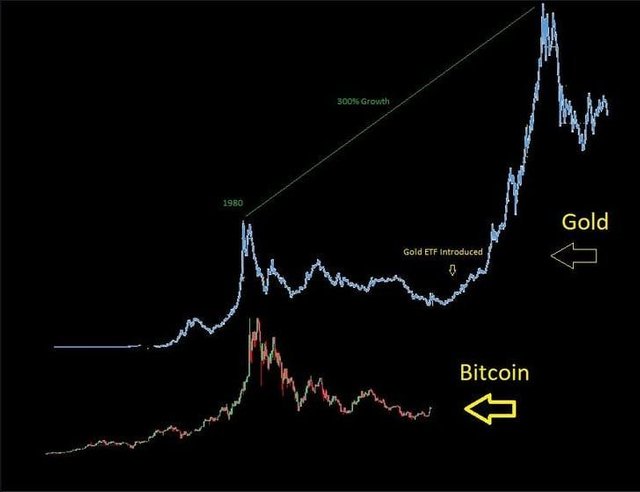

Bitcoin Vs Gold ETF

Gold Dwarfs Bitcoin

While bitcoin and gold share many similarities, one thing that sets them apart is the numbers. The gold market is magnitudes larger than the bitcoin market. The value of all the gold that's ever been mined exceeds $8 trillion. The value of all the bitcoin that's ever been mined is $76 billion.

In fact, the value of the gold mined just in the first half of this year―$68 billion at current prices―is almost equal to the value of all the bitcoin in existence.

Gold is held by countless individuals and institutions. About 89,200 metric tons, or $3.9 trillion worth, is held as jewelry, according to the World Gold Council. Approximately 40,000 metric tons, or $1.7 trillion worth, is held as private investment; and 31,500 metric tons, or $1.4 trillion worth, is held by central banks around the world.

Meanwhile, ETFs hold about $92 billion worth of gold, small potatoes in the broader gold market, but still a substantial sum.

More Room To Grow

Though the bitcoin market can't boast anything close to those numbers, that's not necessarily a knock against the digital currency. Proponents of bitcoin would argue that the relatively modest size of the digital currency market compared to that of gold means the former has much more room to grow.

After all, even after rising 400% this year alone, bitcoin is still dwarfed by the yellow metal. That's why you have some bitcoin analysts calling for even more eye-popping gains for the digital currency, such as Fundstrat's Tom Lee, who forecasts prices could climb another tenfold in the next five years.

Bitcoin "has a lot of characteristics that are very similar to gold and will ultimately make it attractive as an alternate currency," he said on CNBC. "It's a good store of value; the encryption and distributed ledger not only act as protection, but it has an industrial use in that it could replace a traditional payment platform."

"The supply of bitcoin is starting to slow, and within the next two or three years, the number of coins discovered, mined, or rewarded will actually be slower than the amount of gold discovered, so bitcoin will actually be a rarer unit than gold," Lee added.

New Investment Avenues

Lee still sees bitcoin as "an underowned asset, with the potential for huge institutional sponsorship coming."

In the coming month, bitcoin ETF are expected to launch on regulated exchanges, opening the door to the bitcoin market for institutions and other investors that previously couldn't be involved.

That could be followed by the first U.S.-listed bitcoin ETF, enabling investors to buy bitcoin from their brokerage accounts just as they would a stock. If that happens, some of the money that would otherwise be headed into gold ETFs could instead head for bitcoin ETFs.

Bitcoin bulls argue that these new avenues for investment will enable bitcoin to match and eventually surpass gold as the world's predominant alternate currency or safe haven.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.etf.com/publications/etfr/bitcoin-0?nopaging=1