Bitcoin and other popular cryptocurrencies are crashing yet again

Bitcoin and all the other cryptocurrencies rebounded last week after a two-day bloodbath in which the price of Bitcoin dipped under $10,000 for the first time in months. We told you at the time that you shouldn’t get too excited that prices were climbing again, as a new price drop may be just around the corner.

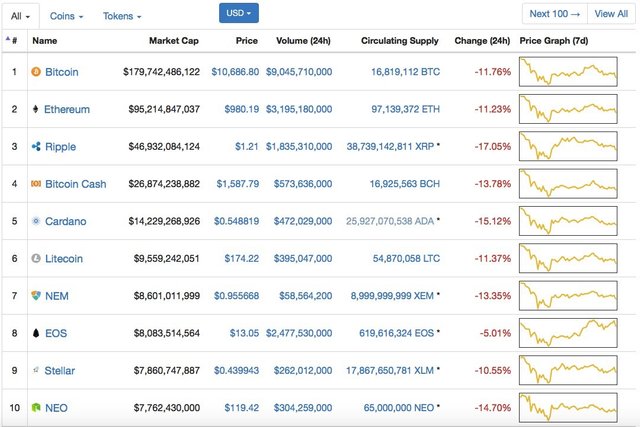

It turns out the price drop was closer than we thought, and all cryptocoins were down by at least 10% on Monday morning at the time of this writing. Bitcoin is still above that $10,000 psychological milestone, while Ethereum dropped below $1,000 again. Ripple, the third largest cryptocurrency by market cap, traded for around $1.21 on Monday, according to data provided by CoinMarketCap  Ripple’s is the most significant drop, with the coin having lost more than 17% of its value compared to Sunday’s prices — Ripple has been sliding for a couple of days now.

Ripple’s is the most significant drop, with the coin having lost more than 17% of its value compared to Sunday’s prices — Ripple has been sliding for a couple of days now.

Why are prices dropping again? There’s no good answer right now. Fears persist that more regulation is looming, and some investors may be worried about losing the fortunes they’ve already invested in Bitcoin and other coins. Reports last week that South Korea and China are looking to regulate the crypto exchange business led to the price crash we talked about a few days ago.

Right now, no real “bad” news can explain the new dips.

Peter Boockvar, Chief Investment Officer at Bleakley Advisory Group, told CNBC the other day that Bitcoin might drop to as low as $1,000 this year. He added that the stock market could see some collateral damage, but it would be all psychological, not a sign there’s something wrong with the economy.

In a different CNBC report, Robert Shiller, Nobel-prize winning economist, told the network that Bitcoin will likely “totally collapse,” just like the “tulip mania” that captured the Netherlands centuries ago. He also agreed that Bitcoin might still be here in 100 years, though.

Are there reasons to worry? Well, The Sun says that panicky Bitcoin investors struggle to withdraw their cash from money exchanges, as they fear virtual currencies will continue to collapse. And they’re now turning to other investments. European gold traders report a “five-fold increase” in demand amid fears that Bitcoin could crash.