Standing on the top of 30,000 US dollars and making headlines in the Financial Times, Bitcoin is being integrated into the mainstream financial system?

Facing the upsurge of private money, the process reengineering of the global financial system with digital currency as the core is on the agenda

At the beginning of 2021, gold and the stock market are starting, and Bitcoin is taking off.On January 4, the first trading day of 2021, the three major stock indexes opened higher , and the Shanghai Stock Index finally stood at 3,500 points, the first time since January 2018. The ChiNext Index closed up nearly 3.8%, achieving a good start.During the same period, the price of Bitcoin continued to break through historical highs, reaching a record high of 34786.4 US dollars . Driven by the upsurge, blockchain concept stocks are taking advantage of the trend. Oukeyun Chain (01499.HK) opened sharply on January 4, with the highest rising to 0.38 Hong Kong dollars, an increase of 50.41%, leading the block chain concept stocks; on January 5, Oukeyun Chain opened 12.33%, the highest The price is HK$0.41.The British "Financial Times" (Financial Times) published an article "Goofy: Bitcoin price stands at $30,000" on the front page that day, recording this moment. According to "Financial Times" newspaper Road, Bitcoin The rise than any other major assets. In the past year, the S&P 500 in the United States has increased by 16%, gold has increased by 25%, and the price of Bitcoin has increased by 305% ."Institutional demand and US regulators more clearly the attitude of the industry, and the latest fiscal stimulus package passed by Congress may stimulate retail investment needs of the funding. There are indications that bitcoins are increasingly integrated into the financial system. "Regarding this rise, economist Nouriel Roubini called Bitcoin “completely a speculative asset with no underlying value”; some analysts said that this rise was due to the entry of corporate and institutional investors .

According to "Financial Times" newspaper Road, Bitcoin The rise than any other major assets. In the past year, the S&P 500 in the United States has increased by 16%, gold has increased by 25%, and the price of Bitcoin has increased by 305% ."Institutional demand and US regulators more clearly the attitude of the industry, and the latest fiscal stimulus package passed by Congress may stimulate retail investment needs of the funding. There are indications that bitcoins are increasingly integrated into the financial system. "Regarding this rise, economist Nouriel Roubini called Bitcoin “completely a speculative asset with no underlying value”; some analysts said that this rise was due to the entry of corporate and institutional investors .

Institutions accelerate entry, Bitcoin may be integrated into the mainstream financial systemAccording to public data, companies and institutional investors represented by Grayscale, Micro-strategy, and Paypal are accelerating their entry and incorporating Bitcoin into their asset allocation strategy .

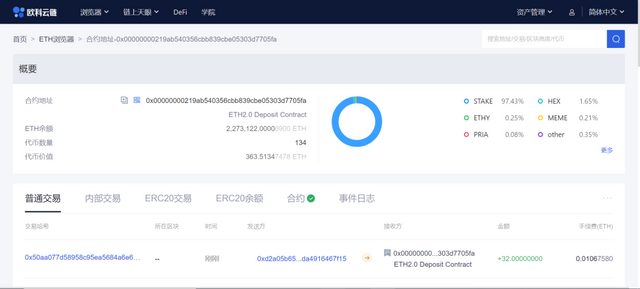

(Data source: https://bitcointreasuries.org )Encryption is a gray-owned production investment management company, founded in 2013, under which there are nine single-asset trust and a digital market fund. On January 21, 2020, Grayscale Bitcoin Trust was officially registered with the US SEC, becoming the first crypto asset investment tool to report to the SEC. Up to now, Grayscale Bitcoin Trust has purchased 572,644 bitcoins, accounting for 2.73% of the total circulation . Since Grayscale does not support redemption for the time being, the "disguised lock-in" has stimulated market demand for bitcoin.At the same time, some Nasdaq listed companies and asset management companies have also begun to incorporate Bitcoin into their asset allocation strategies .MicroStrategy is a Nasdaq listed company that provides enterprise-level analysis and mobile application software. Since August 2020, the company has purchased bitcoins for 4 consecutive times, totaling 70,470 bitcoins, with an average price of US$15,964. Since August, the stock price of Micro Strategy has risen from $130 to $420.In addition, on October 21 last year, the American payment giant Paypal announced that it would support the purchase of 4 types of encrypted assets such as Bitcoin and Ethereum by American users. Fidelity Investments is one of the world's largest asset management companies. In recent years, it has established a number of Bitcoin and encrypted asset funds.This series of actions drove the rise in the price of Bitcoin, and at the same time accelerated the pace of Bitcoin as a mainstream asset .Under the "assistance" of the Bitcoin market, ETH returned to $1,000, hitting a maximum of $1167.99. According to OKLink data from OKLink , the balance of the ETH2.0 deposit contract address has now exceeded 2,273,122 ETH .

(Data source: OKLink)

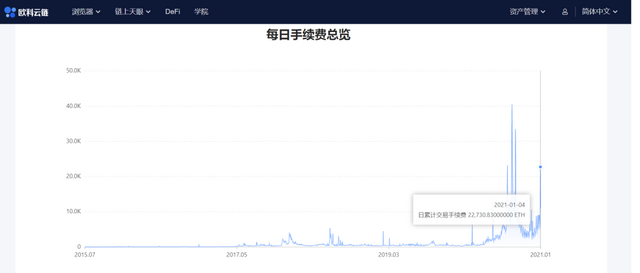

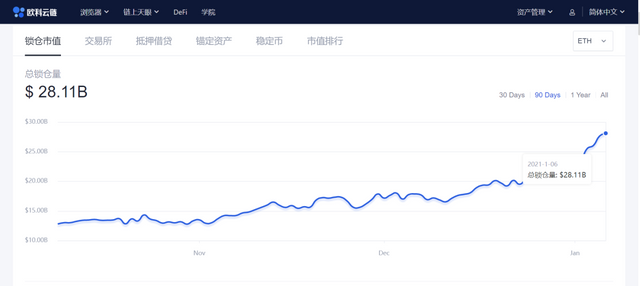

On January 4, the transaction fee on the Ethereum chain reached 22730 ETH , the fourth highest in the history of Ethereum . In the same period, the block reward for Ethereum mining was approximately 12,992 ETH, and the income from the handling fee to the miners was 1.75 times the block reward. 1 Yue 6 days, the Ethernet protocol DeFi Square Lock total amount of breakthrough high before, to $ 28.11 billion.

(Data source: OKLink )

Bitcoin: digital gold or high-risk asset?In the past year, the wealth effect of Bitcoin has attracted many new investors . From the perspective of the total number of Bitcoin addresses, according to OKLink browser data, at the beginning of 2020, the number was 595,728,673. By the end of the year, the total number of addresses had increased to 760,005,153.

(Data source: OKLink )

As the popularity of Bitcoin continues to increase, the coverage of the group becomes wider and wider, and the risks and governance of "coin speculation" are paid attention to. People’s Daily Online has continuously reprinted reports, “Bitcoin is a high-risk asset, and young people are not encouraged to use leverage to speculate coins”, “Bitcoin chaos and the rule of digital renminbi”, to remind investors that on the highway of pursuing wealth and freedom, First fasten your seat belt .The report cited the analysis of Zhongtai Securities and confirmed the value of Bitcoin . "The essence of Moutai, housing prices, and Bitcoin's rise is the same. When the currency is over-issued, buying gold, Moutai, core stocks, and core real estate are all a process of re-searching for scarcity. And the scarcity of Bitcoin is different from it. The main features of banknotes, tulips, etc., the latter two can be printed and produced unlimitedly."But at the same time, “the Bitcoin market is known for its violent volatility.” Since 2016, there have been 10 cases where Bitcoin has fallen by 20% or more, and there have been 7 times when it has fallen by 30%; and the case has fallen by more than 48%. A total of 4 times, "Some people use credit cards, loans, and leverage dozens of times to speculate coins. This kind of speculation is not worth promoting."In addition, safety and supervision have also become a key issue .In another report, the financial risks brought by Bitcoin were mentioned. With the entry of all kinds of capital into Bitcoin, "the capital siphon effect may form a snowball-like virtual financial bubble, which will make more and more capital lose the supervision of the central bank. The consequences will be serious: first, the decentralization of Bitcoin leads to the entity The hollowing out of supervision; the second is to reduce the physical currency, which makes central banks continue to print money in the post-epidemic era, causing global inflation and global systemic financial risks ."

In order to prevent blockchain financial risks and promote the healthy development of the industry, my country is also continuing to promote the supervision of cryptocurrencies, clarifying regulatory policies involving cryptocurrencies, and promoting industry compliance. In the industry, the blockchain browser represented by OKLink has also continued to assist the public , prosecutors and judicial departments in many places in detecting multiple anti-money laundering cases related to encrypted assets. While serving industry users and empowering the real economy, it protects the security of the chain and helps The development of compliance in the blockchain industry .

(Data source: OKLink )

Block chain as an emerging industry, gave birth to a lot of "wealth legend", but the S & P through investment capital still need to remain rational. Encrypted assets represented by Bitcoin have strong price fluctuations and investment risks. Investment tools such as high leverage should be used with caution. With the district block chain gradually fall in various fields, industry and policy both inside and outside force, the industry gradually compliance, enhancing safety, the wave of new infrastructure, the block will become the chain's economic development, financial innovation is an important driver .