Komodo Platform SWOT Analysis

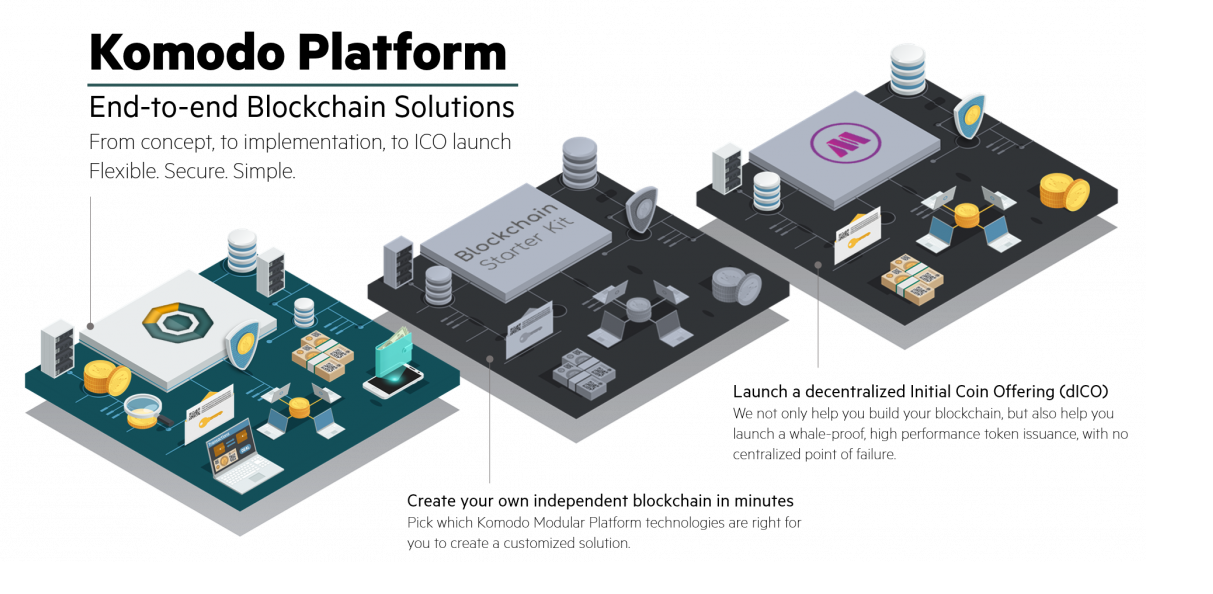

Please first let me introduce you to the Komodo platform.

The Komodo platform is the only ecosystem to launch its own dICO (decentralized ICO) it is the first mechanism that uses Jumblr technolgy to protect the privacy of investors.

This platform can offer all the most advanced functionalities necessary for a blockchain project:

Wallet multi-currency (Agama) , Decentralized exchange (BarterDEX : http://dexstats.info/ ), Atomic-Swaps: more than 65k swaps already done (with all ERC20 supported) , Smart contract, Simple contract, Full independant blockchain creation, support staff, Privacy or KYC/AML, Bitcoin Security (dPoW delayed proof of work) and more features...

https://coinmarketcap.com/currencies/komodo/

Website : https://komodoplatform.com/en

Twitter : https://twitter.com/KomodoPlatform

Github : https://github.com/KomodoPlatform

Komodo ICO raise in 2016 more than 2270 BTC : https://bitinfocharts.com/bitcoin/address/35Rwwc9e2Mj7smFXJ1iXF826cMW3tqfz6x

The first dICO of the Komodo platform will be the online bank Monaize (https://www.monaize.com/#/uk) "date announced very soon"

The second will be : https://utrum.io/

Ethereum is certainly not the best solution for ICO in terms of security, decentralization and features.

If you have any question , you can reach Komodo slack here : https://komodoplatform.com/en/slack-invite

or Telegram here : https://t.me/KomodoPlatform_Official

We are also looking for new members, developers, graphic designers, blockchain experts, writers, investors...

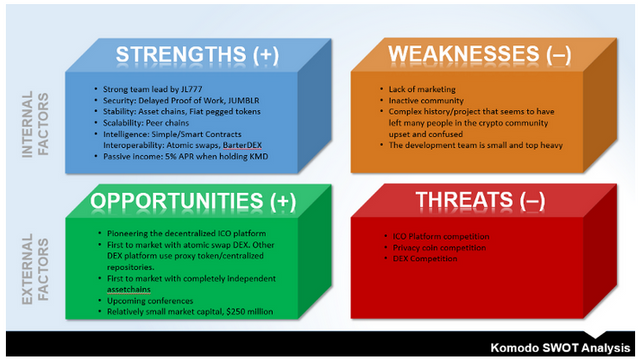

The KMD project is trying to accomplish A LOT in the cryptospace, and with that said I apologize for the length of this article. There was just so much to cover that I had to make it this long. For those readers who don’t have the time to read the entire article I’ve included a graph below that summarizes the analysis at a high level. I suggest those readers take a look at it and then go to the conclusion at the bottom, or any other section they are interested in reading more about.

STRENGTHS

Strong team of developers lead by JL777

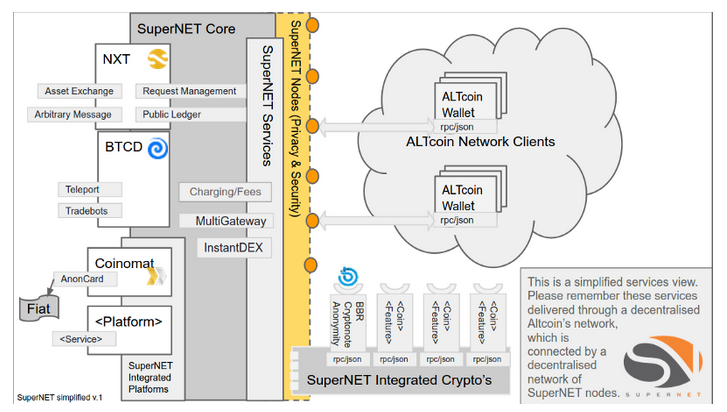

James Lee, famously known as “JL777” is the lead developer of the Komodo Platform. He has always been a strong advocate of privacy, liberty, and decentralization. To this day his true identity remains a secret. However this hasn’t stopped people from recognizing his talent as a developer. In the past people often joked that he must be Satoshi Nakamoto because of all the crazy ideas he had. This kind of praise has amassed an almost cult like following, which has proven to be both a benefit and detriment to his projects at times. Initially he worked on the NXT project and brought over his own projects that were under the SuperNET umbrella he created. SuperNET was in origin a system built for interblockchain technology that was compatible with NXT and many other cryptocurrencies. For whatever reason the NXT developers broke away from the compatibility functions of SuperNET and forced JL777 to leave that project and start over on a new protocol. This is what lead him to create the Komodo Platform. Now on the Komodo Platform JL777 and his team implemented the new consensus mechanism called delayed proof of work (dPOW), as well as developing JUMBLR (token privacy mixer), BarterDEX (decentralized exchange) and the dICO (decentralized initial coin offering). All these different projects (and more) make up the Komodo Platform, a completely decentralized crypto ecosystem that gives people control over their investments while maintaining absolute privacy.

Security and privacy

The KMD team has developed a new consensus mechanism called delayed proof work (dPOW). This mechanism essentially creates a second layer of security for the blockchain, on top of the security produced by miners mining blocks on the KMD chain. The way this second security layer is created is through the use of 64 notary notes that take the KMD blockchain and engrave it into another blockchain, currently BTC (most secure blockchain today). By doing this, the notary nodes are cementing all transactions that occur on the KMD blockchain into the BTC blockchain, so if there was ever an attack on KMD the hacker will also have to take down BTC to manipulate the ledger. These 64 notary notes are elected by stakeholders of the KMD project, basically the users of KMD get to vote on which nodes get to notarize the KMD blockchain to the BTC blockchain. Although the existence of these notary nodes strays away from the idea of true decentralization, the fact that the KMD users get to vote and elect these nodes helps guarantee that the notary nodes are trustworthy and can be controlled. It’s also important to note that, any BTC compatible chain, like LTC, can be used for the dPOW mechanism.

From a privacy point of view, The KMD team has developed their own token mixer called JUMBLR. This token mixer provides a second layer of privacy on top of the zK-SNARK protocol that Komodo has inherited from Zcash. In a nutshell, JUMBLR trades your BTC (or other crypto) for KMD via atomic swap and provides complete privacy through the zero-knowledge proof technology. Then that KMD is mixed with KMD from other sources to provide an additional layer of security. Last, the mixed KMD will be converted back to BTC through another atomic swap and sent to its destination. The JUMBLR process is still a manual process and completely optional, but provides complete anonymity for its users if they choose to use it.

Market and network stability

Assetchains are separate blockchains that can be created through the Komodo daemon with a few lines of code that specify certain aspects and parameters of the blockchain (like the name of the asset, total supply and so forth). This blockchain is what ICO issuers will control if they choose to launch their blockchains using Komodo. Many other companies offer similar services, but with Komodo this is a bit different. The KMD assetchains standalone and are independent of the parent chain. Creators of assetchains on the KMD platform will have their own fully functional blockchain that they can completely control, but still have the support of the Komodo parent chain. This is especially important as the business needs can be very different from one company to another, or one industry to another. Users of Komodo assetchains will not be forced to adhere to the lead developers of Komodo, but instead have the option to adopt, or not adopt, changes on their blockchain that are made at the parent level. Additionally these asset chains can benefit from the dPOW consensus mechanism like the Komodo chain, giving all assetchains the security of Bitcoin’s hashrate.

Fiat pegged tokens are assetchains on the Komodo platform that are pegged to the value of local currencies around the world. These assetchains will track the price fluctuations from the European Central Bank for fiat currencies which will allow users to have complete liquidity in the market with the currency of their choosing. KMD tokens can be burned (or locked away) to issue new fiat pegged currencies. At this point, the team has created 32 fiat pegged currencies which they call ‘Komodo Currencies’. For an in depth explanation of this revolutionary technology you can read the SuperNET white paper: https://supernet.org/en/technology/whitepapers/decentralized-fiat-currencies#dfc-deposit-and-redeem

Scalability Solution

The KMD team has developed a scalability solution called Peerchains. Peerchains are where sibling chains (different assetchains) on the KMD platform can form a network of blockchains. This scalability solution connects chains together with the atomic swap protocol. On the core level, the funds can freely move from chain to chain with a lock/redeem system that is similar to how the Komodo Currencies work. These peerchains can operate on their own and will not be tied to the Komodo blockchain which solves the bloating issues many other platforms face (ETH).

Intelligence through Simple/Smart Contract implementation

In this section I think it makes sense to first explain the key differences between smart and simple contracts. First, smart contracts are computer programs that authenticate and implement the conditions of predetermined contracts (a chain of contracts essentially). This means that smart contracts have to constantly track certain values in a network in order to know when the conditions are met for the next contract to be executed. This requires the smart contracts to monitor the entire system of a business to know when to perform their duties. This is great when complex variables fall into play and processes are lengthy, but it also requires a lot of work and overhead to build/maintain these contracts. Simple Contracts on the other hand rely solely on the specific data that the contract can see, the entire system overall doesn’t matter. Simple Contracts can only execute transfers, they cannot trigger additional contracts and this is the fundamental difference between the two. Depending on the business/industry a company may benefit from using simple contracts as a way to cost effectively facilitate automatic functions through their blockchain. The KMD team has plans to implement both features in the future, but simple contracts is a key differentiator that we don’t see many other blockchains implementing. A great read up on the differences between simple and smart contracts can be found here: https://blog.bigchaindb.com/an-argument-against-smart-contracts-57f4f2a05b3d

Interoperability between different blockchains

Perhaps one of the strongest advantages the Komodo platform has is their atomic swap technology. The team has been conducting atomic swaps on their blockchain since 2014. This is something that the crypto community isn’t aware of, most people think atomic swaps are relatively new. Over the years the KMD team has been perfecting this technology that allows blockchains to communicate with one another, and now they are in the final stages of this project. The final stage being the development of the GUI (graphic user interface) which will enable anyone to execute an atomic swap with the click of a button. The team is days away from finalizing this last step which ties into one of the other great innovations on the Komodo platform, BarterDEX.

BarterDEX is the decentralized exchange (DEX) technology utilizing decentralized order matching and cross-chain atomic swaps. It is compatible with Electrum servers, which means users are able to do atomic swaps without downloading any blockchain. It should be noted that other projects developing atomic swaps have not yet implemented order books, which is crucial for a working end-user product. There are many other companies out their talking about their decentralized exchanges. However many of these other DEX platforms fail to mention that they are truly not decentralized, they either still maintain a centralized repository where coins are held or they give their users proxy tokens (IOU’s) instead of actual cryptocurrencies. BarterDEX is the first true DEX where users trade peer to peer and have complete ownership of their tokens.

Passive income

This strength is a no brainer, when holding your tokens on the blockchain through one of the KMD wallets you will earn 5% KMD annually by just sending your coins back to your address. Currently Agama is the main wallet on the Komodo Platform, however it’s important to note that the wallet is still being developed and is in the beta stage right now. Although the wallet is still in beta testing, the KMD team has confirmed it is safe to use and has fully functional GUI for holders to claim their interest. This is not POS, but rather it is passive income earned by creating new KMD to reward holders of the token. Total KMD in circulation after the ICO this year was 100 million tokens, and will plateau at 200 million tokens in about 14 years.

The 5% passive income was implemented for two reasons. The first is to incentivize people to hold their token off exchanges which will create a form of scarcity and help strengthen the price of the tokens. The second reason is to protect long term investors from inflation that is inevitable as new blocks are mined and tokens are created. Currently 3 KMD tokens are mined in every block, and a block is mined every minute. This equates to approximately 1,576,800 new tokens mined every year. These newly minted tokens are the definition of inflation, an increase in supply of a currency. However, the 5% passive income is used as a way to offset this inflationary penalty for long term holders who believe in the future of the project.

WEAKNESSES

Marketing

For anyone who has been following the Komodo platform and their team it’s pretty obvious that marketing is not this team’s strong suit. All one has to do is look back to the presentation on September 8, 2017 to see what I’m talking about. The infamous “brown sheet” incident caused most investors to run for dear life as they only focused on the poorly executed presentation and completely ignored some pretty ground breaking news. Initially after the ICO for KMD, the team decided not to spend any funds on marketing and focused solely on developing their technology which is a reason that marketing is the biggest weakness for the Komodo platform. Even now after the team recognized this weakness and are actively working to remedy it, it is still one of the things holding them back. Since the crypto industry is still relatively new we see investors flocking to projects that have a great marketing campaigns and can attract a lot of attention. This is something the KMD team has not been able to do yet.

Inactive community

Most definitely related to the lack of marketing for their platform, the KMD platform has a pretty small and inactive community. No doubt this will change if the team fixes their marketing issues, but right now this is a weakness the team has to deal with. Although the slack community has some dedicated and active followers, the reddit community is extremely small. If you check it out in r/KomodoPlatform you will see that many of the posts are created by the actual KMD team members, and rarely have many comments or upvotes on them. This weakness seems to have been identified after the “brown sheet” incident as the marketing team now does monthly AMA requests on the subreddit, but even those have failed to garner a tremendous amount of activity.

Complex history and project

First I have to talk about the history behind the Komodo Platform, and more specifically the history of JL777. I will have to admit I don’t know the whole story to this history, perhaps I will try to interview some knowledgeable people on the subject and write another article just to cover it. From what I do know the story begins with JL777’s involvement with the NXT project. When JL777 joined the NXT project he brought over all his projects that were all under the SuperNET umbrella. He was also invited to work on the Bitcoin Dark (BTCD) team. However, things turned south as the NXT team decided to break away from assetchains (the bulk of projects under SuperNET) which was the entire vision JL777 had been working toward. This forced JL777 to leave NXT and form his own blockchain so they he would never be put in this situation again. However, before moving on from NXT, JL777 was rewarded with approximately 5% of the entire NXT market cap which may be a reason for people to question the motives and integrity of the developer. I’ve seen people accuse him of giving inside information to the people he is closest with, which again I can’t find any information to either confirm or deny their claims. It’s obvious that when JL777 parted ways with NXT it was a huge loss for them. No doubt the investors/followers of NXT took this personally as I am sure their investments were affected. It seems like they hold a grudge against KMD and are active in their attempts to hinder the project.

Since the KMD team is aiming to accomplish so much they have built a very complex ecosystem to capture all they seek to achieve. This isn’t a simple cryptocurrency like BTC or LTC, but rather an intricate system with little nooks and crannies that hold everything in place. To be honest, I don’t fully understand all the intricacies of the Komodo platform, but to illustrate how complex JL777’s vision is I’ve included a chart he put together a few years ago when he was part of NXT. This isn’t a current depiction of KMD, but I believe it still is applicable to explain this point in my analysis. Needless to say it didn’t clear up anything for me haha. The team will need to work on this weakness and find a way to clearly explain how the KMD platform works.

Top heavy team

Although the dev team has definitely grown over the years it still has to be mentioned that the team is top heavy. This can really be said about many projects (ETH, LTC), but it is an inherent weakness for KMD. If for some reason the project loses team members it will not be easy to replace that lost talent. I suggest the team look both ways before crossing any street.

OPPORTUNITIES

Decentralized initial coin offering (dICO)

The KMD team is trying to revolutionize the ICO process with their superior approach to ICOs. The entire crypto market has exploded from the beginning of 2017, where total market capital equaled $18 billion USD, to now where we are sitting at a little over $200 billion USD. While BTC accounts for a good amount of the this growth, the ICO boom is by far the main factor for the crypto market exploding. Total market capital for altcoins at the beginning of 2017 equaled approximately $2.2 billion USD and was a staggering $73 billion USD in September (when total market cap was $140 billion USD) and, over $80 billion today. While many people believe that we are in an ICO bubble, I believe we are just getting started. Regulations and crackdowns on the ICO space have already been seen from government agencies (SEC in USA and China ban). In my opinion all this negative press/attention just means that ICO’s will be under harsher scrutiny from investors, but the number of ICO startups/projects will continue to grow. The dotcom bubble back in the late 1990s and early 2000s reached a height of over $3 trillion USD before it came crashing down. When factoring in inflation from then to now, we are well below 10% of what the dotcom bubble had. Although some people don’t think this is fair comparison, I can’t see a reason why not to view it like this. Not only is crypto founded on a groundbreaking new technology (Blockchain), much like the internet during the dotcom bubble, it also came to fruition in time when there is massive wealth inequality in the world and when another global recession/depression is most likely on its way. Crypto gives people the ability to gain true economic freedom, and in a time where corruption is blatant and obvious, it only makes sense people will begin to use crypto to better their lives.

The dICO on the Komodo platform is just the next evolutionary step in how ICOs will be conducted. The truly decentralized nature of these ICOs grants maximum security for ICO participants, as well as a strong layer of privacy (especially if JUMBLR is used). A dICO is wholly executed via the atomic swap protocols the KMD team has perfected. Traditional ICOs require investors to send their tokens into a centralized website or address, at which point the ICO team would have to then manually distribute the ICO token to the investors (this could take day/weeks some times). This ends with the dICO the KMD team developed. Also, you aren’t swapping your coins for a proxy token (basically an IOU), participants will be receiving an actual crypto token they have complete ownership over. The KMD team has also built a system that is resistant to wealthy individuals/groups and aims to prevent mass accumulation of any ICO token by these people. This gives more investors a chance to swap for the ICO token and creates a fairer market. The last item I want to mention about this is that the KMD team is not forcing ICO issuers to only accept their token during the ICO issuance. The KMD team is allowing issuers to collect BTC, KMD, and potentially other cryptocurrencies in the ICO issuance. This creates true freedom for both the ICO issuer and ICO participant. The KMD team aligns themselves with Satoshi’s vision of creating a fair and leveled playing field for people around the world, they are not trying to topple BTC but rather aim to work in tandem with it. One issue that many people have raised concerns about is that this will fail to drive demand for KMD, but the KMD team doesn’t believe in forcing people to use their coin if they don’t want to. They see moves like this as a tax on an ecosystem and movement away from a free and open source environment. The KMD team believes use of their ecosystem will drive demand for KMD and create real organic growth. Its also worth mentioning that many ICO issuers will decide to help KMD by providing their investors incentives to use KMD. You can check out my last reddit post on the Monaize dICO coming up on November 10, 2017. https://www.reddit.com/r/CryptoCurrency/comments/79l08q/komodo_and_monaize_present_the_first/

BarterDEX

As mentioned above BarterDEX will be the first truly decentralized exchange in crypto history thanks to their atomic swap protocols. This gives KMD a huge advantage, being the first to market with their DEX that utilizes atomic swaps allowing complete peer to peer trading. Everyone knows that the first to market advantage is extremely important in an evolving market like crypto (just look at BTC) so this this is a huge opportunity for KMD. With countries, like China, banning ICOs and closing down exchanges, the KMD team has a great opportunity to gain market share in these areas.

True independent assetchains

Again in my eyes this is another first to market advantage that KMD has when it comes to assetchains. Although other platforms are capable of creating side chains, none of these platforms yet offers the actual ability to create blockchains that hold the characteristics of the parent chain, but are also completely independent of the parent chain. Platforms like ETH require their assetchains to be pegged to the parent chain, which gives zero freedom to the ICO issuer. If there is an upgrade on the ETH platform then all the assetchains have to implement this change on their blockchain even if they don’t want/need the upgrade. On the KMD platform though, any changes made at the parent level are not forced down to the assetchains. The ICO issuers have complete power over their blockchains and can reject changes made at the parent level, and even completely separate themselves from KMD if they choose to without losing out in anyway. Again this is just another way the KMD team wants to create a free and open environment and bring true decentralization to the world.

Upcoming Conferences

The KMD team has a few conferences coming up on their schedule. These are all great opportunities to give some great presentations and garner attention with demos of their tech. Listed below are the dates and locations on their calendar as of today.

BlockShow Asia 2017 conference in Singapore on 11/20/2017

Gold Sponsor for the Let’s Blockchain This World Together conference in Abu Dhabi on 12/7/2017

Bitcoin, Ethereum, and Blockchain conference in Dallas, Texas on 2/16/2018

Relatively small market capital

As of this article Komodo has a market capital of around $250 million USD. I believe this is an opportunity, not really for the KMD team, but for the investors who see the potential of this coin. When you compare this to some of KMD’s main competitors like ETH ($29 Billion USD), DASH ($2.2 Billion USD) Monero ($1.6 Billion USD), and Zcash ($600 Million USD) you can see how much potential there is for the Komodo project. The only way to really compare a cryptocurrency’s value is comparing it against other cryptocurrencies since traditional valuation techniques don’t apply in this industry. Once you understand all the innovations that KMD is bringing to the table, the superior tech (dICO, DEX, JUMBLR, dPOW), an investor can see there is a lot of room for growth.

Also, the KMD team has confirmed in the October AMA on their subreddit that they have many companies interested in doing an ICO on the platform, but they are waiting to see how successful the Monaize ICO will be on November 10. If the Monaize ICO has good results, it’s pretty much guaranteed that we will see many more ICOs launched on the KMD platform in 2017 and 2018. This will drive the price on KMD even further and bring it into the arena of a legitimate ICO platform like ETH, WAVES, NEO. There is huge potential here! There is also the future prospect of simple/smart contract implementation which will really make KMD a director competitor to ETH.

THREATS

ICO Platform Competition

Needless to say the crypto space is just starting and there are many companies out there all competing for market share. Everyone is trying to come out on top once the dust settles and become Amazon of the crypto industry. Unfortunately while the Komodo team has been developing their tech other companies have been actively gaining market share. In the ICO space there is a ton of competition, companies that have been doing ICOs on their platforms for a long time, so KMD is kind of late to the game with the upcoming Monaize ICO. To name a few of the larger competitors KMD is facing in the ICO space; Ehtereum, WAVES, NEO, NXT/ARDOR.

Privacy coin competition

There are many privacy coins out there that KMD will have to compete with. Again this is the same situation as mentioned above, the competition has already secured market share in this space and it may prove difficult to take that away from them. The major competitors in the privacy space currently are DASH, Monero, and Zcash. Both DASH and Monero have loyal followers that KMD will definitely have a hard time swaying to their side. As for Zcash, the fact that KMD is a fork will make it difficult for the inexperienced investor to see KMD’s potential thinking that they just copied the code from Zcash. Aside from the current competition there are others who are thinking of entering the privacy arena like ETH, LTC, and even BTC (not likely but possible).

DEX Competition

While the DEX space is not as developed as some of the other areas of crypto mentioned above, there are still a lot of competitors trying to be the first highly successful decentralized exchange. After the whole China fiasco, where ICOs were banned and the exchanges closed, the community started hearing much more chatter over decentralized exchanges. They are definitely a hot topic right now, but it doesn’t seem like any DEX has taken significant market share yet. In my opinion this will really boil down to user experience, which company will make their software look the most appealing and implement the best features. These features will relate to not only how easy it will be to use the DEX, but also how information is displayed (charts, order books, etc). These facets will most definitely play a factor in determining which company will garner the most attention and market share. As of right now BarterDEX is being finalized, but hasn’t been released to the public yet. In fact the test dICO for Monaize using BarterDEX will be held on November 8, 2017 2PM (UTC). This will be the first display of what the tool will look like and how well it operates. KMD will face fierce competition in the DEX space from WAVES, Etherdelta, Bitshares, Opendledger, Blocknet, and many more.

CONCLUSION

From my research into the Komodo platform it is clear that the current situation of this project is one filled with great potential. The Komodo platform can boast over its superior technology and innovative ideas. They have some great opportunities to be first to market in many areas thanks to their revolutionary tech, and will be in the spotlight during the upcoming conferences. The gold sponsorship in Abu Dhabi is a HUGE opportunity for them to really show the world what they have to offer.

On the other hand the team does face the obstacle of overcoming their weaknesses and their competition. The team will need to address these issues head on. I can confidently say the team is aware of the issues that are in front of them, what is left to be seen is how well the execute on combating them. From a marketing point of view, the team has hired an entire marketing team since the “brown sheet” incident, and they are currently in the middle of re-branding their website. Their presence on social media has also increased significantly. Time will tell how the public reacts to these efforts, but in my opinion I think the team needs to push harder on this front. As for the market pessimism stemming from JL777’s past, the team will need to do a better job at addressing this if they hope to silence these naysayers. I think this could be cleared up through social media marketing and content creation(AMAs, interviews, articles) that explain the history to clear up any rumors. Lastly, they are working on educating their investors and honing their skills at public speaking to better explain what their technology does and how it works. This will help clear up some confusion for the less technical investors who can’t understand the more complicated aspects of this platform.

As far as competition, the KMD team has a leg up on everyone from a tech point of view in my opinion. And from what the world has seen in the past the superior tech will always win. All that is left to do is for the KMD team to get out there and show it to the world.

For myself, I am bullish on the future of this project. I believe if they execute well on all their opportunities, and address all the weaknesses they face, we will see Komodo become a real competitor for a spot in the top 5. This is just my personal opinion based on all the research I have done on the platform, please do your own research before making any investment decisions. I will be watching this one closely over the coming months/years and hope to see great things come out of this team.

AbsolutionX

https://medium.com/@absolutecrypto99/komodo-platform-swot-analysis-77c954b5163d

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@absolutecrypto99/komodo-platform-swot-analysis-77c954b5163d