Trading in 2025: Between Geopolitical Chaos and the Hunt for Quick Gains, Where Are DEXs Heading?

For several months now, financial markets have been living in a state of near-constant instability. Trade tensions between the U.S. and China, monetary uncertainty, persistent inflation, and geopolitical conflicts—the global economic climate is electric. And in this ongoing storm, crypto keeps moving forward. But it's changing its face. Slowly but surely.

Where long-term thinking was still the ideal in 2020-2021, fueled by the rise of DCA, staking, and the dream of a "Web3 tomorrow," we now see a shift toward short-term thinking. The fast. The raw. The volatile. The "degen." And in this context, DEXs have soared in popularity.

In December 2024, DEXs recorded a record-breaking $463 billion in volume. This number is no accident. It reflects a clear market behavior: users are chasing high-yield, short-term opportunities. They want access to tokens before they're listed on Binance. They want to buy into hype, into buzz, and hope it pumps.

The Decline of Long-Term Thinking?

We can't say the long term is dead. But it's clearly on pause. Many small investors have lost faith in traditional cycles. They see BTC stagnating, ETH going in circles, while memecoins like $TRUMP or $PNUT are making millionaires out of pocket change.

One user turned $20 into $830,000 on $PNUT. Another made $500,000 from a $200 trade on $TRUMP. These success stories go viral, and they reshape risk perception: today, risk is acceptable if the reward is explosive.

The Problem? DEXs Are a Minefield.

Anyone trading on Uniswap or Pump.fun knows this: the degen game is thrilling, but it's also a minefield. You have to spot honeypots, understand token taxes, LP lockers, auto-renounced contracts, fake tokens across chains...

And above all, you have to manage your own wallet. Sign the right transactions. Avoid malicious dApps. Sometimes, you have to accept losing an entire wallet because of one wrong click. That's the rule of the game. And it's brutal.

A Bridge Between Two Worlds: The Rise of Hybrid DEXs

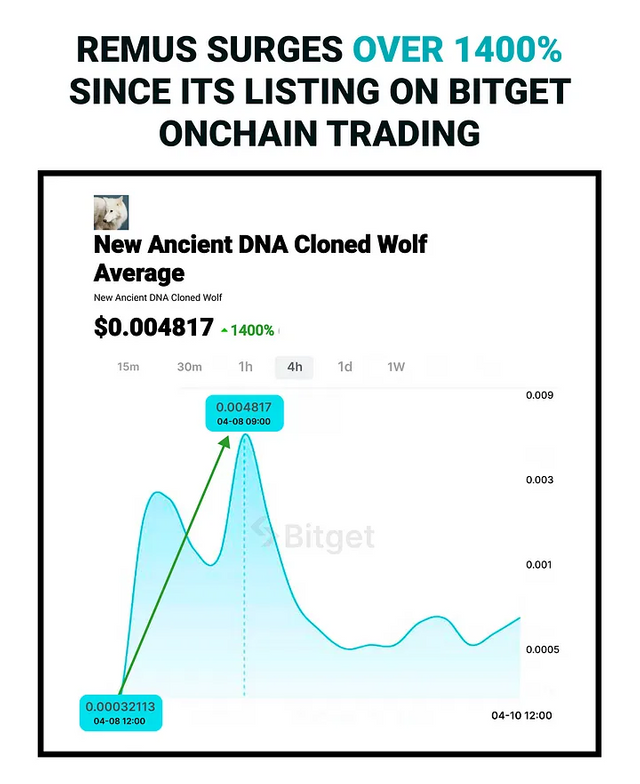

In response to this complexity, hybrid solutions are emerging—half-CEX, half-DEX. One notable example is Bitget Onchain, which deserves attention not for promotion, but because it reflects a deeper trend: making on-chain trading more accessible.

With Bitget Onchain, you can trade on-chain tokens directly from your Spot account. No need to create a Web3 wallet or manage private keys. Transactions are automated, fees are paid in stablecoins (USDT or USDC), and there's an added security layer via Bitget's $300 million protection fund.

Some may see it as betraying crypto ideals. I see it as a pragmatic compromise. Web3 won't evolve if every user has to become a cybersecurity and smart contract expert. We need bridges. And CEXs are well-positioned to play that role.

Toward a More Accessible Crypto?

Bitget Onchain, like other similar initiatives, aims to meet this need: allowing non-technical users to benefit from the on-chain world without suffering its full complexity. Does it replace classic DEXs? No. Is it useful for securing the experience? Absolutely.

DEXs aren't going anywhere. But if we want them to truly explode (in the good sense), they need to become simpler, safer, more intuitive. And perhaps this new generation of hybrid platforms is what will open the door.

In 2025, the choice isn’t just CEX or DEX anymore.

The real question is:

how do we survive and thrive in a world where each click could mean a 10x gain or total loss?