Choose Your Money Wisely

Old Money

Unless you have been living under a rock you know that the modern financial system is rotten. Unfortunately, few understand why this is so. Rather than addressing the many externalities and byproducts of this system, I think it is prudent to look to the core and, as the saying goes, “follow the money.”

For as far back as anyone living can remember, governments around the world have enjoyed monopoly control over the issuance of money. This arrangement has served the political and banking classes by giving them the exclusive right to manipulate interest rates and legally counterfeit the nation’s currency. In the United States, the Federal Reserve and its legion of apologists wrap these realities in saccharine-sounding euphemisms such as “quantitative easing” and “discount window.” They also explain in excruciating monotone that price deflation (prices dropping) is bad for you. You see, it is good to pay more for the things you need to survive. They dress in starched shirts and many of them look like your grandparents, and they are all living in the past. They have given us a financial system built on debt and theft and it is up to us to find a better way.

The Dawning of a New Age

With the release of his white paper in 2008, Satoshi Nakamoto sparked a money revolution with Bitcoin. For the first time in our lives, we have real choice when it comes to money. You can hold on to government fiat money and watch as your purchasing power erodes year-after-year. You can store the value of your labor in a bank offering no interest (or even negative interest in some places). You can hope that bail-ins do not make it to your country. Or you can “be your own bank” and use decentralized, peer-to-peer, cryptographically secured, open-source money built for the 21st century. The smart choice seems obvious to me.But can Bitcoin really succeed? Didn’t it die? In spite of the droves of unimaginative types waiting with nails in hand next to an empty coffin, Bitcoin is still very much alive. Even more ironically, if Bitcoin happened to be a corporation in the traditional sense of the word, it would be lauded as a massive success and would doubtless be a darling of the Venture Capital world. With a market capitalization of around $6.3 billion, Bitcoin would have come in at #19 in the 2015 list of Billion Dollar Startups compiled by the WSJ, just above Lyft. Where are the droves of writers eulogizing the end of Lyft?Obituaries aside, Bitcoin adoption metrics continue to move steadily upwards (transactions per day, addresses used). In spite of the contention surrounding the block size, the big story is that Bitcoin is succeeding and needs to scale up to accommodate the additional demand. Thanks to first-mover advantage and the power of network effect, Bitcoin will likely continue to dominate the cryptocurrency scene well into the future.However, the future is uncertain and I do not know that Bitcoin will succeed in its quest to obsolesce the current financial paradigm. Sometimes the first version of a new technology ends up supplanted by a derivation. How many people would have bet on Facebook unseating MySpace?

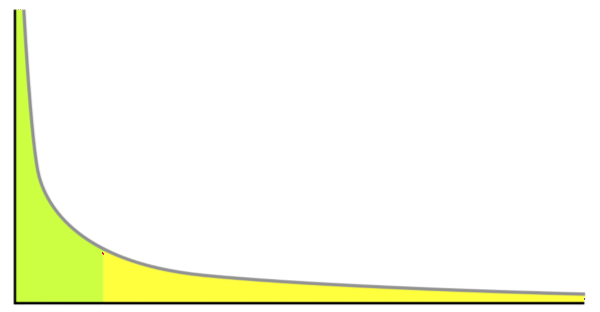

With this sobering thought in mind, let us remember the wisdom of diversification. Taking 10–20% of your Bitcoin holdings and moving into alternative cryptocurrencies can help insulate you from some of the risk of holding Bitcoin and may also provide additional upside. It seems likely that we will see the free-market in currencies develop such that we can observe a power-law distribution where 80% of the total market capitalization of cryptocurrencies will be found in the top 20% most used currencies.

Power-Law Graph

Because of this likelihood, I would caution against speculating on new or extremely small market cap cryptocurrencies unless you have a very strong reason to do so. Competition is a good thing for any market and so, because I love Bitcoin, I welcome competition. Bitcoin promises to act as a superior store of value (thanks to its finite supply, capped at 21 million) and a fast and nearly frictionless network for the exchange of that value. If Bitcoin developers stumble in scaling the network (and many in the community believe they already have), it is up to the users of the network to voice their concerns, support alternate versions of the Bitcoin software, and if their needs are still not being met, look for alternative currencies. Thankfully, cryptocurrency users have a choice.

Litecoin, a fork of the Bitcoin code with two modifications (a block time of 2.5 minutes compared to 10 minutes for Bitcoin, and a currency cap of 84 million) has been imagined as the silver to Bitcoin’s gold. Consistently ranking in the top 5 cryptocurrencies by market capitalization, Litecoin has existed quietly for the most part in the shadow of Bitcoin but it seems to have staying power. Although development work is tepid at the moment, the Litecoin GitHub repository has 276 contributors and close to 8,000 commits.

Ethereum, a blockchain based network specializing in distributed computation has recently rocketed to #2 in market capitalization (currently sitting at $1 billion). With a constant annual rate of inflation, Ethereum is approaching the currency issuance question from a different perspective. Ethereum is effectively subsidizing their network nodes through this constant inflation model. While I prefer the hard limit approach for currency issuance, since the rules are set from the start, the Ethereum approach may work well and will be disinflationary (while not necessarily deflationary). Ethereum has a very active community of developers with several implementations of the Ethereum protocol.

I for one am thankful that the future of money looks increasingly diverse and that the interests of developers must align with those of the users of a cryptocurrency in order for that currency to succeed. To this end, I am happy to announce the release of my company’s second product, a portfolio rebalancing algorithm called “TIDE.” Users can build a diversified portfolio of cryptocurrencies with current support for Bitcoin (BTC), Litecoin (LTC), and Ethereum (ETH). TIDE also supports several fiat currencies including USD, CAD, EUR and GBP. The algorithm continuously monitors and rebalances user accounts to maintain their desired allocations. For more about the algorithm and some sample backtested portfolios please visit our website.

Written by: Robert William Allen, Founder & CEO of COINCUBE

Congratulations @robertallen! You have received a personal award!

Click on the badge to view your own Board of Honor on SteemitBoard.

For more information about this award, click here