Looming Crypto 'Civil War' Sends Virtual Currencies Crashing, Ethereum Below $200

Chaos is back in cryptocurrencies with both Ethereum and Bitcoin collapsing in the last few hours as it appears concerns over the so-called 'Bitcoin civil war' are coming to a head.

As Bloomberg reports, it’s time for bitcoin traders to batten down the hatches.

The notoriously volatile cryptocurrency, whose 160 percent surge this year has captivated everyone from Wall Street bankers to Chinese grandmothers, could be headed for one of its most turbulent stretches yet.

Blame the bitcoin civil war. After two years of largely behind-the-scenes bickering, rival factions of computer whizzes who play key roles in bitcoin’s upkeep are poised to adopt two competing software updates at the end of the month. That has raised the possibility that bitcoin will split in two, an unprecedented event that would send shockwaves through the $41 billion market.

While both sides have big incentives to reach a consensus, bitcoin’s lack of a central authority has made compromise difficult. Even professional traders who’ve followed the dispute’s twists and turns aren’t sure how it will all pan out. Their advice: brace for volatility and be ready to act fast once a clear outcome emerges.

“It’s a high-stakes game of chicken,” said Arthur Hayes, a former market maker at Citigroup Inc. who now runs BitMEX, a bitcoin derivatives venue in Hong Kong. “If you’re a trader, there’s a lot of uncertainty as to what happens. Once there’s a definitive signal about what will be done, the price could move very quickly.”

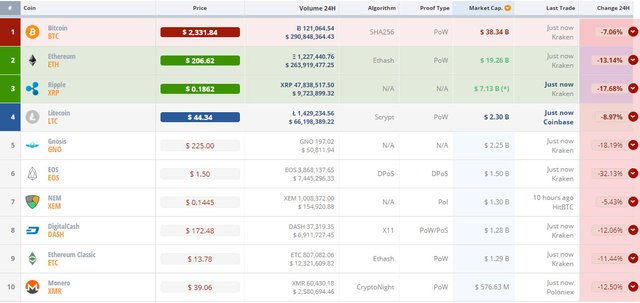

All the largest market cap coins are getting slammed...

Ethereum plunged to as low as $189 before ripping back above $200...

Aside from Ether's flash-crash, these are the lowest levels since May...

Bitcoin was battered below $2300 - its lowest since June 15th...

Bloomberg points out that behind the conflict is an ideological split about bitcoin's rightful identity...

The community has bitterly argued whether the cryptocurrency should evolve to appeal to mainstream corporations and become more attractive to traditional capital, or fortify its position as a libertarian beacon;whether it should act more as an asset like gold, or as a payment system.

The seeds of the debate were planted years ago: To protect from cyber attacks, bitcoin by design caps the amount of information on its network, called the blockchain. That puts a ceiling on how many transactions it can process -- the so-called block size limit -- just as the currency’s growing popularity is boosting activity. As a result, transaction times and processing fees have soared to record levels this year, curtailing bitcoin’s ability to process payments with the same efficiency as services like Visa Inc.

To address this problem, two main schools of thought emerged.

On one side are miners, who deploy costly computers to verify transactions and act as the backbone of the blockchain. They’re proposing a straightforward increase to the block size limit.

On the other is Core, a group of developers instrumental in upholding bitcoin’s bug-proof software. They insist that to ease blockchain’s traffic jam, some of its data must be managed outside the main network. They claim that not only would it reduce congestion, but also allow other projects including smart contracts to be built on top of bitcoin.

But moving data off the blockchain effectively diminishes the influence of miners, the majority of whom are based in China and who have invested millions on giant server farms. Not surprisingly, Core’s proposal, called SegWit, has garnered resistance from miners, the most vocal being Wu Jihan, co-founder of the world’s largest mining organization Antpool.

“SegWit is itself a great technology, but the reason it hasn’t taken off is because its interest doesn’t align with miners,” Wu said.

Still, after previous counter-proposals championed by Wu fell through, miners last month agreed to compromise and support SegWit, in exchange for increasing the block size. Wu says the plan will alleviate short-to-medium term congestion and give Core enough time to flesh out a long-term solution. That proposal is what is known as SegWit2x, which implements SegWit and doubles the block size limit.

“You can think of the SegWit2x proposal as an olive branch,” said Wu.

Support for SegWit2x has reached levels unseen for previous solutions. About 85 percent of miners have signaled they are willing to run the software once it’s released on July 21, and some of bitcoin’s largest companies have also jumped on board. The unprecedented level of endorsement is partly prompted by anxiety of bitcoin losing its dominant status to ethereum, a newer cryptocurrency whose popularity has soared thanks to its ability to run smart contracts and its more corporate-friendly approach.

Below is an outline of the main events that could unify or divide bitcoin:

By July 21: SegWit2x software is released and supporters begin using it.

July 21 to July 31: The community monitors how many miners deploy SegWit2x:

If more than 80 percent deploy it consistently, that should signal community-wide adoption of SegWit and the avoidance of a split, at least for now.

But if a majority do not deploy, expect anxiety within the community to grow as the focus shifts to the Aug. 1 deadline.

Aug. 1: UASF is deployed by its supporters, who begin checking if bitcoin transactions are compliant with SegWit.

If a majority of miners still do not deploy SegWit2x or otherwise accept SegWit, and if UASF supporters do not back down, then two versions of bitcoin’s blockchain could come into existence: a UASF-backed one where only SegWit transactions are recognized, and another where all trades -- SegWit and non-SegWit -- are recognized.

If a split occurs, bitcoin will likely begin existing on both blockchains in parallel, resulting in two versions of the cryptocurrency. Expect traders to quickly re-price the value of both, likely leading to massive volatility.

“It’s moderates versus extremists,” said Atlanta-based Stephen Pair, chief executive officer of BitPay, one of the world’s largest bitcoin wallets. “It depends on how much a person values the majority of people staying on one chain at least for a little while longer, versus splitting and allowing each pursuing their own vision for scaling.”

As a reminder, investing legend Michgael Novogratz recently noted, that he’s looking to add more ether if it falls between $200 and $150... and more bitcoin if it falls to $2,000.

Source : ZeroHedge

For only the best of ZeroHedge and articles relating to Steem, Follow me @Zer0Hedge

I say it all the time, invest only what you can afford to lose and in fact, you really should think in terms of ten years.

TEN YEARS BABY!!

#payitforward

i totally agree ...I feel that i am strong to hold only because the money i have invested in the cryptocurrencies is money that I don't need in order to survive - I am not willing to lose it but i am ready to wait a bit to recover it ...actually in these days and today - i have invested even more in the cryptocurrencies that have lost a lot in my portfolio - this way I will brake even and will be "in the money" even faster

Given that the last few days have been an absolute blood bath with cryptocurrency world, I don't think many people can even think 1 year ahead let alone 10 years.

If only we could fast-forward and have a glimpse at how cryptocurrencies hold up against fiat currencies. I'm a firm believer that it will, but there will definitely be much more volatility to come in the coming months.

Great post @Zer0Hedge

Well I bought in at $203, now it will plunge, cause I bought. You guys can start shorting now..

ain't it how it always goes?? lol

Sure enough it plunged below $203 now in the $180's

Hold it. Then pick up tau chain/agoras and eos.

what and where is that?

It's really simple. When you are in these bubbles and I think this is #5 since Bitcoin started or 6, you hold and stack on the way down and now you just dollar cost averaged yourself better and can laugh it off in the future!

If you just hold on to your coins for multiple years, this dip will not even be remembered...

Agreed and or set up a cloud mining account into your exodus wallet on a 5 year contract and you will be in for a surprise at the end of the race.

These images say it all at the moment for whats going on the wild west of CryptoLand .Nice post.Peace.

ETH will be it!! I bought at 40 hahaha. BTC is way to slow

well yeah BTC is to slow & ETH is running out of gas to easy !

ETH and Bitcoin are two totally different things...

good thing I moved most of my investments to Steem then. I'll wait out this storm and just watch from the sidelines for now.

id say that was a pretty smart move! I'm with you

Steem down 40% from week ago.

Not afraid! Buy low, diversify and be prepared to hold for the long ride!

Always buy!

words to live by

Yup