Stress Testing and Battle Hardening! Bitcoin Cash Pushes Its Limits! Fees Stay LOW!

Bracing for the Future

It’s been over a year since the creation of Bitcoin Cash (BCH), splitting apart from the Bitcoin (BTC) community and moving forward with its own vision of how Bitcoin should evolve and grow. It hasn’t been easy, and the deep tension still remains between the two communities.

Despite political problems with the big players in the BCH ecosystem and a declining price trend against Bitcoin, technological developments are well underway.

BCH’s primary difference to BTC is the increase in its block size capacity, allowing it to harness a larger number of transactions at scale on the original blockchain protocol while remaining cost-effective for users to conduct micro-transactions.

To prove this can become a reality, a stress test was conducted by the community on September 1st, ten weeks prior to the controversial protocol upgrade in November.

Keeping Micro-Transactions Viable!

According to the official stress test website, the objective is to gather data on and push the potential boundaries of the BCH blockchain, with all members of the community able to contribute to the historic event.

_“We aim to create millions of minimum fee transactions within a 24-hour period. Such volume of minimum fee transactions will prove to merchants and businesses worldwide and also to ourselves that the BCH main network is capable of scaling on chain and is capable of handling such volume of transactions today.” _– BCH Stress Test Website

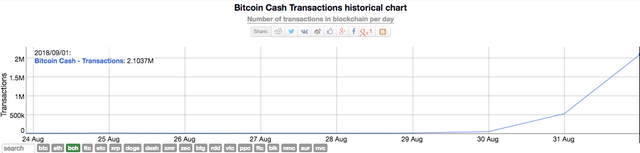

The test revealed some very interesting results. According to blocktivity.info and bitinfocharts.com, BCH reached an impressive 2.3 million transactions during the 24-hour test period.

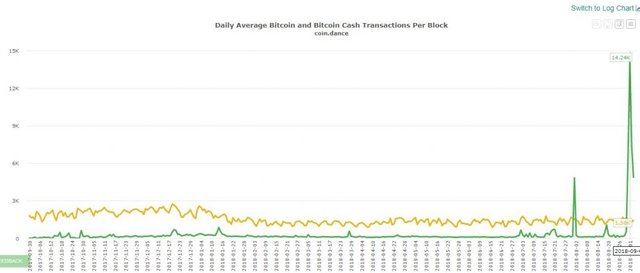

According to data from the Coin.dance image below, during the height of the test, over 14,000 micro-transactions got processed on average in each block.

Another interesting piece of data we can take away from the stress test is the transaction fee volatility against high volumes of network activity.

Again, according to data from bitinfocharts.com, the surge in activity on the BCH blockchain had little effect on the average price of network fees, a key talking point in the ongoing rivalry with BTC.

BCH’s average fee on the day of the test was around $0.0017, an impressive breakthrough meaning that micro-transactions can potentially happen at scale without pricing out the unbankable or those with little wealth to their name.

In the image above, the trendlines of BCH, XRP, and LTC are difficult to spot because the blue and red lines represent network fees of Bitcoin and Ethereum.

Bitcoin and Ethereum have the highest network fees on average, with XRP being the cheapest blockchain by far, costing just $0.0006 to conduct transactions. Litecoin hovers in the middle above BCH at $0.05.

Despite the political and ego-driven rifts happening within the Bitcoin Cash community, this community-driven test is a positive sign and shows us that not just BCH, but blockchain tech overall, has huge potential to disrupt and humble the global financial cartel.

Please always conduct critical research before purchasing cryptocurrencies and only invest what you can afford to lose!

Coins mentioned in post:

I upvoted your post.

Mabuhay, keep steeming.

@Filipino

Posted using https://Steeming.com condenser site.