MagicPoopCannon — is he Magic or just plain Poop?

MagicPoopCannon or ‘Magic’ was recently crowned the top yearly author on TradingView. With over 600+ published ideas, 70,000 followers and 10 million views he has been sharing his insights on the cryptocurrency market for the last 2 years.

At Signal, we love TradingView authors. Their analysis of the market can be critical for any trader who is not able to monitor the market 24/7.

But for cryptocurrency to thrive and grow we need to make sure the influencers in this space stand up to scrutiny. An analysis of their trading history and predictions is long overdue.

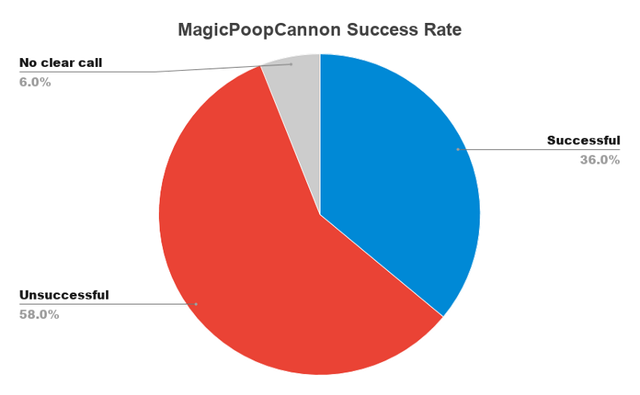

We took a random sampling of 70 of MagicPoopCannon’s posts from 2018 onward and checked to see how his predictions have played out over time. Here are the results.

How good are MagicPoopCannon’s predictions?

During our analysis we were very generous in labeling vague or partially successful predictions as successful. For example, if MagicPoopCannon predicted a rally to a specific zone (say 4000–4500) and a rally followed that went significantly past that zone, we counted the prediction as a success.

When a post contained multiple predictions that contradicted each other, we used the prediction he was strongly leaning towards.

MagicPoopCannon is incorrectly identifying the Head and Shoulders pattern

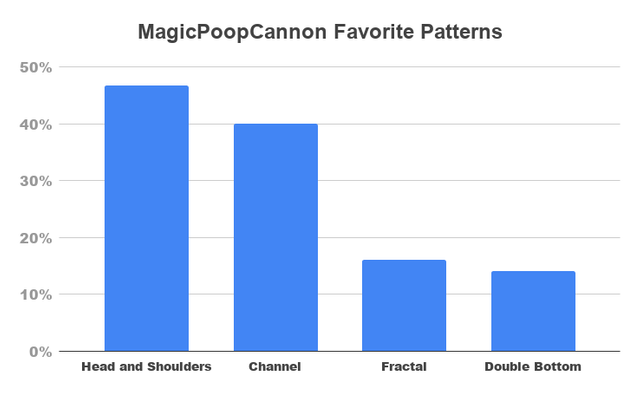

One of the reasons for MagicPoopCannon’s lack of successful predictions might be his incorrect use of the head and shoulders trading pattern

It’s his favourite pattern, mentioned in almost half of his predictions.

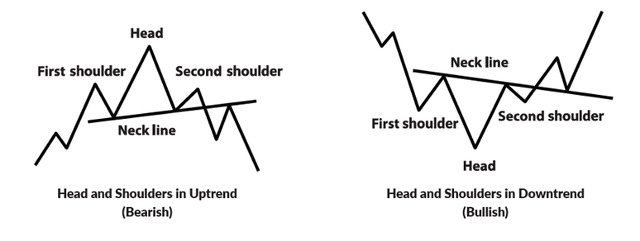

For those wondering — a head and shoulders pattern typically follows this structure:

It’s an easy to identify pattern, and represents 3 attempts (and failures) to continue the trend. If used correctly it can indicate that the market is about to change direction.

There are a few specific criteria that analysts look for when identifying a head and shoulders pattern.

Criteria 1: A head and shoulders pattern happens at the end of an upward trend.

MagicPoopCannon incorrectly labeled this head and shoulders pattern during his Jan 12th 2019 analysis of BTC.

This formation appeared after a drop and not during an uptrend. It is absolutely not an H&S pattern.

Criteria 2: The middle peak in the formation (the head) must be taller than the peaks on either side (the shoulders).

Here is another head and shoulders pattern misidentified by MagicPoopCannon on February 14th 2019.

You can see in the graph that the second peak is lower than the first peak. The second peak needs to be HIGHER than the first and third peaks in order to classify as a head and shoulders pattern.

XRP was also not in an uptrend during this time. That’s two strikes against this analysis.

Criteria 3: The head and shoulders pattern is not complete until the price breaks the neckline (the line drawn between the two shoulders).

Trading on an incomplete pattern can blind you to what is really going on with the market.

During his April 23rd analysis of BTC, MagicPoopCannon called out a head and shoulders pattern extremely early, before the second peak had even fully formed