A year later: how the Bitcoin Cash community found itself on the verge of a split

Exactly a year ago appeared the most significant and definitely the most controversial fork of bitcoin-Bitcoin Cash (BASH, Bash). In contrast to the" digital gold "with its growing problems with scaling and significantly increased transaction fees at that time, Bitcoin Cash was promoted by its apologists as" digital cash", which most corresponds to the original idea of Satoshi Nakamoto.

Exactly a year ago appeared the most significant and definitely the most controversial fork of bitcoin-Bitcoin Cash (BASH, Bash). In contrast to the" digital gold "with its growing problems with scaling and significantly increased transaction fees at that time, Bitcoin Cash was promoted by its apologists as" digital cash", which most corresponds to the original idea of Satoshi Nakamoto.

The notorious Roger Ver and Craig Wright and is presented with Bitcoin Cash as the "original bitcoin". According to them, it is well suited for everyday calculations, and not only for investment purposes. Often such statements cause in the crypto community indignation or laughter, heated discussions and cascades of funny memes.

However, what exactly was done during the year and did Bcash become a competitor of Bitcoin Core? How actively is "digital cash" used in daily payments and is there a consensus in The bitcoin Cash community itself?

Background and main milestones in the development of Bitcoin Cash

As you know, before the activation of SegWit, the size of the bitcoin block was only one megabyte. When "digital gold" was not yet so popular, this restriction did not particularly affect the performance of the blockchain and did not lead to huge queues of transactions in the mempool and the growth of commissions.

In April 2017, the bitcoin exchange rate accelerated its growth and began to attract more and more attention of the masses. This, in turn, caused an exponential growth in the number of network users and increased transaction demand.

By about may last year, the situation with the overcrowding in the mempool has worsened: commissions have increased, some transactions were confirmed within a few days.

To solve these problems in the crypto community, two main approaches have emerged:

- Bitcoin Unlimited (BU), whose supporters offered to significantly increase the block size by means of a hard fork. This option was to the liking of many miners who believed that a larger block would "unload" the blockchain, and also increase the profitability of cryptocurrency mining due to the growth of the total Commission. Against BU was a large part of the developers, who believed that this approach will lead to the concentration of capacity only in the major players of the mining market and the centralization of the blockchain system.

- Segregated Witness softfork, optimizing the structure of the block. Thus, the solution involves the separation of transaction signatures from the process of their transfer. In addition, SegWit solves the problem of plasticity of transactions, and also creates the basis for the implementation of the Lightning network Protocol. The Protocol of the second level of the cardinal relieves the bitcoin blockchain, accelerates transactions and reduces Commission costs. In turn, supporters of the" big blocks " criticized this approach for the complexity of the implementation, arguing that this decision can only give a temporary effect.

After some time, a compromise Protocol SegWit2x was proposed, which meant the activation of Segregated Witness, followed by an increase in the block size to 2 MB.

However, some members of the crypto community were still inclined to believe that even SegWit2x is only a temporary solution, which, in fact, does not solve the problem, and makes it less relevant. Soon after, a group of developers led by ex-Facebook engineer Amori Sesh announced the abandonment of SegWit2x while maintaining the current structure of the bitcoin blockchain, but with an increase in the block size to 8 MB.

In the end, August 1, 2017 was held hardwork Bitcoin Cash, in which the first cryptocurrency was divided into two circuits. The holders of bitcoins have the opportunity at a ratio of 1:1 to obtain the appropriate balance of the number of new coins under the Ticker symbol BCH (at least — BCC).

The first block of the new chain was extracted by ViaBTC pool. Its head Haipo Yan previously spoke in support of the"big blocks". The size of the first block was 1.9 MB, it contained about 7000 transactions.

After a while, the Bitcoin Cash network began to have its own hard forks, mainly aimed at improving performance. So, on November 13, a hard fork was carried out, aimed at optimizing the algorithm of recalculation of complexity, which also supposed to make the transaction confirmation time more predictable (about 10 minutes). In addition, it was intended to make the network more resistant to some vectors of attacks.

Soon after that, it became known about the intention of the developers to switch to the new format of Bitcoin Cash addresses. In particular, the solution was designed to prevent the erroneous sending of BCH coins to bitcoin addresses. Also, according to Amori Seshe, this format would allow developers to "introduce a safer way of implementing smart contracts between several participants"in the future.

Despite the low occupancy of the blocks, in may this year, another hard fork took place in the Bitcoin Cash network. The block size was increased to 32 MB. In addition to block size increase and other code changes, OP_CODES is now available, providing functionality for smart contracts and other solutions.

According to The bitcoin Cash roadmap, the next update of the BGP Protocol is due in November this year.

After all these dramatic events, many, perhaps, natural questions arise, such as " has Bitcoin Cash become the digital cash promised by the developers?"

Current status of the project and its market position

As you know, time puts everything in its place, and in this context, the current state of Affairs of the "obstinate" Bitcoin Cash is no less interesting. In particular, we will consider such important indicators for any cryptocurrency as the volume of transactions, the average size of commissions, as well as trade turnover.

Despite the many gloomy forecasts about the future of Bitcoin Cash from the mouth of its ardent opponents and skeptics, the coin has long been consistently ranked fourth in the ranking of CoinMarketCap.

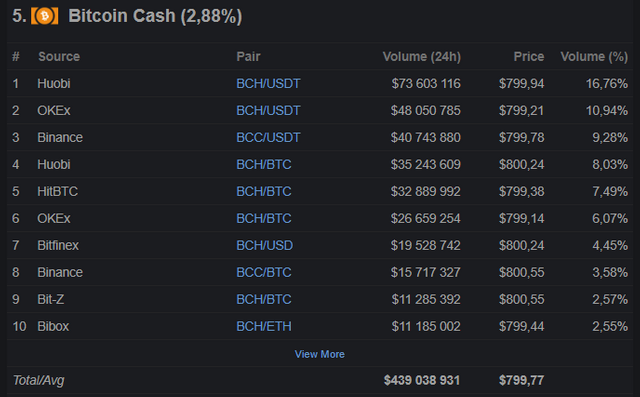

At the same time, Bitcoin Cash turnover on the exchanges is not so small. So, as of 31.07.2018 BCH takes the fifth position in terms of trading volume, second only to bitcoin, tether USB, Ethereum and EOS.

From the table it is seen that a fork of bitcoin is trading mainly on the major Asian exchanges.

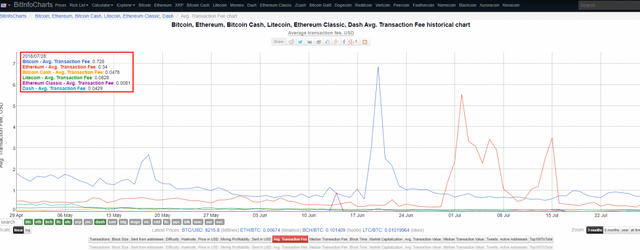

Thanks to the large block size, Bitcoin Cash developers have certainly managed to achieve a significant reduction in the average size of transaction fees:

As you can see on the chart, the BCH fees are significantly lower than bitcoin Ethereum and even Litecoin. However, Bitcoin Cash is much inferior to Ethereum Classic in this indicator, competing with DASH.

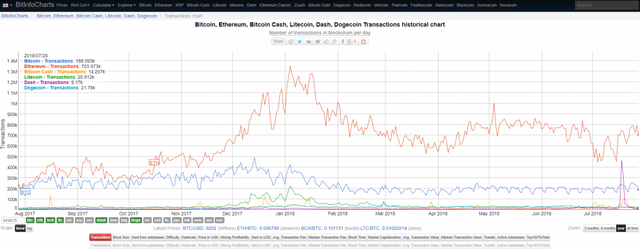

But how do the downloaded blockchain Bitcoin Cash? Having studied the following chart, it becomes obvious that the transactional demand for" digital cash " is very low.

Bitcoin Cash is significantly inferior to the "grandfather" in terms of the average daily volume of transactions, even more — Ethereum, as well as to Litecoin and Dogecoin, although a little more popular than DASH. Moreover, in March, the volume of bitcoin's SegWit transactions exceeded the total number of transactions in the network of its implacable opponent.

Once again, we emphasize that Bitcoin Cash was originally positioned as "digital cash". Of course, the crypto community could not help but notice such low transactional demand and not respond to the obvious failure of BCH in this important aspect.

Some believe that the current price stability and the fourth line of the Bitcoin Cash rating is due to miners (especially the AntPool pool), artificially maintaining the rate by burning part of the transaction fees.

Due to the small volume of transactions, it happens that the blocks of "true bitcoin" are only 5 KB in size.

It is worth noting the fact that the activity of developers in bitcoin Cash repositories decreased to a minimum.

Caution among BCH supporters and holders of diversified crypto portfolios can also cause the fact that the blockchain of "digital cash" is extremely centralized — 98% of the nodes control only one server.

On the verge of a split

Most recently, the main developer of Bitcoin Cash, Amori Seshe, proposed the so-called pre-consensus Protocol, the essence of which is that the nodes agree in advance on the General form of the block, not yet knowing which node will find it.

The initiator of this proposal believes that the pre-consensus will facilitate the introduction of zero-disclosure transactions, which can be used in the BCH network for quick payments, and also solve the problem that bitcoin hopes to eliminate through the Lightning Network.

In General, the proposal is intended to make the Bitcoin Cash system more reliable, and the block operation more productive. Seshe insisted on making changes to the code as soon as possible.

This proposal was supported by the main developer of Bitcoin Unlimited Peter Rizun, calling the consensus a good idea. Cornell University Professor Min Gyun Server also tried to convince his Twitter followers that the new Protocol does not threaten anyone's interests and its implementation is appropriate.

The founder of mining pool ViaBTC, Hypo Yan spoke in favor of reducing the time to create a blog in the network BCH tenfold. Thus, he believes that a block can be created every minute in the Bitcoin Cash network.

However, the decision came across a fierce criticism from the" self-proclaimed Satoshi Nakamoto " and the head of nchain Craig Wright.

In particular, Wright said that those who wish to support the Pro-consensus can create a separate chain, but no one else will use this code.

Mercilessly criticized the more reliable, according to Seshe, the system, Craig Wright also expressed the view that it does not contain any advantages, is not focused on the long term and in General is "dangerous".

Moreover, Wright has promised to "destroy" the pool ViaBTC if he would support the proposed Case change in Protocol

This conflict was vigorously discussed at Reddit, whose members are actively "stocking up on popcorn" in anticipation of irreversible changes in The bitcoin Cash community, which is now more than ever close to a split.

Thus, we can conclude that the team of the Bitcoin Cash for the year are not brought into the industry, nothing really new. Despite the relatively low fees, the daily volume of transactions in the Bitcoin Cash network is more than 10 times lower than bitcoin.

It also seems a bit strange that BCH, although its exchange rate to bitcoin has fallen below 0.1 BTC recently, is still in the top five of CoinMarketCap rating.

Given not the best position in the market, the decline in activity of developers and growing disagreements in the community, the long-term prospects of Bitcoin Cash is unlikely to seem to many rosy.

At the same time, the first crypto currency everything is going on, and the conservative-balanced approach of Bitcoin Core developers is gradually bearing fruit. At least, bitcoin is still the undisputed market leader, its capitalization exceeds the same indicator of Bitcoin Cash ten times.

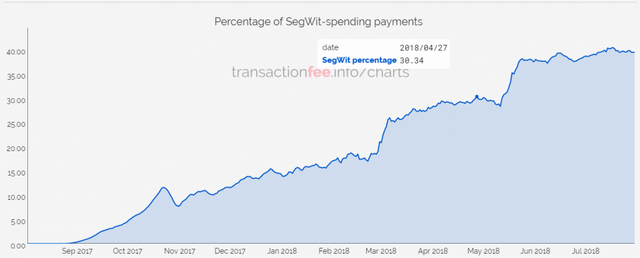

In addition, the volume of SegWit transactions in the bitcoin network is growing steadily:

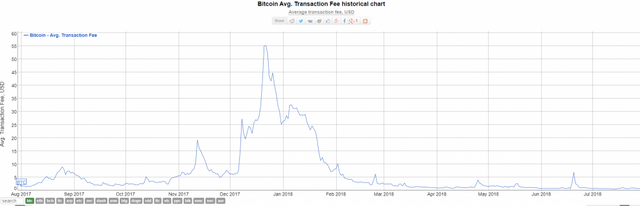

Largely due to Segway and batching, the average bitcoin transaction fees are significantly lower than, for example, in the second half of last year:

Quite rapidly developing infrastructure Protocol Lightning Network, which just lays the Foundation for it to bitcoin has become a true "digital cash".

Perhaps the status of bitcoin leader is provided by the main guiding principles in the development community: changes to the Protocol should not be made too often, and the improvements themselves should be as safe as possible, focused on the long term and meet the interests of the community. They should also be preceded by active discussions among developers, where there is no place for the struggle of personal interests.

@realmedvedev, I'm waiting for the continuation of the topic