"I think they're all Worthless. I think they're the 21st century version of a Chain Letter"

That was a quote from Bill Fleckenstein of Fleckenstein Capital.

He goes on to say:

"Blockchain isn't, but if I wanted to buy the blockchain, I sure wouldn't buy Bitcoin!"

Now before you spit out your kool-aid in outrage, let's take a step back. Because I think he has a point. On the road to riches it's important not to get married to any one position.

To use cold, ruthless logic. Even positions you really really like.

The point of any good speculation (and let's not kid ourselves, that's exactly what Bitcoin is) is to SELL at a profit.

Let's take a look at some technical analysis shall we?

The Bear Case for Bitcoin:

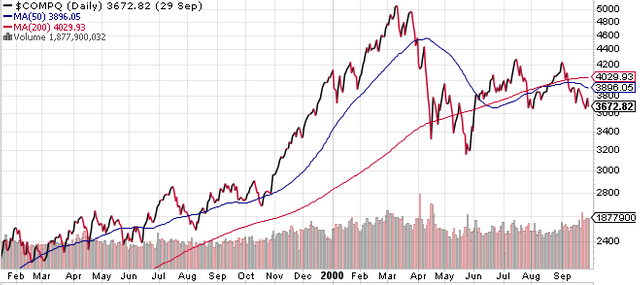

Here is a current chart of Bitcoin

Oh my mistake, this is a chart of the Nasdaq during the infamous DOTCOM bubble.

You know, back in the late 90's, when any stock with the name "dotcom" in it, such as pets.com instantly skyrocketed in price.

Sound familiar?

Today anything with blockchain in the name has become all the rage. Most recently IceT and Kodak-

Kodak! merely whispered that they might be doing something with blockchain and saw their stock price take off! ಠ_ಠ

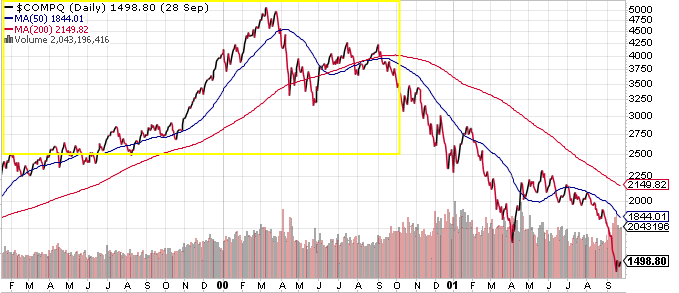

Here is an actual chart of Bitcoin:

Note any similarities?

Here are the same charts, side by side.

- Meteoric rise. Check

- Dead cat bounce. Check

- Double top leading to complete sector wash out... remains to be seen.

Are we kidding ourselves here?

Now ideologically I love the concept of BTC and I hope it or something like it succeeds. I really do.

Having said that, concerning my own personal finances:

My goal is to make money.

Plain and simple.

Which is why I sold all of my crypto/ blockchain related investments the first week of December for a profit.

The great thing about selling for a profit, is if I'm right, I made money. And if I am wrong... I made money!

Let me be very clear: I do not believe in HOLDR

Parabolic rises are great, but the back side of that chart looks just as volatile, and with far less liquidity...

@weaselhouse posted this fantastic piece: Quinlan & Associates Predict 2018 Bitcoin Crash

Where they attempt to value BTC as both a currency and an investment asset, and they came to the same conclusion.

I'm not trying to be the last chump at this party holding the bag, and neither should you.

Until Next time

Thanks for reading, if you enjoyed this rant, you might also enjoy some of my Recent Articles:

Is CHINA Done financing the American Dream?

Death of the Petrodollar Imminent as China Moves to Undercut U.S. Hegemony

Thanks for the shout-out!

While I'm gloomy on the long-term prospects of Bitcoin, I still have some money in it - for now. I think there's still enough crypto hype and new investors entering the space that we can hope for a sustained bull market for a little while longer.

Of course it's a fool's investment. The crash is coming. The key is to be one of the lucky fools who quits at the right peak.

lol lucky fools. And no problem! Personally this setup has just become too risky for this Steemian

Great charts.

Personally, I don't believe in Bitcoin. The ONLY thing that is has going for it is the 21 million limit.

The future belongs to coins with uses, plain and simple. The better the use (the more people it serves), the better the coin will do.

Thanks! And I couldn't agree more. It's got the limit, as well as the largest adoption and first mover advantage, but so did aol. So I think that will change.

Good point with the AOL reference