, with Stop loss, on cross margin)

#Tip10: (A bit weird one :P) : Lets say, you suddenly earn an astronomical figure, lets say, some 2000% in just one trade, out of luck. Book profits immediately, get out of the trade, and take rest for at least a week. Go out, enjoy with your friends and family, let the euphoria inside you settle. Come back once you feel the euphoria is gone. I've seen many people, and its my personal experience as well. "You make all wrong decisions when you become euphoric".

Hope this article helped you in some way. Constructive criticism and feedback will be greatly appreciated.

Do resteem and share if we helped you in any way. :) We'll come up with more articles if you all find this useful. Do show some inspiration :D

Thanks,

Team CryptoZilla!

Keep Rocking,

Happy Trading/ HODLing/BTFDing!!

Congratulations @cryptozilla1! You have received a vote as a way to thank you for supporting my program.

BitMex works great if you live outside the US. If you're effected by the reach of the US Gov't, consider access through TOR or set up a foreign based entity. Also practice the trading concepts on their testnet. Simplefx is also another platform you can use.