Bitcoin Halving Could Be Different This Time Around.

The emergence of a futures and options market has created a new ecosystem for bitcoin markets, which faces its first supply cut since 2016.

The programmed supply reduction could potentially bring a supply shock and large price implications.

Bitcoin markets are bound to change between each successive halving, and the market has matured a great deal since 2016.

Whatever happens, the 2020 event will define bitcoin markets for the foreseeable future.

At A Glance

The emergence of a futures and options market has created a new ecosystem for bitcoin markets, which faces its first supply cut since 2016.

The programmed supply reduction could potentially bring a supply shock and large price implications.

Once every four years something happens to bitcoin that slashes the supply growth rate in half.

Bitcoin halving, as it's called, is set to take place for the third time on or around May 12. In the past, this event has coincided with a strong run-up in the bitcoin price and may lead to pre- and post-halving volatility, with price implications extending into 2020 and beyond.

The 2020 halving event has several additional factors than previous such events including the availability of CME Bitcoin futures and options, which investors and miners can use to hedge or express views on the bitcoin price. This changes the narrative around the halving for three key reasons: it enables price risks to be hedged, demand risk for bitcoin can be managed and speculators can look to the indicators of options pricing.

Miner Incentives

New units of bitcoin are created through mining. Mining is the process of confirming transactions, combining them into blocks and adding them to the blockchain. As a reward, and to keep miners incentivized, every time a block is completed, the miner responsible for creating that block receives a reward in the form of new bitcoin. Miners compete with each other to earn newly-issued tokens known as the block reward.

The bitcoin protocol was programmed with several rules; a cap on the total supply of bitcoin of 21 million and a planned reduction in the block rewards miners receive. Currently a new block of bitcoin transactions is solved by miners and added to the blockchain approximately every 10 minutes. Halvings happen once every four years - or more precisely, at every 210,000 blocks of transactions. The next one will happen at block 630,000; on or around May 12, 2020.

With this program of diminishing returns, miners reap fewer bitcoins with each halving. Initially, in 2009, winning miners were rewarded with 50 bitcoin per block. That halved in November 2012 to 25, and again in July 2016 to 12.5 bitcoin per block. The third halving will see the network incentives or block rewards fall to 6.25 bitcoin.

In notional terms, given the bitcoin price of approximately $8,750 as of May 1, 2020, miners receive ~$110,000K for their 12.5 BTC. After the next halving, assuming the same price level, they will instead earn ~$55,000 giving them less of an incentive to mine blocks.

What Can We Expect for the Price of Bitcoin?

In normal markets, lower supply with steady demand usually leads to higher prices. With bitcoin supply reduced, halving has the potential to push the price up, theoretically to double the pre-halving level. This hasn't happened in the past due to the preemptive run-up to the halving event; however, it has usually preceded some of bitcoin's largest runs.

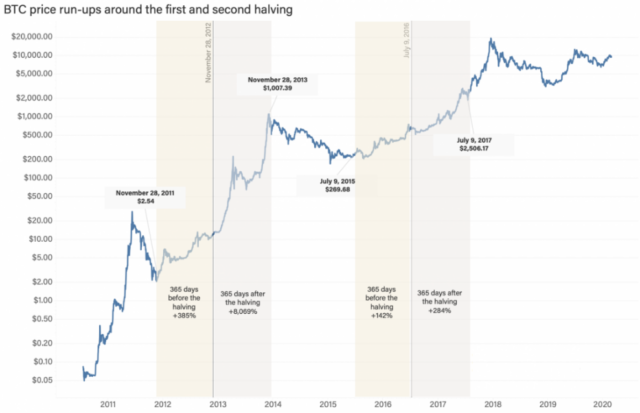

In previous years, the price of bitcoin started rallying 12 months ahead of the reward halving and continued for some time after.

A year before the first halving, bitcoin was trading around $2.50. By the time of the halving event, it had hit $12.60. Over the course of the following year, the price rose to $1,007 before falling away.

A similar pattern played out in July 2016 when bitcoin was gaining greater mainstream recognition and coincided with the first boom in initial coin offerings. One year prior to the event, bitcoin was trading at $270. Twelve months after, it was at $2,500.

Will 2020 Be Different?

So far, bitcoin's third halving looks different to prior events, and there doesn't appear to have been such a sustained price run-up. Given the reward change has been known since bitcoin's inception in 2009, and having already seen two such events, investors may have already incorporated the supply adjustment into their models and taken positions accordingly. The impact of COVID-19 has resulted in lower volumes as some participants focused on larger adjacent non-crypto markets and some mining operations being impacted by these difficult market conditions.

Previously, miners typically sold their bitcoin for fiat currency as they earned it to pay for operational costs. Mining is now dominated by professional mining companies seeking a profit. With lower rewards they may decide to hold onto their bitcoin until a new price forms that compensates them for their expenses. The halving could force a shakeup of the mining landscape.

The Evolution of a Derivatives Market

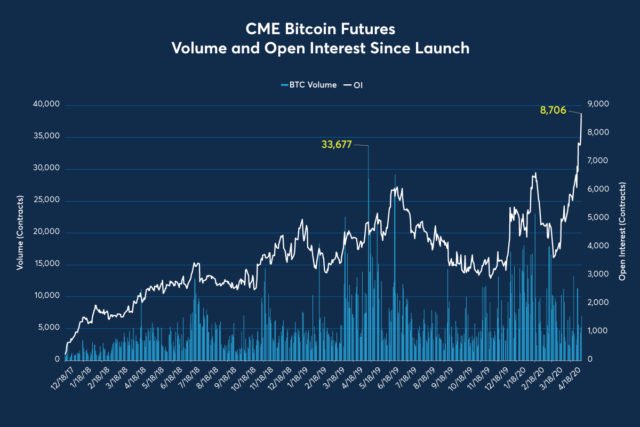

For the first time there is a robust derivatives market for bitcoin in both futures and options. In previous halvings, market participants could only express their views on bitcoin through the spot market. This time around, firms looking to hedge or speculate have the ability to trade a derivate rather than the underlying and so they can express both positive and negative views on bitcoin's price action.

At the time of the last halving, miners could either hold on to their block rewards or they could sell them in the spot market to pay for operating costs. This constant selling meant that price appreciation was measured. After a halving event, as miners would have fewer bitcoins to sell, there would be less selling pressure, meaning the price would go up. Now, with a liquid derivatives market, it is possible to hedge and lock in future bitcoin prices in order to cover expenses without selling bitcoin.

If this is the case, then selling pressure from miners is less likely to act as a drag on bitcoin prices going forward. A robust options market could also allow for additional income to be earned by miners or enhance long bitcoin positions which would further cushion the impact of the upcoming halving. With the emergence of a healthy options market, investors can take price signals and consensus estimates about market expectations.

The Final Countdown

There are multiple reasons why market participants would want a futures contract when the block reward will occur to help manage potential price volatility. The halving does not change the specifications of the CME contract. Bitcoin futures contracts continue to represent 5 bitcoin. Contracts are listed for six consecutive months, as well as two December contracts, meaning that participants can manage their risk from May/June 2020 out to December 2021.

Growing institutional participation saw open interest rise to $407 million - a record 8,706 contracts on May 6. Year to date average daily volumes in CME's BTC futures are 8,399 contracts, up 43% compared to the same period in 2019. Large Open Interest Holders (a LOIH is any entity that holds at least 25 BTC contracts) achieved a record of 62 holders on April 14, indicating a resurgence in institutions that want exposure to the cryptocurrency.

Bitcoin markets are bound to change between each successive halving, and the market has matured a great deal since 2016. Whatever happens, the 2020 event will define bitcoin markets for the foreseeable future.

Dear @wishmir

Solid read. It's clear that we're sharing similar interests towards blockchain technology and crypto.

Perhaps you would like to check out this contest / challenge done by my good friend hardaeborla: "What is Bitcoin Halving ?".

Enjoy your weekend,

Yours, Piotr