You are viewing a single comment's thread from:

RE: Why Bitcoin Could Reach $23,000 Soon

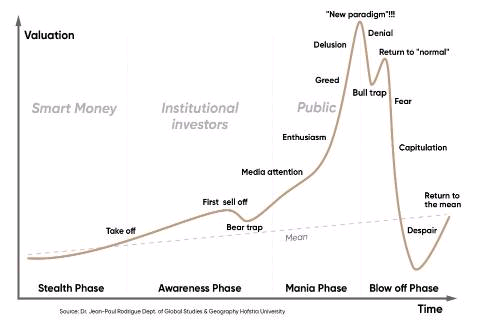

This is illustration of what a bubble looks like, I believe bitcoin just formed the bull trap and is at the return to normal stage, but the rally up will be slow and this will cause fear amongst the new investors.

Edit: Also, if people by cryptos only to speculate, they do not have future. Cryptos are not backed by assets and are not worth even the electricity used to mine them.

Awww this picture brings back memories... funny how many times it's been posted in relation to BTC. In 2012. Couple times in 2013. In 2015. Summer 2017. Now.

See ya next year!

I know... when you post this graphic, you're supposed to say "Tulips! Tulips!"

You don't have to be a genius to say that cryptos are overvalued. But somehow people seem to think that saying so makes them a genius. Yes, son, cryptos are overvalued. Shush now, the adults are talking.

https://imgur.com/nEnQrWl

:)

Well this is why you never know when we will hit the top. The fact is you must not be lead by the image of the graph, but by the stages presented in it.

As long as bitcoin continues to command near-zero utility value, it will always be associated with irrational exuberance and bigger and bigger idiots rushing into a market they don't understand. @yourboy said it perfectly in another comment: "Idiots are a finite resource." The only question is whether we're running out now, or later.

Idiots are not a finite resource.

That's where he is wrong, the supply of idiots will never cease.

Humanity itself with its entire "economy" is a primate bubble, and it's going to go plop while this century trundles towards its end.

It seems you haven't seen the updated bubble model for bitcoin

https://imgur.com/nEnQrWl

It can't be endless, the other name of bubbles is "the bigger idiot" market. In other words, people enter the market knowing that the asset is overpriced, but lead by greed and fomo think that someone will buy it at higher price. And idiots are finite resource.

Of course you're right...but for now, this market has defied all logic...and I suspect it will continue to, at least for the time being. Also, on the contrary, I am making considerable returns mining a variety of coins.

I hope that ypu continue to make money and exit the market at the right time.

It's possible that we see the bubble pop here, but I am doubtful at this stage. So much new capital just flowed into the market and this hypothesis of mine is ONLY based on a shift of that money to Bitcoin rather than more new money. I don't think we'll see everyone heading for hills quite yet, although again - it is notoriously difficult to predict tops in bubbles so you just never know.

If you are right for the altcoin exodus, then yeah we will see massive bull run for bitcoin, for the reasons presented by you. The question is whether or not btc will surpass it's previous high. This is what I doubt, the herd has seen one top, if it is already in the market, making profits, they will cash out of Bitcoin as soon as it reaches the previous top. At this time in the market of BTC/USD we do not have rational people believing in bitcoin's future , but speculants who are in the amrket only for the quick buck.

Comparing that graph to the Bitcoin price, they sure look very similar. So it's easy to conclude that Bitcoin has now peaked. However, one could argue that, instead of being in the 'Bull trap' area, we've actually just entered the 'Institutional Investor' phase, and that we're in the 'Take off' area. The general public is definitely not in yet, and institutional investors, afaik, have only just begun to explore Bitcoin. For me personally, I think we will see Bitcoin at $100,000 within a couple of years. But it will surely be a very volatile ride.

Compare it with this picture. As long as money is going to be printed at such rates because of quantitative easing, all asset classes (including cryptos) will have higher and higher USD evaluations – it's not the value of crypto that is increasing, it is the value of printed FIAT that is decreasing rapidly.