Decentralized vs. Centralized exchanges - Which one is better

What is Herdius and how is it unique in relation to contrasted with customarily unified trades?

In this piece, I need to clarify and plot why DEXs (Decentralized Exchanges) are the eventual fate of digital money exchanging and what are the correct favorable circumstances Herdius' future design offers in contrast with customary incorporated and decentralized trades. One can likewise observe increasingly blockchain new businesses moving into the heading of decentralization — Gnosis is beginning to build up their very own DEX.

Berlin is about DEXs this week with any semblance of OmiseGO, Kyber, Radar Relay, Gnosis, Melonport all taking an interest in a meetup that I am specifically directing the Q&A for. We will share the account and slides on our Twitter ASAP. So with this out the way we should hop into what I get a kick out of the chance to call DEX 101…

Why decentralize a trade? What does it mean at any rate?

Blockchains and digital forms of money were imagined as network arranged open-source activities where the members of a decentralized system have the influence rather than a focal expert. This has remained constant except for dev groups that still have a critical say in the task. In many cases blockchains have a pioneer that everybody trusts in and takes after, restricting the impacts of decentralization, be that as it may, it isn't that huge of an arrangement.

Unified trades are the correct inverse of what has been specified above — there is an immediate clash between what they speak to and blockchain values. A concentrated trade (ex. Coinbase, Kraken, Binance, and so on.) is controlled by a benefit situated organization that gets income from their stage's expense structures. Essentially: both the entrance and leave focuses into the current blockchain biological community require fees — all of which go to incorporated trades. Not reasonable or network arranged, is it? This is the fundamental motivation behind why decentralization is required. In all genuineness, it merits specifying that brought together trades can do fiat (USD, EUR, and so on.) to digital money exchanges while DEXs, then again, are just crypto - > crypto (for now) — this is because of KYC and different directions.

Then again, a genuinely decentralized trade like Herdius works distributedly through a blockchain, with requests and data directed in a shared convention. Along these lines, you are entrusting an arrangement of several free hubs rather than a solitary incorporated substance, similar to a trade.

The issue of trust

On January tenth 2018, Kraken a genuinely enormous unified trade went down for what was guaranteed to be a 2– 3 long stretches of support work. This ended up being false and 40 long stretches of dimness took after. Support work itself isn't an issue, as it was really expected to update their exchanging framework. In any case, the way that everybody's assets are exclusively controlled by Kraken ought to be a disturbing. The private key to get to all your digital forms of money isn't with you yet with them, implying that if trade goes down or is ruptured, every one of your assets are no more. Since digital forms of money are exceptionally unstable and recorded on many optional markets, a 40 hour downtime implies significant misfortunes for the client as far as happenstance costs.

Open key cryptography is great — no question about it, however it likewise has one noteworthy weakness — once your private wallet key is imperiled your assets are gone, until the end of time. In the event that a solitary trade controls billions of dollars in stores and the keys to open them, it turns into an immense focus for those needing to manhandle the framework.

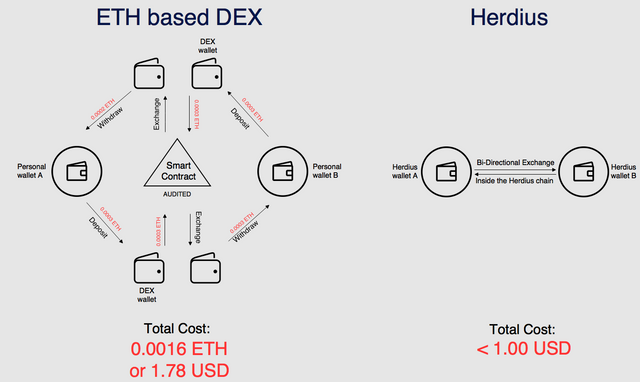

Conventional decentralized trades (not Herdius), which means those that keep running over the Ethereum arrange (Airswap, Raiden, Etherdelta) utilize savvy contracts or a blend of brilliant contracts and installment channels to encourage the exchange of digital forms of money. There is no go between or single confided in element included and you trust the unchanging and decentralized part of a brilliant contract. At Herdius we adopt an alternate strategy and make our own particular blockchain that goes about as an exchange layer over all chains. This not just implies that we are blockchain rationalist and future-confirmation, yet that we are additionally speedier and less demanding to utilize.

Client encounter

Issue with current decentralized trades is that they accommodate a ghastly client encounter and confounding advances/exchanges. In a brought together trade you squeeze exchange and things simply occur out of sight while in a customary decentralized trade there are various exchanges required to trade one digital money to another. In my view there are three things a DEX needs to improve the situation than a current incorporated trade in the event that it needs to end up a feasible option: 1) it must be less demanding to utilize , 2) give more exchange choices, 3) be more moderate.

Herdius illuminates the greater part of the above:

1 In the Herdius framework you are intended to exchange straight out of your wallet by squeezing the exchange catch. The entrance to your tokens would seem straight away. It isn't expected to move reserves from your wallet to a trade, at that point make an exchange arrange after which you have to pull back your tokens to your wallet again — in Herdius you enter your coveted exchange your wallet and afterward gain admittance to your recently obtained cryptographic money straight away.

2 Herdius is blockchain rationalist and explains everything on the private key level. Ethereum construct decentralized trades keep running in light of best of shrewd contracts and consequently you are just restricted to exchange ERC20 standard based tokens. For whatever length of time that a blockchain has private keys included, be it diagram based or not, it will work with the Herdius organize with no extra correspondence layer required.

3 Herdius is likewise less expensive to utilize, much less expensive than current decentralized trades where you pay for the charges of the Ethereum arrange.

In the outline above you can truly perceive how muddled things get when managing a customary decentralized trade while in Herdius the objective is to do bi-directional trade straight out of your wallet so that having stored the assets into a Herdius wallet there is no compelling reason to move cash again somewhere else and you can get to your recently exchanged tokens straight away.

Security

As specified above when we discussed trust, the security of your assets and private keys lies in the hands of unified exchanges — which as a rule don't utilize the most astounding security models. On account of Herdius, the wallet arrange that incorporates each client's assets is of an indistinguishable level of security from a work area wallet.

Truth be told it would really profit brought together trades to execute the Herdius wallet arrange as back-end framework themselves. Doing as such enables them to get to accessible liquidity inside the Herdius system and match exchange orders from the Herdius tie to exchange orders from their own stage. For them there would be no security drawback when contrasted with the present framework that is utilized.

Speed and cost

With regards to speed current circulated systems can not rival brought together ones so to the extent speed is concerned, unified trades have the high ground. This isn't the situation, be that as it may, in the event that you need to move the assets from your work area wallet to your wallet on the brought together trade.

Envision you have Bitcoin/Ether in your work area wallet and you have to purchase a specific token to utilize an expectation advertise or whatever other dApp that expects you to have its token for you to have the capacity to utilize it. The procedure resembles this:

1 Send BTC/ETH from you wallet to the unified trade. You sit tight for the affirmation from the fundamental blockchain and additionally pay the expenses.

2 Once the exchange is affirmed you purchase your token. You pay the unified trade's charges which can be anything from 0,2%-0,8%.

3 Pull back your recently bought tokens. Again you pay the charges of the chain and in many cases even an extra withdrawal expense.

4 After at last getting your tokens you by and by need to send them to the dApp's wallet/keen contract for you to have the capacity to utilize the administration.

I have forgotten the time required at each progression, yet we should represent a 1 minute exchange time at each progression while experiencing the blockchain and imagine that Bitcoin is equipped for that. Here is the thing that the procedure looks like inside the Herdius arrange:

1 When you have Bitcoin/Ether or some other digital money in your wallet that is good with Herdius you make an exchange arrange at showcase cost

2 On the off chance that there is a match settlement occurs in less than 1 second with you having the capacity to exchange your tokens straight away inside Herdius

3 On the off chance that you need to move your tokens outside of the Herdius organize, an exchange is started on the hidden blockchain and your assets are exchanged

To the extent costs go we at first needed to set charges at 0,4% for an entire exchange (creator + taker), however after a specific limit this turns out to be much more costly than different DEXs. The new charge structure would even now utilize a similar expense conspire until a specific sum, after which the expense changes to a settled expense of <$1.

✅ @yosimori, enjoy the vote!

Have you claimed your FREE Byteballs yet? Check out this post on how you can get $10-80 just for having a Steem account: https://steemit.com/steem/@berniesanders/get-free-byteballs-today-just-for-having-a-steem-account-usd10-80-in-free-coins

hello robot @introduce.bot nice to meet u

Coins mentioned in post: