The Fed Construct Known as Ripple - The Blockchain Trojan Horse

January 21, 2019

Part II of II: The Balkanization of Bitcoin - Divide and Rule

(Delving deeper into the dark-side of the cryptocurrency space filled with Fake-Bitcoin constructs such as Ripple, Stellar, CME, CBOE, and LedgerX)

King Philip II of Macedon (382–336 BC), father of Alexander the Great and the first to conquer Greece (except for the city-state of Sparta), is attributed with coining the term: Divide and Rule.

----------------------------------------------------

Latin: dīvide et imperā = “divide and rule”

From Wikipedia:

Divide and rule in politics and sociology is the military strategy of gaining and maintaining power by breaking up larger concentrations of power into pieces that individually have less power than the one implementing the strategy. The concept refers to a strategy that breaks up existing power structures, and prevents smaller power groups from linking up, causing rivalries and fomenting discord among the masses. It was heavily used by the British Empire in India and elsewhere.

Traiano Boccalini cites "divide et impera" in La bilancia politica as a common principle in politics. The use of this technique is meant to empower the sovereign to control subjects, populations, or factions of different interests, who collectively might be able to oppose his rule. Machiavelli identifies a similar application to military strategy, advising in Book VI of The Art of War (Dell'arte della Guerra), that a Captain should endeavor with every art to divide the forces of the enemy, either by making him suspicious of his men in whom he trusted, or by giving him cause that he has to separate his forces, and, because of this, become weaker.

The maxim divide et impera has been attributed to Philip II of Macedon, father of Alexander the Great, and was utilized by historical figures such as Roman ruler Caesar and the French emperor Napoleon.

https://en.wikipedia.org/wiki/Divide_and_rule

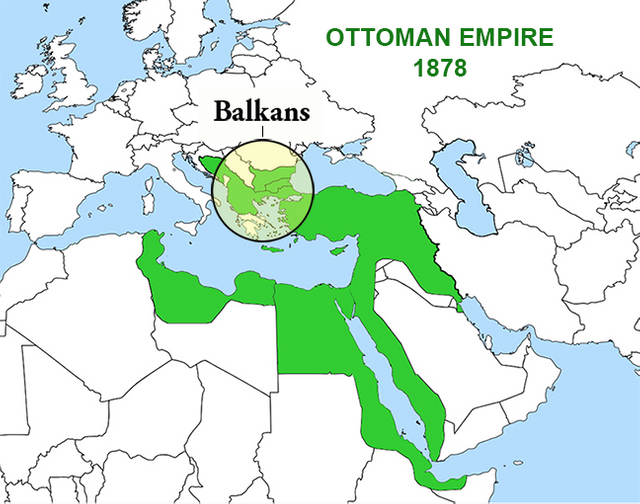

Division of the Balkans Post-WWI

From Wikipedia:

Balkanization

The term Balkanization refers to the division (divide and rule) of the Balkan peninsula, formerly ruled almost entirely by the Ottoman Empire, into a number of smaller states between 1817 and 1912. It was coined in the early 19th century and has a strong negative connotation. The term however came into common use in the immediate aftermath of the First World War, with reference to the numerous new states that arose from the collapse of the Austro-Hungarian Empire and the Ottoman Empire.

The Balkans Campaign, or Balkan Theatre of World War I was fought between the Central Powers, represented by Austria-Hungary, Bulgaria, Germany and the Ottoman Empire on one side and the Allies, represented by France, Montenegro, Russia, Serbia, and the United Kingdom (and later Romania, Greece, and the United States, who sided with the Allied Powers) on the other side.

https://en.wikipedia.org/wiki/Balkanization

Throughout history, numerous empires have successfully Balkanized their enemies to maintain military superiority, including those in power today, in the U.S.

Over the past century, those in power of the Fed have utilized this divide and rule tactic to great success to become what they are today, the dominant global military power.

The dominance of the U.S. military industrial complex over the world rests solely on the power of the Fed to print U.S. dollars without restraint - for without the Fed’s ability to freely print the reserve currency of the world, the U.S. has no means to pay for a military budget that exceeds US$1 trillion dollars each year.

Million, Billion, Trillion

To get a sense of how great an amount $1 trillion dollars is - the astronomical amount of money the U.S. spends on its military each year – consider the difference among the numbers: million, billion and trillion.

To count (per second) to a million: takes about 13 days. To count to a billion: takes about 33 years. To count to a trillion: takes nearly 33,000 years. So, well before the last ice age on earth when Neanderthals were still flourishing on the Eurasian continent, one would have had to start counting (and live for a very long time) to count to a trillion by today.

The difference between these numbers is beyond very large, and a trillion is an enormously large number.

If one were lucky enough to earn a dollar every continuous second: it would take a mere 13 days to amass $1 million; $1 billion, 33 years; but amassing $1 trillion would take nearly 33,000 years.

$1 trillion is an enormous amount of money to spend each year on weapons to blow people up in countries that don’t even have an air force to speak of such as Iraq, Libya or Syria - it’s a very big number representing a ridiculously large amount of money, and it’s all paid for by the printing presses at the Fed.

The U.S. Dollar and Inflation

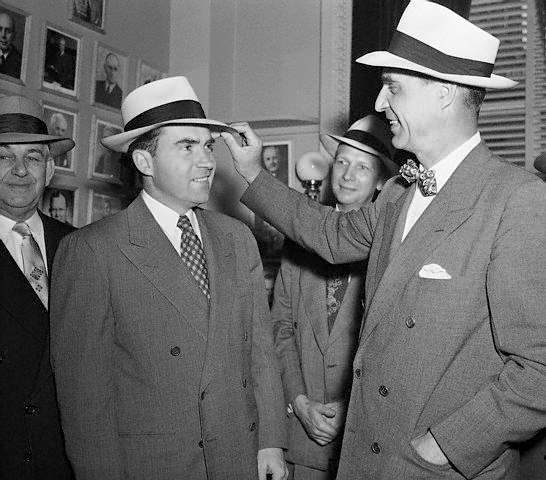

America has printed so many U.S. dollars since 1971 when the U.S. dollar was decoupled from the gold-standard by Richard Nixon (and surreptitiously converted into the current Saudi-oil-backed dollar), the world is now drowning in tens of trillions of U.S. dollars in the global banking system, creating a worsening global environment of ever-increasing prices of the essentials of life such as food and housing for a vast majority of people on earth, including those demonstrating today with the Yellow Vests Movement against one of the Fed's closest allies, the government of France.

https://en.wikipedia.org/wiki/Nixon_shock

https://en.wikipedia.org/wiki/Yellow_vests_movement

Prescott Bush with Richard Nixon (President #37). Prescott is

the father of George H.W. Bush (President #41); and grandfather

to George W. Bush (President #43 and president during 9-11).

The price of a single-family home, the price of a decent education, or a simple bowl of rice - anywhere on earth - have all gone up tremendously since 1971. No longer can the average family in the developed world afford to buy a home, educate their children or even live comfortably as they did just a generation ago.

The sharp rise in the cost of living since the Nixon era, globally, is due to the unrestricted printing by the Fed of trillions and trillions of dollars of the world’s reserve currency to pay for America's Military Industrial Complex.

While the Chinese, Japanese and Koreans are required to manufacture cars or smartphones to earn a dollar, or resource-rich countries such as Indonesia, Iran, and Russia must invest billions in equipment and manpower to extract oil out of the ground, the U.S. simply presses a few buttons on a keyboard at the Fed to create, out of thin air, as many U.S. dollars it wishes.

How long the current geopolitical system (heavily slanted in favor of the U.S. and the Fed) continues is anyone’s guess. But indubitably, those in power in the U.S. will do all they can to sustain their control over the world, including well-calculated and executed attacks on potential rivals to the U.S. dollar: gold and Bitcoin.

The Balkanization of Bitcoin

Finite vs. Infinite

In a world dominated by a single global currency that can be inflated infinitely, at will, by the Fed - the primary value proposition of Bitcoin, like gold, is that there is a limited, finite supply of it here on earth.

In the case of gold, it forms only when stars with enough critical mass explode in a supernova.

https://en.wikipedia.org/wiki/Supernova_nucleosynthesis

What gold there is on earth today, is all there will ever be as gold is simply remnant dust of stars exploded a long time ago, in a galaxy far, far away, before the earth ever existed.

Although there is still some question as to Bitcoin’s long-term security (e.g., quantum computing or simply bad code in its software that has yet to be exploited) the primary value proposition of Bitcoin is that there is a finite, limited supply of it: 21 million.

https://www.longfinance.net/media/documents/Quantum_Countdown.pdf

https://thenextweb.com/hardfork/2018/09/20/bitcoin-core-vulnerability-blockchain-ddos/

The “double-spending” problem that was addressed by Satoshi Nakamoto in his seminal 2009 Bitcoin Whitepaper that details the manner in which to limit the number of Bitcoin is the primary reason why Bitcoin is perceived by many around the world to have true value – just like gold.

https://en.wikipedia.org/wiki/Double-spending

Main Stream Media (MSM) Shills

MSM shills, such as Paul Krugman of the New York Times, point to gold as being incomparable to Bitcoin because gold has “intrinsic value” due to its use as jewelry or as a tooth replacement; while Bitcoin is just "rat poison squared".

Like so many ludicrous comments made by numerous MSM pundits like Krugman these days, this “intrinsic value” they speak of concerning gold is simply ludicrous.

A person can stick a feather in their hat, but it doesn’t make the feather possess “intrinsic value”. All it is is an ornament that only has the potential to have "perceived value" by the eye of the beholder, and does not possess some theoretical "intrinsic value" that an MSM shill like Paul Krugman says it has because it can be used as jewelry.

As well, dentists today have a wide array of advanced dental composite resins that are far superior to gold and far cheaper as well, negating any need for gold in dentistry. So gold possesses little, if any, real value (intrinsic or otherwise) in dentistry as an MSM shill such as Krugman states.

Put simply, the primary reason why gold is perceived to have value around the world is because it has a limited, finite supply, like Bitcoin – and unlike the U.S. dollar that has no limit to its supply.

This is the crux of Bitcoin’s value proposition – that there will only be 21 million Bitcoin ever in existence - no more, no less.

So, if you are the Fed, how do you subvert this new blockchain technology represented by Bitcoin that has the potential to weaken the U.S. dollar?

How does the Fed Balkanize Bitcoin?

The answer is to create an endless supply of fake Bitcoin and dump it into the market so that individual investors dilute their investments into a vast sea of fake cryptocurrencies, thus suppressing the rise of Bitcoin or any other blockchain platform that is censorship-resistant and truly decentralized.

The Fed has successfully Balkanized Bitcoin by flooding markets with counterfeit Bitcoin over the past year and has incessantly promoted these fake Bitcoin products with MSM shills on such news outlets as Bloomberg, CNBC, Fortune Magazine, Washington Post, New York Times, and The Motley Fool – to name just a few.

That is why we have Ripple (xrp - #2 Market Cap: $13 billion) and its bastard spawn, Stellar (xlm - #7 Market Cap: $2 billion) – both with a total supply of 100 billion coins each that pretend to be decentralized blockchain platforms when in fact, they are simply centralized databases (like any traditional bank database) running on a few servers controlled by the same odd characters who own almost all the Ripple and Stellar that exist.

The Bitcoin Balkanization strategy by the Fed is also why we have U.S. government approved fake Bitcoin products such as cash-settled futures sold by the CME and CBOE, as well as high-risk options sold by LedgerX.

As a side note, LedgerX , one of only three U.S. government Bitcoin licensed companies, has an employee and director list full of ex-Goldman Sachs employees and even a former chairman of the CFTC. The same CFTC (Commodities Futures Trading Commission) that is the agency of the U.S. government that granted the right to CME, CBOE and LedgerX to print as many fake Bitcoins they can sell to unsuspecting and naive investors who don't know any better.

https://steemit.com/bitcoin/@temujinx/how-the-fed-manipulates-the-price-of-gold-and-bitcoin

Final Thoughts

Ripple (as well as Stellar) is an obvious Fed construct. Both Ripple and Stellar have 100 billion coins each, that’s 200 billion coins or nearly 10,000 times more fake Bitcoins now in existence with just these two fake Bitcoin scams.

The more I research Ripple, the more I find an endless stream of nonsensical b.s.

The stated use of xrp by Ripple Corporation - for a means to transfer funds internationally by banks to replace the current SWIFT system - is simply stupid.

If you would like an explanation of why it is so stupid of an idea for Ripple (or any other cryptocurrency) to be used as a means for international bank settlements, please comment and request below. For the time being, suffice it to say that it is a ridiculously stupid idea - the main stated purpose of Ripple's xrp.

To provide just a few more Ripple Oddities:

i) Ripple was supposedly given out to a few insiders that made them multi-billionaires with almost all XRP held today by the Ripple Company and these insiders who supposedly control this company;

ii) Ripple promotes the use of designated payment providers which are owned by the same banks that own or are global partners of the Fed such as Goldman Sachs, J.P. Morgan, the Bank of New York, Citibank, SBI Holdings (Japan), National Bank of Kuwait, and SECOM, the largest security company in Asia based in Japan with contracts with governments across Asia and police departments such as the Singapore Police Department - yes, the Police of Singapore, the bastion of libertarianism in Asia (that's a joke :);

iii) The Ripple network is simply a highly-centralized (non-blockchain) database calling itself a "blockchain" platform that can be adulterated at the whim of the current owners of Ripple;

iv) Ripple has an obviously well funded propaganda machine that produces slick videos of compilations and interviews that are obviously brainwashing compilations on Youtube such as:

https://www.youtube.com/channel/UCJ7e5K5v1iQxUwMDiqZp5jg

These propaganda compilations concerning Bitcoin, Ripple and the supposed genius of Ripple’s CTO, David Schwartz, and the brilliance of its CEO, Brad Garlinghouse, are obviously produced by the Fed and their paid agents.

If you want to know what the Fed wants you to believe, just watch these videos on this YouTube channel calling itself: Crypto Bear – it also has a link to a dedicated website that has a direct link to the Federal Reserve. Yes, a supposed libertarian cryptocurrency website has a link to the Fed – yet another Ripple Oddity - that promotes Ripple and Stellar.

Take a look at this site, for it is the only “independent” cryptocurrency YouTube channel that I know of that pays for its own website:

v) None of the five members of the Ripple genesis team who manage or who are attributed with creating Ripple in 2012 (or its bastard step-child Stellar) have any background in computer science or cryptography – this is unlike every other top cryptocurrency project – other than Stellar. All other leading cryptocurrency projects are founded by people who have serious academic and/or professional backgrounds in key blockchain fields such as computer science or advanced mathematics and cryptography.

vi) Ripple is supposedly capped at 100 billion coins with 40 billion handed out immediately upon inception in 2012 to Ripple insiders, and the remaining 60 billion coins in the control of an organization, the Ripple Company, that is controlled by the same people with close ties with the CIA/NSA and the leading banks in the U.S. that own the Fed;

vii) As an indication to the endless Oddities with Ripple, one of Ripple's widely published partnerships is with the National Bank of Kuwait (NBK).

As you may know, without the assistance of the U.S. military when George H. W. Bush was president, Kuwait would not exist. NBK is the largest bank in Kuwait and is owned by the government of Kuwait.

NBK's International Advisory Board is filled by the who's who of Fed shareholders and its agents: Former Prime Minister of the United Kingdom, Sir John Major; Emeritus Senior Minister Goh Chok Tong, Former Prime Minister of Singapore and Senior Advisor of the Monetary Authority of Singapore, Mohamed El Erian, CEO and co-CIO of PIMCO, the Chairman of the President’s Council for International Development, USA, William Rhodes, Senior Advisor for Citigroup, President and CEO of William R. Rhodes Global Advisors, LLC, Josef Ackermann, The Chairman of Zurich Insurance Group Ltd and Former Chairman of Deutsche Bank Group, Martin Feldstein, President Emeritus and Professor of Economics at Harvard University, United States, Abdlatif Al Hamad, Chairman and Director General, Arab Fund-Kuwait, Charles Dallara, Chairman of the America’s, Partners Group, Switzerland, Lubna Olayan, Deputy Chairman and CEO, Olayan Financial Company, Saudi Arabia, Anthony Cordesman, Arleigh A. Bruke Chair of Strategy, CSIS and Edward Morse, Managing Director, Global Head of Commodity Research for Citigroup.

---------—------------------

PART I of II:

https://steemit.com/bitcoin/@temujinx/the-fed-construct-known-as-ripple-the-blockchain-trojan-horse

@temujinx, thank you for sharing your thoughts with us! It was really interesting to read your post. But even by creating "fake"Bitcoins I don't think that someone will be able to ruin the real Bitcoin.

Posted using Partiko Android

@cryptospa, Agreed 100%, they are just delaying the inevitable. Thanks for reading.

Curated for #informationwar (by @wakeupnd)

Ways you can help the @informationwar!

This post was shared in the Curation Collective Discord community for curators, and upvoted and resteemed by the @c-squared community account after manual review.

@c-squared runs a community witness. Please consider using one of your witness votes on us here

Congratulations @temujinx! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!