University of Texas - Tether is used to provide price support and manipulate Bitcoin price.

The recent Texas University paper investigates whether Tether, a digital currency pegged to U.S. dollars, influences Bitcoin and other cryptocurrency prices during the recent boom.

Using algorithms to analyze the blockchain data, we find that purchases with Tether are timed following market downturns and result in sizable increases in Bitcoin prices.

Less than 1% of hours with such heavy Tether transactions are associated with 50% of the meteoric rise in Bitcoin and 64% of other top cryptocurrencies. The flow clusters below round prices induce asymmetric auto-correlations in Bitcoin and suggest incomplete Tether backing before month-ends. These patterns cannot be explained by investor demand proxies but are most consistent with the supply-based hypothesis where Tether is used to provide price support and manipulate cryptocurrency prices.

Bitfinex supplies Tether regardless of the demand from investors with fiat currency to purchase Bitcoin and other cryptocurrencies. The acquired Bitcoins can then gradually be converted into dollars. In this setting, the Tether creators have several potential motives.

First, if the Tether founders, like most early cryptocurrency adopters and exchanges, are long on Bitcoin, they have a large incentive to create an artificial demand for Bitcoin and other cryptocurrencies by ’printing’ Tether. Similar to the inflationary effect of printing additional money, this can push cryptocurrency prices up.

Second, the coordinated supply of Tether creates an opportunity to manipulate cryptocurrencies. When prices are falling, the Tether creators can convert their Tether into Bitcoin in a way that pushes Bitcoin up and then sell some Bitcoin back into dollars to replenish Tether reserves as Bitcoin price rises.

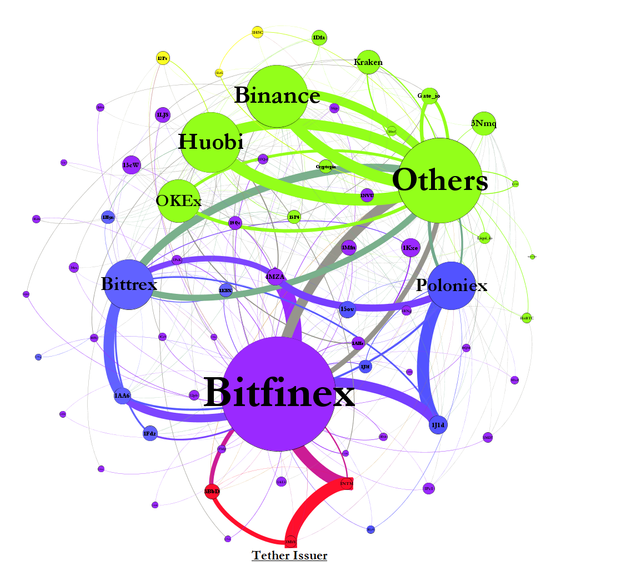

Tether is created, moved to Bitfinex, and then slowly moved out to other crypto-exchanges, mainly Poloniex

and Bittrex. Interestingly, almost no Tether returns to the Tether issuer to be redeemed, and the

major exchange where Tether can be exchanged for USD, Kraken, accounts for only a small proportion

of transactions. Tether also flows out to other exchanges and entities and becomes more

widespread over time as a medium of exchange.

Figure 1. Aggregate Flow of Tether between Major Addresses. This figure shows the aggregate flow of Tether between major exchanges and market participants, from Tether genesis block to March 31, 2018. Tether transactions are captured on the Omni Layer as transactions with the coin ID 31. The data include confirmed transactions with the following action types: Grant Property Tokens, Simple Send, and Send All. Exchange identities on the Tether blockchain are obtained from the Tether rich list. The thickness of the edges is proportional to the magnitude of the flow between two nodes, and the node size is proportional to aggregate inflow and outflow for each node. Intra-node flows are excluded. The direction of the flow is shown by the curvature of the edges, with Tether moving clockwise from a sender to a recipient.

First, following periods of negative Bitcoin return, Tether flows to other exchanges are used to purchase Bitcoin.

Second, these flows seem to have a strong effect on future Bitcoin prices.

They are present only after periods of negative returns and periods following the printing of Tether, that is, when there is likely an oversupply of Tether in the system.

This phenomenon strongly suggests that the price effect is driven by Tether issuances.

For the full research documentation that includes more chart & algorithms that were used to discover this Bitcoin price manipulation can be found here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3195066&download=yes

Posted from my blog with SteemPress : https://247cryptonews.com/university-of-texas-tether-is-used-to-provide-price-support-and-manipulate-bitcoin-price/

Warning! This user is on our black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

If you believe this is an error, please chat with us in the #appeals channel in our discord.