Trading as a Public Utility of injective protocol

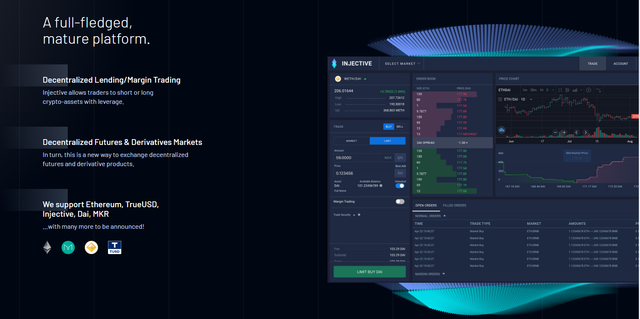

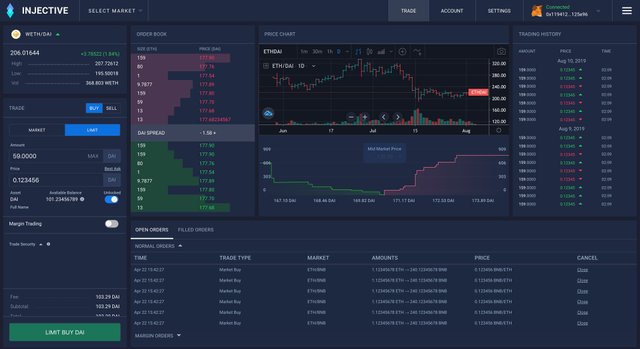

The injective chain is based on the Cosmos zone and is a decentralized protocol built on Layer-2, providing a high-speed Ethereum decentralized trading experience.

It will use the Cosmos IBC protocol to achieve cross-chain transactions, VDF (Verifiable Delay Function) to simulate real-time through Proof of Elapsed Time, and standardize order sequencing to eliminate early tradings. Also, the Injective chain supports token staking and provides technical support for creating more services such as staking in the future.

INJECTIVE CHAIN

The Injective Chain has built with layer-2 side chain and it is the Cosmos zone connected to Ethereum Blockchain. The Injective Chain has enforced a fair transaction ordering and fastest way with it, also Injective Chain solving critical race conditions and miner extractable value issues available in the Ethereum chain.

Now we have got a basic idea about injective protocol and injective chain, also got an idea of what will be solved by injective protocol. The presently injective chain has powered by layer -2 derivatives platform, serves as a decentralized Trade Execution Coordinator, hosts a decentralized open order book. The injective chain has built itself by allows for transferring and trading Ethereum-based assets on the Injective Chain.

Internet finance and the digital age

In the 21st century, human civilizations have made significant progress in digitizations. In just two decades, the internet has gone through three ages: the age of portal (Web 1.0), the age of search/social (Web 2.0), and the age of the internet (Web 3.0). The continuous development of the internet has altered and revolutionized the ways that humans think, behave, and interact.

It started about 300 years ago during the industrial age, people were working endlessly to increase productivity and efficiency on machines to manufacture from steam engines to automobiles; the keywords were mass production, automation with machines, and efficiency optimization for maximized profitability.

Now everything has changed, and the passing of time seems to be even faster as we witnessed the iteration of technologies. Humans shift their attention away from basic productions and machines back to humans themselves; the internet connects integrates humans, information, and machines/devices.

Position of exchanges

Now either in traditional finance or internet finance, "exchange" plays a fundamentally crucial role. The essence of the commodity economy is the exchange economy, and in the commodity economy, productions and consumptions are matched through market exchanges. When a proper equilibrium is achieved for supply and demand, the marginal substitutional rate between any two commodities will be the same for any consumer, and the exchange of values is optimized.

The development and current status of traditional exchanges

An exchange is a trading platform with diverse products, which provides price discovery and liquidity for traded products. Technological advancements have facilitated and effected also the business model and infrastructure of the exchanges. Not many people stand in offline market places and shout out the prices of their goods to attract buyers nowadays, but try to get their goods sold through electronic trading systems.

In terms of the business model, most exchanges in Europe and the United States have gone from membership-based to form for-profit companies.

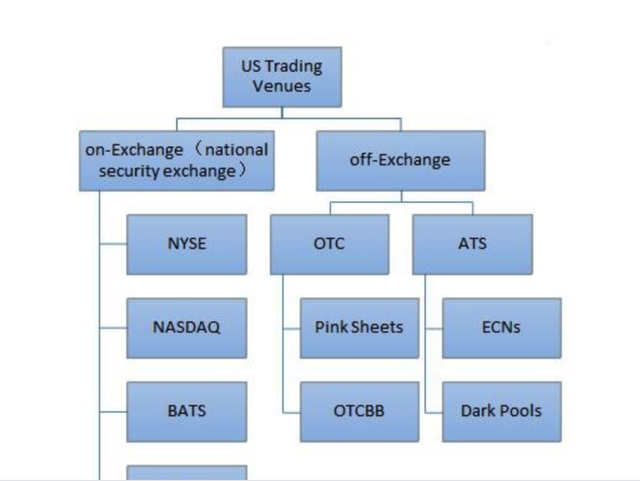

As the hub of financial activities, the development of exchanges is heavily affected by regulatory policies. However, as technology develops, regulations loosen, and business competitions carry on, Alternative Trading System (ATS) has emerged since 1990 in the US (Multilateral Trading Facility (MTF) in Europe), adding flexibility and diversity to the financial world.

The development of exchanges based on blockchain technology

With the application of blockchain technology in asset tokenization and the trading of it, many digital asset exchanges have emerged, such as Binance, Coinbase, Bitmex, etc. These well-known exchanges are also classified as centralized exchanges in the blockchain and digital asset industry.

Centralized exchanges, as the name suggests, means that the assets deposited by the users are stored in the hands of the exchange owners, and matching of trades and even prices of products are subject to centralized controls operated on centralized servers. In other words, we, as users, do everything on the platform based on our trust in the team and institution running it.

Centralized Exchange

When using a centralized trading platform for the first time, you need to complete the registration required by the centralized exchange and KYC (real name authentication, etc.).

Upon different levels of task completion, you will have permission to deposit, withdraw, trade, and more.

Deposit a certain amount of assets from other exchanges or your wallet to the newly registered centralized exchange. It should be noted that the address to receive the deposit is assigned to you by the centralized exchange, and thus you do not have the private key to this address.

Withdraw assets away from the exchange, you are subject to centralized risk control conducted by the exchange persons as you do not have control of the address. It is usually the case that you will need to complete the highest level of KYC (e.g. video chat, picture with yourself holding your ID and written waiver of rights).

Further, the release of your assets is completely subjected to the permission and execution of the exchange staff.

This is where it gets interesting as well when you make a trade, all transaction-related data and record are stored on the exchange's server, on some of the exchanges, the settlement of a transaction does not even take place (you only see the transaction completed on the front-end), and for most, you do not have access to their back-end and therefore if there is any dispute on a transaction/order, you probably would not have any edge arguing with a centralized exchange.

Decentralized Exchange

With the advancement of blockchain technology and the emergence of more public blockchains, there are now a variety of decentralized exchanges.

DEXes are different because of the diverse public blockchains they are based on and their respective concepts and technologies. Here we only discuss the decentralized exchanges about the general traits.

One of the key aspects of decentralized exchanges is that the exchange accounts equate to smart contract accounts.

In brief, storing assets on DEX is to store them in smart contracts which is to store them in codes, and in codes you trust. Generally, most DEXes will only ask for registration

Official Website: https://injectiveprotocol.com

Bounty Link : https://bitcointalk.org/index.php?topic=5256993

Telegram: https://t.me/joininjective

Whitepaper Link: https://docsend.com/view/zdj4n2d

Github: github.com/InjectiveLabs

Twitter: https://www.twitter.com/@InjectiveLabs

Reddit: https://www.reddit.com/r/injective