Crypto isn’t the only bubble in town…

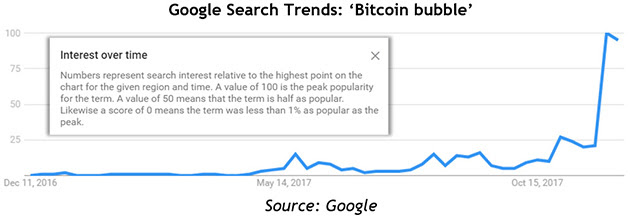

You may have noticed how the term “bubble” has recently picked up a shadow partner. In the financial media, it’s now usually accompanied by the word “bitcoin”.

Right now, there’s even somewhat of a bubble in the whole “bitcoin bubble” story itself.

Take a look at the Google search trends chart for the term “bitcoin bubble”. In the past week, the number of people searching for this term has skyrocketed. The price of bitcoin also broke the US$10,000 price threshold during this period. Coincidence?

I recognise that the broader crypto market is getting bubbly… in some respects, it’s already beyond absurd.

Example? A friend of mine sent me this screenshot earlier today. It’s a post on LinkedIn from someone in his network. Take a moment to read it.

.jpg)

ow it’s one thing to “shill” (i.e., shamelessly plug) a crypto initial coin offering (ICO). But look at the language used. For example, “It’s projected to 1000x in under 1 year”. Really? A one-thousand-fold return in a year? Who is projecting these figures anyway?

Or jump to where the LinkedIn member said, “It will follow what Bitconnect did in under 10 months…” – this is particularly ironic because Bitconnect is widely acknowledged to be a highly dubious Ponzi-like scheme.

Oh… and the post doesn’t contain a single detail as to what the crypto is, what problem it solves… nothing. Just promises of “1000x returns”.

I’ve said it before and I’ll say it again, there will be blood – sooner or later, crypto market participants will learn the hard way that many, if not most, of these kinds of projects will fail. It doesn’t take a genius to realise that huge sums of capital will be squandered during this speculative boom.

But where is this mania coming from?

In my opinion, the origins of this bubble are to be found in another one..

Let me explain.

Money. Money. More Money….

Most folks in the developed world are still waiting for the post-global economic crisis “recovery” to appear – nearly a decade on from the crisis.

In fact, in the U.S. it’s taken a full decade for median real (inflation adjusted) household income to return to its 2007 level. Economic growth has perpetually disappointed and fallen short of forecasts

But meanwhile, financial asset prices have skyrocketed. The S&P500 is now 70 percent above its previous peak, and 260 percent above its global economic crisis trough.

But real incomes, the monthly cashflow that families rely on? That’s only just returning to pre-crisis levels now. There’s no bubble in incomes, that’s for sure…

But there is a bubble in "money"… and it keeps on growing.

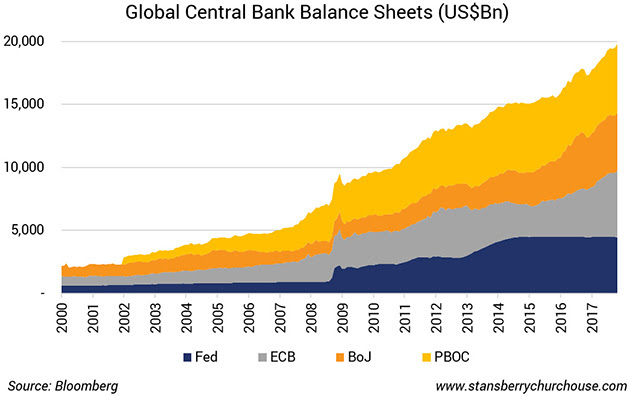

Take a look at the chart below. It shows the cumulative balance sheets of the world’s four major central banks; the U.S. Federal Reserve, the European Central Bank (ECB), the Bank of Japan (BoJ), and the People’s Bank of China (PBOC).

The Fed may be winding down its balance sheet and effectively selling assets (i.e., by not rolling maturing bond proceeds into new bonds). But other global central banks are not.

.jpg)

But just look at the sheer scale of central bank action in the past decade. In January 2007, these four central banks had US$5 trillion of assets on their balance sheets.

Today, it’s nearly US$20 trillion… and it’s still growing. Central banks are still pumping more and more money into the global financial system.

Let me ask you this – do you think bitcoin goes to US$12,000 (its current price) in the absence of this relentless tidal wave of money printing?

I don’t.

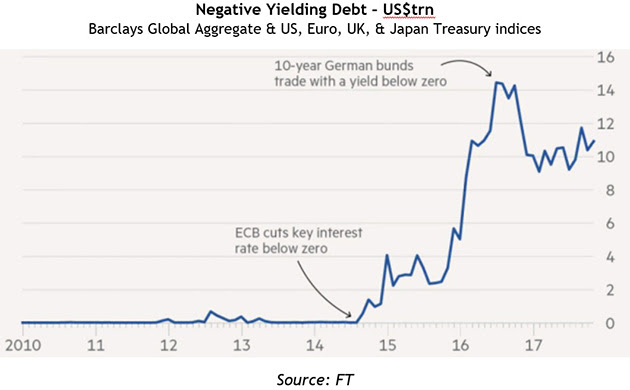

And take a look at the chart below – this shows 10-year government bond yields for the U.S., Japan, Germany and U.K. going back to 1990. Despite bottoming out in the past few months, yields remain near historical lows.

.jpg)

In other words, you can’t get yield for love nor money.

And although it doesn’t seem to get much airtime these days (with all eyes on the US$210 billion market value of bitcoin), there’s still US$11 trillion of outstanding debt out there that offers investors a negative yield – in other words, a guaranteed loss.

.jpg)

A negative yielding asset is madness. Eleven trillion dollars’ worth is insanity.

In this context, is it any wonder that money is pouring into non-traditional asset classes like cryptos in search of returns?

Junk squeezed

Return profiles everywhere else are being compressed.

Take a look at the chart below which shows the historical spread of high yield (i.e., junk/non-investment grade) debt over “risk-free” treasuries.

.jpg)

t a spread of 350 basis points (3.5 percent) over treasuries, junk debt spreads are near their multi-decade lows, hit just before the global economic crisis.

Where and when does it end?

Nobody can answer this question.

But the simple fact that, a decade on from the global economic crisis, central banks are still pouring trillions of dollars into the financial system should worry the heck out of everyone.

Tell me, what are they going to do when this global economic cycle ends?

What are they going to do if we face a particularly sharp global contraction?

Print a few more trillion bucks? Buy some more bonds? Jam interest rates back below zero again?

I don’t have the answers to these questions. No one does.

Good investing,

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.valuewalk.com/2017/12/bitcoin-not-bubble-around/

great work! keep it up!