"...the price of any commodity tends to gravitate towards the production cost...", Satoshi Nakamoto

Well, if the purpose of this drop is to scare the bulls, they've succeeded. Some are even questioning if the move up from early 2019 is actually an impulse. They argue for the December 2018 bottom to be wave A, June 2019 top to be wave B and we're heading to new lows, below the $3200 low from December 2018, for wave C.

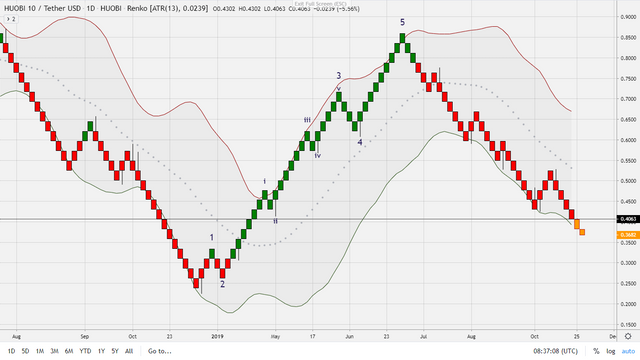

I don't think so. It's true that on the Renko chart the 2019 rally looks more like a three wave than a five wave move (unlike a barchart where an Elliott impulse can be counted quite convincingly), but sometimes patterns are more clear on a Renko chart as it filters out more noise. The three wave corrective structure we're in now, f.i. becomes more clear. When we go to the Huobi10 below however, the five wave structure for early 2019 is undeniably there.

In addition, and very important: "...the price of any commodity tends to gravitate towards the production cost..." Satoshi Nakamoto 21 February 2010. Assuming I'm well informed, the mining costs per bitcoin are momentarily around $6500. Which means: bottom.

The same bitcoin bottom price principle, as defined by Satoshi, was used, amongst others, by trader filbfilb who used it to predict the $3000 bottom - remarkably, even before the $20k top occurred; which, by the way, he also predicted correctly. For sure, here we have someone to listen to. He then called for a move up from 3k towards 14k and a drop to somewhere between 6.5k$ and 7.5k$, after which we would stay between 7k and 10k until the end of 2019. Pretty spot on, I'd say. You can see his work here: https://www.tradingview.com/chart/BTCUSD/TRHIyhs1-Bitcoin-12-Month-Forecast-Updated/ He doesn't post much, but when he does it's worth reading. He also has a YouTube channel where he posts irregularly.

Unsurprisingly, the bitcoin fear index is currently at 17. In December 2018 we were at 10: bottom values.

Conclusion: either we have seen the bottom or we are going to correct upwards, only to visit this bottom one more time before, finally, start searching for new all time highs.

Good analysis, thank you. So its time to buy now.

Thanks, actually buying depends on your perspective or trading strategy. If you're long term extremely bullish, like me, then any dip is a buying opportunity. I bought some more this morning. If you're a trader however, it all depends on your strategy with entry, stoploss and profit stop.