Morgan Stanley Report Institutional Investors Increase Interest in Bitcoin

Morgan Stanley Report Institutional Investors Increase Interest in Bitcoin

On October 31 Morgan Stanley a multinational investment bank and financial services company released the latest report on Bitcoin. The report entitled "Update Bitcoin Cryptographic Currency and Blockchain" said that since 2017 Bitcoin and other tokens have formed a "new institutional investment category."

Compared with Morgan Stanley's 2017 report on Bitcoin they are more optimistic about the 2018 forecast. This report outlines how Bitcoin has evolved and how its investment objectives have changed in its existence. Analysts at Morgan Stanley also mentioned the reaction of central banks and regulators to Bitcoin over the past six months. This report lists several shortcomings of Bitcoin such as energy consumption and a lack of a sound regulatory framework. Analysts revealed that there has been a "surprising" change in the flow of funds into the industry and the trend of cryptocurrency futures is also on the rise.

Cryptographic currency futures

This latest development has been described by the bank as “surprising” while Morgan Stanley is launching a bitcoin-linked derivatives deal. It is worth noting that the bank does not actually intend to trade bitcoin or cryptocurrency directly but rather to provide bitcoin swap transactions linked to futures contracts. Earlier this year CEO James Gorman said a division that specializes in derivatives transactions related to digital assets might provide services to potential customers.

Futures are contracts in which the buyer agrees to purchase assets at a time and price agreed upon in the future. The same arrangement applies to the party that sells the asset. These contracts record the quality and quantity of the standardized assets being traded and the contracts may require actual assets to be delivered or settled in cash.

According to Bloomberg Morgan Stanley already has measures to provide bitcoin swaps but the bank will not officially launch any initiatives without first determining the level of institutional customer demand and completing a thorough internal approval process.

According to previous reports Morgan Stanley told customers that Bitcoin is similar to Nasdaq but the speed of change is "15 times faster." The bank also predicts that financial markets will increasingly use encryption technology in the future

“In the next few years we believe that the focus of the market may shift more and more to cross-transactions between cryptocurrencies/tokens which will be traded through distributed books not through the banking system.”

Although the bank is clearly preparing to launch this latest initiative the fact that the list of institutions willing to liquidate Bitcoin futures has not changed since the 2017 report was released has discouraged short-term hopes for wider adoption of Bitcoin.

Stable currency

The report specifically mentions the most recent development in the field of cryptocurrency the stabilization of coins.

The trend of stable currencies began in late 2017 and experienced an outbreak throughout the summer of 2018. Some industry giants also launched their own stable coins.

Stabilized currency is a cryptocurrency designed to keep volatility at an absolute minimum usually anchoring legal tenders such as US dollars commodities and other crypto assets.

The report emphasizes that although Bitcoin currently accounts for 54% of the market value of the encryption market it also points out that the introduction of stable currency into the encryption market has squeezed away part of the Bitcoin transaction volume which may have contributed to subsequent price declines resulting in the current Bear market.

According to the report the existing large number of cryptocurrency exchanges currently do not provide the convenience of exchange of legal currency because cryptocurrency and legal currency transactions need to pass through the mainstream banking sector and require higher fees. The report then explained that the resulting drop in bitcoin prices also had a knock-on effect on the industry as a whole which meant that owners seeking to be freed from bitcoin holdings needed to find an asset an estimate of the asset. The value is closer to the dollar's valuation.

Morgan Stanley researchers also stressed that although recent trends in the industry have been supported not all stable currencies survive. The report assumes that only those stable currencies with low transaction costs high liquidity and specific regulatory structures can be successful and widely adopted.

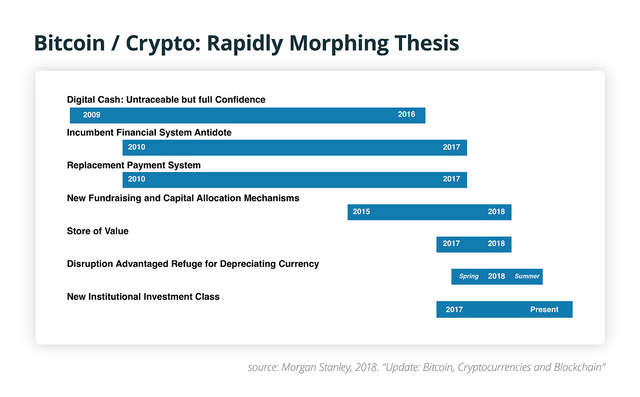

Another key aspect of the Morgan Stanley report is its proposed “fast deformation theory”. This report traces the evolution of Bitcoin from its role in digital cash to a new financing mechanism to a value storage method and to the latest as a new institutional investment category.

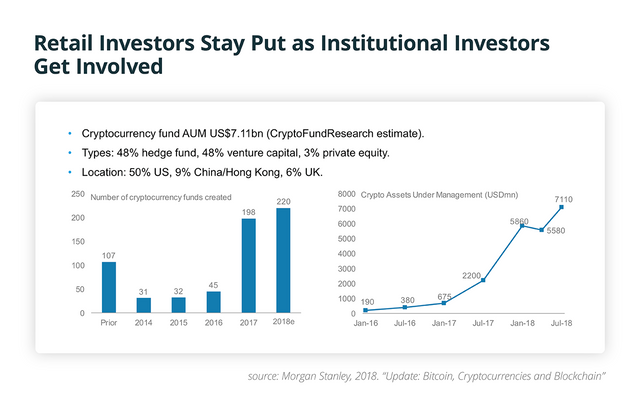

The report shows that 48% of Bitcoin comes from hedge funds another 48% comes from venture capital and the remaining 3% comes from private equity.

In terms of the source of Bitcoin investment more than half of the bitcoin is from US investors China and Hong Kong rank second with 9% and the UK ranks third with 6%.

In addition to financial statistics the report also emphasizes that large companies from the mainstream financial system have also joined the ranks of the competition. Analysts are focusing on Bain Capital's $15 million Series B financing for the seed Cx institutional trading platform Cx Goldman Sachs and Galaxy Digital's $58.5 million investment for BitGo and Coinbase 8 billion. The valuation of the dollar which can be compared with Charles Schwab Fidelity and Nasdaq.

The report also mentions the new trend of encryption companies actively collaborating with institutional investors as well as the market monitoring of Nasdaq by the Gemini Trust Twins Trust (Gemini Trust).

Although the report on agency involvement seems to be quite optimistic the report continues to mention that asset management companies are still reluctant to take on reputational risk in a situation where the regulatory environment is underdeveloped. The bank also stressed that in addition to the large financial institutions currently investing there is still a lack of a hosting solution that holds both cryptocurrencies and private keys.

Although this report represents a major shift in the attitudes of Morgan Stanley and other major financial institutions it does highlight several areas that remain of concern. The report touched on one of the most frequently discussed shortcomings of blockchain and cryptocurrency power consumption. Morgan Stanley analysts predict that falling mining equipment prices will push up electricity consumption.

Morgan Stanley regularly publishes research reports on cryptocurrencies. On August 21st the bank released an encrypted report called Diversified Finance Exploring Global Cryptographic Monetary Regulation. Morgan Stanley's last report on Bitcoin was released in January 2018. The November 2018 report first recorded changes in institutional investment patterns and recorded trends in encrypted futures. The optimistic outlook for the report is likely to indicate that in the 2019 fiscal year large institutional institutions were more willing to adopt bitcoin.