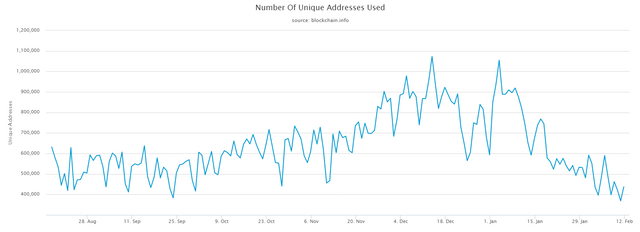

There is Little Chance Bitcoins can Sustain any Real Recovery Until This Fundamental Metric Begins to Turn Upwards Again

Right now for the first time in over 8 years, Bitcoins is going through some of the longest and lowest stretches where its adoption rate is very low and not growing. And there is almost no chance it would fully recover until that reverses. I mean what will that recovery be based on if fundamentally actual users are no longer adopting it at the growing rate they were for years. Any temporary rises would be like vapor - based on nothing. And that is what bubbles are made of, which are guaranteed to eventually burst. Fundamentals will never go away - they can only take temporary vacations.

The metric is based on daily unique address rate. This metric is published here. A comparison to its price looks as shown below:

_feb_13_2018_6.png)

(Source: blockchain.info)

That trend was converted into a model, based on its Network effect using Metcalfe's law, which was explained in a prior article here. So we will continue to keep an eye out to see if Bitcoins will get back to its growing ways in terms of actual number of new users that are adopting the asset.

Maybe the Lightning network will change that dynamics but something will have to give here or its growth rate in price too will have to eventually change, long term. If Bitcoins are being used less, and the growth in blockchains and cryptocurrencies is continuing, this might be the sign of the beginning of a whole new realignment where cryptocurrency adoption is now proceeding through other alternative assets. This is important to blockchains and even steemit because previously the value of all other cryptocurrency asset has followed that of Bitcoins. We might slowly see that begin to change. Drop me a comment to let me know what you think or what you are seeing.

References:

https://www.sciencedirect.com/science/article/pii/S1567422317300480

Legal Disclaimer: I am not a financial adviser and this is not financial advice. The information provided in this post and any other posts that I make and any accompanying material is for informational and educational purposes only.

It should not be considered financial or investment advice at all. You should consult with a financial or investment professional to determine what may be best for your individual needs.

This is only opinion. It is not advice nor recommendation to either buy or sell anything! It's only meant for use as informative, educational, or entertainment purposes.

Do market need more correction?.My personal thinking is $8000 is also too much for it, I do not think any assets appreciated that much in a year.

We very well could see it back there shortly. If the adoption rate continues to dwindle as it looks like it id doing right now. But things also do change very quickly in the blockchain space.

Wow amazing idea for other people.

Cryptocurrency is different than the stock market, thus, leaving your technical analysis invalid. I see your point, and I agree with lightning network may Change this analysis, but maybe lightning network isn’t all that it seems because people don’t want to spend their bitcoin. Well, the majority. I personally would rather spend my crap fiat money and safeguard my bitcoin. So although lightning network will make it more practical if a payment option using bitcoin, I’m still not sure if I would spend my bitcoin. But idk 🤔 lots of things are to be considered. Interesting. But yes, lightning network would be a major upgrade and wouldn’t slow its adoption, only accelerate it. Hmmmm maybe it’s not that invalid of a post here, but some don’t care if lightning network come out or not, as they think of it more as digital gold, and not a daily spent currency. 🤔🤔🤔

You may be right. And yes cryptocurrencies are not stock markets. But eventually if bitcoins was growing in adoption for 9 years and then suddenly stops growing and the number of people using it continues to dwindle I kind of believe its value will not continue to grow inversely with its usage. Even if it was being mined from the moon.

And I do not know if the Lightning network will work either. We shall see. Thanks for reading and your perspective. Upvoted the comment.

You do raise some concerning points, but I personally do believe in bitcoin. The lightning network can only help that is, if it does what it says it will do, as it will be a major improvement to the fundamental function to the bitcoin network layed on top of it. A true improvement can only raise confidence, thus, giving it some legitamacy, as it will get back to being closer to the vision of what bitcoin was supposed to be, a decentralized, damn near free method of payment. This should in theory increase user base, if you think about it

What attracted most in the first place I believe was a search for a decentralized (not controlled by any one or entity), non-inflated, nearly free method of payment. Plus it would have stopped the scalability issue, which prevents the user base from growing actually without. So I agree that should in theory increase user base.

As mentioned above, the Lightning network is about to be launched. Its currently in test phases. If that launches successfully, that could change things significantly so we are watching that. In a follow up, we'll look at that network and its technology and how it might impact blockchain adoption, and ultimately value.

yes your right, and with many exchanges starting to offer more pairs against the dollar, bittrex has 15 pairs right now against the usd, so that means btc should be going down in volume because of that alone...........so if btc is the locomotive ? what will happen to alts...

Agreed. It just might mean that Bitcoin dominance of the blockchain space may slowly begin to reduce. Who knows? We are just watching closely but the adoption rate is definitely down now and for the first time last year the number of new stores and businesses accepting it as a payment medium dropped.

What really caused it

Who knows for sure? There were several reasons imo, as follows:

Bitcoin scaling issues are finally catching up to it. It can only handle about 1,000 to 1,500 transactions every 6 minutes. So they know that is an issue and they are trying to fix that with the side chain called Lightning. In the past, that may have not being as big an issue but as other blockchains now come online that can do better and faster, many that use bitcoins are indeed switching to those alternatives.

Bitcoin transactions are getting more expensive. You are finding people paying up to $20 and more for transactions just so they can get mined. Part of the attractiveness was its speed and value to tansfer funds. What would be expected if it begins to get more expensive than WU?

Some of the regulatory action such as the Chinese ban on exchanges and some of the FUD might have began to affect actual adoption.

We are still observing and wait to see if this level of adoption growth rate is a temporary issue or a long term realignment.

Interesting, I also have checked the price of Bitcoin since recent huge drop. I would say in the future many cryptocurrecy will be classified into two categories; coins backed useful tech or not.

It may take years but coins that eventually find no use will likely slowly wither. Especially when there are coins that are backing useful tech then and are actually being used and growing.

Up vote and follow me bro plzz, I also voted and followed you

Done. Thanks for reading.

You got a 8.15% upvote from @bid4joy courtesy of @kenraphael!

Thank you!

You got a 0.88% upvote from @postpromoter courtesy of @kenraphael!

Want to promote your posts too? Check out the Steem Bot Tracker website for more info. If you would like to support the development of @postpromoter and the bot tracker please vote for @yabapmatt for witness!