Bitcoin vs. Bitcoin Cash

It's been awhile since I've done any blogging and I'm admittedly feeling a bit awkward writing again but just given the state of things and this new interesting platform Steemit, I figured it's either now or never.

If you're anything like me, you're interested in cryptocurriences and your friends are looking at you for advice given your measly one year of experience over them in the subject matter. I figured instead bombarding them with walls of information via text to do a layman's blog dedicated to cryptos so more information could be conveyed in a more efficient manner.

In this case, I'm looking to aggregate data from news sources, social media, leaders in the industry, technical analysis, google trends, etc so people can get a concise opinion from a layman. It should be noted that I am not an expert and there will be times when I get things wrong. I therefore welcome criticism and debate as it is the best way of getting correct ideas across.

Something I wanted to discuss today was Bitcoin dominance. After watching Deconomy 2018 with Roger Ver and Samson Mow (video below) I realized there were some fundamental shifts Bitcoin was taking that the community wasn't fully aware of.

Now before anyone says otherwise, Bitcoin is still the original Bitcoin but if you made it through all the technical jargon of the talk/debate, I think it's clear that there are many criticisms of the direction of Bitcoin that leaders of the industry are contending with and these factors may influence long term price or sustainability of the coin if they haven't already.

While I'm wary of being too friendly with Roger Ver, there are some legitimate points that he brings up in that Bitcoin Cash follows the original vision Satoshi Nakamoto more closely whereas the original Bitcoin is deviating from it. In terms of resolving scalability issues, it was meant for Bitcoin to scale "on-chain" but the core developers decided to go with "second layer solutions" such as the "Lightning Network."

Now my knowledge is a bit limited in the following subject matter so I may need to be corrected but with the recent additions of SegWit and Lightning, many merchants (ie: the drug money that started everything) haven't upgraded their protocol and thus they only accept users that use the old Bitcoin protocol. So if you were to send your SegWit Bitcoins to a non SegWit address, you are in risk of losing your Bitcoins. In that sense, I could see why Bitcoin is seen as somewhat fractured and not even being the real "Bitcoin" despite retaining the name.

Another point that Roger Ver brings up are the high fees being charged by Bitcoin. Bitcoin was founded on libertarian principles and wanting to create a form of currency that wasn't subject to hyperinflation and freely transferable by any individual. While the price volatility somewhat negates the function as a currency, there is a purported massive difference in fees at peak transaction volumes in the favor of Bitcoin Cash. Samson Mow makes a point that if the restaurant is full, you wait, (ie: if transaction volume is high and you don't want to pay a premium, prepare for slow transaction times) but truth be told, I think most people just leave.

(At some point in the talk, Roger Ver jokes that people are dying in third world countries because Bitcoin can't scale properly. To be honest I'm not even sure if he was joking but the whole frame of context is just laughable)

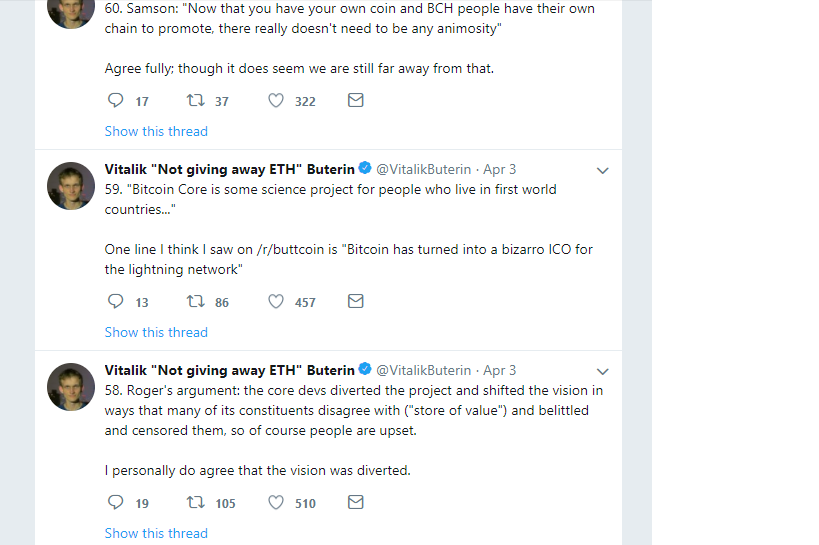

Looking at Vitalik Buterin's remarks on Twitter, he seems to affirm some of the contentions of the community.

This isn't to say that Bitcoin Cash is now the holy grail of cryptos. If anything I would be more wary of investing in either as Roger Ver owns the major communication outlets pertaining to Bitcoin. Being the mouthpiece for Bitcoin Cash, it's my understanding that Roger Ver owns the bitcoin.com domain as well as the original @bitcoin twitter handle which both advocate for Bitcoin Cash over Bitcoin so the newcomers in crypto that download their wallets from bitcoin.com have their default coins set to Bitcoin Cash. It should also be noted that the biggest supplier of Bitcoin ASIC miners only take payments in Bitcoin Cash.

Given that much of the valuation in cryptos comes from perception, this sort of skewing Bitcoin Cash as the real Bitcoin could actually diminish the price of Bitcoin in the terms of the intensity for it to bubble the next time around. For the market as a whole to thrive though, it may be necessary for Bitcoin to lose some dominance as every coin follows the price of Bitcoin and lowering price may have some impact in decoupling the price correlation between the coins.

Looking at things in the short term right now though, I would say it's more likely than not we're going to see another bull run this year. Market sentiment seems to be back up from the February lows and the trading robots will probably continue painting the tape up. Once we start hitting $16,000 - $19,000 Bitcoin price levels, I'm pretty sure public interest will peak again and trading volume will increase dramatically creating another bubble.

In my next post, I'll be covering the Bitcoin bubbles and why I don't think this will keep happening in perpetuity and two interesting coins EOS and Ethereum. Thanks for reading and stay tuned.

Hey @siroak, want free resteems? All ya gotta do is follow me...

Congratulations @siroak! You received a personal award!

Click here to view your Board

Congratulations @siroak! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!