Bitcoin’s prolonged consolidation may introduce volatility

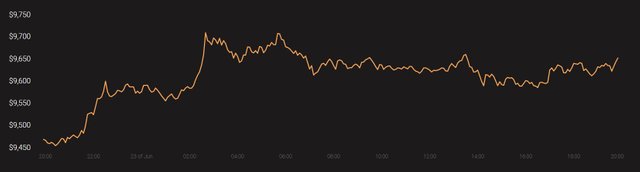

Bitcoin‘s price movement has not been astounding in recent weeks, with the world’s largest cryptocurrency’s price oscillating between $9.5k and $9.7k on the charts. At press time, Bitcoin was priced at $9,656, with a 24-hour trading volume of $19.9 .9 billion.

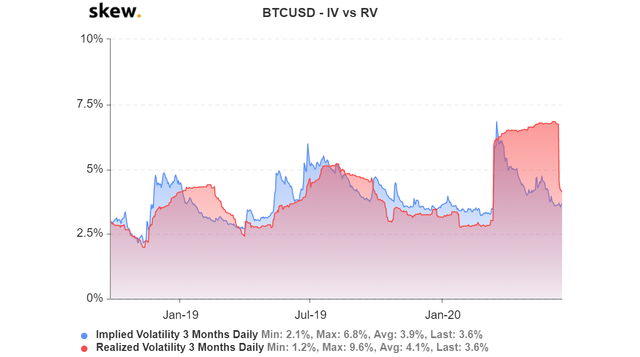

With the price action so restricted, Bitcoin’s Realized volatility [RV] may make a move under its Implied Volatility [IV] soon.

Ideally, the implied volatility is higher than the realized volatility to compensate the seller for the risks involved. However, in this case, the realized volatility had shot up with the implied volatility due to the huge sell-offs in the month of March. Soon after, the implied volatility started to trend lower since traders did not expect the price of the digital asset to swing any higher in the near future. On the other hand, the realized volatility more or less plateaued.

However, on 11 June, as the Bitcoin market plunged by 8.74% within hours, the price of the largest crypto crashed from $9.9k to $9k. This resulted in the realized volatility of Bitcoin dipping from 6.7% to 4.5%, and it has been trending lower ever since. At press time, the implied volatility and realized volatility were at 3.6%, with the realized volatility expected to move further down.

This downward movement in realized volatility’s charts pointed to consolidation taking place in the market. When the RV slides under the IV, this might just be confirmed.

As the IV gauges the impact of future movement of the underlying asset, it is an essential metric for traders. When the IV remains higher than the RV, it compensates the users for the risks in the Options market and traders can go long to earn money. The traders may not be able to reap profits when IV remains lower than the average realized volatility. In the present case, however, the consolidation of the Bitcoin market could continue, as was visible in December 2018 and 2019.

In December 2018, the RV sipped to 3.4%, while the IV remained at 4.9%. This resulted in the price of Bitcoin falling from $5.6k to $3.6k within days, before finally consolidating between $4.2k and $3.3k and later, shooting up. A similar trend was visible in December 2019 when the price first fell and then consolidated between $6.5k and $7k.

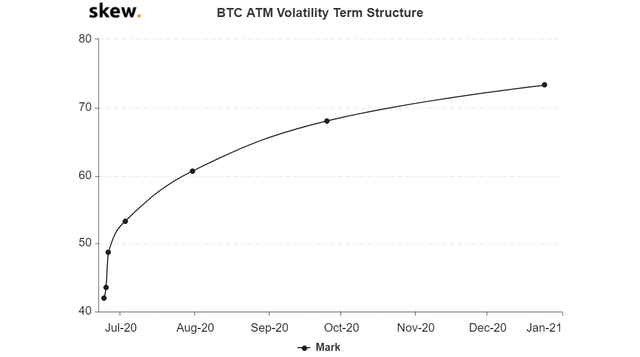

WIth BTC Options contracts set to expire on 26 June, the term structure further highlighted a rise in volatility in the BTC market at the beginning of July.

Bitcoin‘s price movement has not been astounding in recent weeks, with the world’s largest cryptocurrency’s price oscillating between $9.5k and $9.7k on the charts. At press time, Bitcoin was priced at $9,656, with a 24-hour trading volume of $19.9 .9 billion.

Source: Coinstats

With the price action so restricted, Bitcoin’s Realized volatility [RV] may make a move under its Implied Volatility [IV] soon.

Source: Skew

Ideally, the implied volatility is higher than the realized volatility to compensate the seller for the risks involved. However, in this case, the realized volatility had shot up with the implied volatility due to the huge sell-offs in the month of March. Soon after, the implied volatility started to trend lower since traders did not expect the price of the digital asset to swing any higher in the near future. On the other hand, the realized volatility more or less plateaued.

However, on 11 June, as the Bitcoin market plunged by 8.74% within hours, the price of the largest crypto crashed from $9.9k to $9k. This resulted in the realized volatility of Bitcoin dipping from 6.7% to 4.5%, and it has been trending lower ever since. At press time, the implied volatility and realized volatility were at 3.6%, with the realized volatility expected to move further down.

This downward movement in realized volatility’s charts pointed to consolidation taking place in the market. When the RV slides under the IV, this might just be confirmed.

As the IV gauges the impact of future movement of the underlying asset, it is an essential metric for traders. When the IV remains higher than the RV, it compensates the users for the risks in the Options market and traders can go long to earn money. The traders may not be able to reap profits when IV remains lower than the average realized volatility. In the present case, however, the consolidation of the Bitcoin market could continue, as was visible in December 2018 and 2019.

In December 2018, the RV sipped to 3.4%, while the IV remained at 4.9%. This resulted in the price of Bitcoin falling from $5.6k to $3.6k within days, before finally consolidating between $4.2k and $3.3k and later, shooting up. A similar trend was visible in December 2019 when the price first fell and then consolidated between $6.5k and $7k.

WIth BTC Options contracts set to expire on 26 June, the term structure further highlighted a rise in volatility in the BTC market at the beginning of July.

This volatile market may last by the end of the year, as per the chart above.