The Bitcoin BULL is still INTACT and why I was RIGHT to hold these Coins

Just 5 days ago I said "I believe Segwit1x is going nowhere and will survive the upcoming fork" and sure enough within just 12 hours of my post, the SegWit2X fork was called off. I also said my favorite coins other than Bitcoin (BTC) are Monero (XMR) which has rallied 25.9%, Dash (DASH) up 39.6%, Bitcoin Cash (BCH) up a whopping 117.7%, and NEO (NEO) down 2.1%. I also said "I think Bitcoin Cash will rally if there is any turbulence in the fork", and the fork getting called off was just what Bitcoin Cash needed for a nice rally.

To hedge against the fork I sold a small portion of BTC and ETH and added to my positions in BCH and DASH and also increased my cash position. The fact that the fork was called off shows the resilience of the NO2Xers and it is also clear that much of the capital that flowed into BTC anticipating a free 2X larger block dividend coin sold out of BTC post fork cancellation and poured into BCH which drove it up over $2,400. BTC rallied briefly post fork cancellation to over $7,800 hitting a new all-time high and has since dropped to ~$6,000. The fact that BTC has sold off ~$1,800 or ~30% and the total market cap has stayed flat around $200B shows this capital flowed into other coins with similar use cases but lower transaction fees such as those listed above. There is clearly a use case for a digital store of value similar to gold (BTC) and a use case for a digital cash (BCH). The average transaction fee for BTC hit a new record high of $10.69 yesterday (ridiculous), while the average transaction fee for BCH is just $0.20.

I do believe Bitcoin and Bitcoin Cash can and will coexist and serve different use cases, it is not a zero sum game. I believe both teams should focus on building and improving their projects and not on destroying one another. With that said I still think the transaction fees for BTC are excessive and would benefit from a larger block size as Satoshi originally envisioned. For those calling this BCH rally a pump and dump or temporary I think they are mistaken. Bitcoin Cash is here to stay and I do not believe we will see sub $500 like we saw just weeks ago ever again. This is also a lesson to hang onto your Bitcoin dividends as it is a way to stay diversified and not keep all your eggs in one basket.

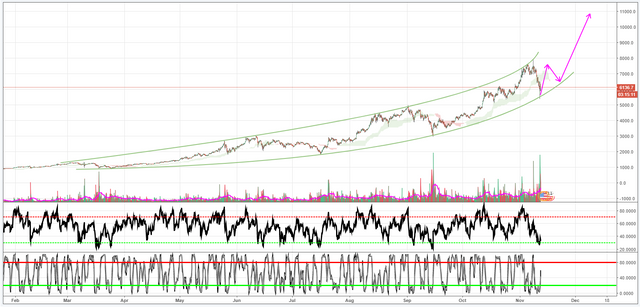

I believe the Bitcoin BULL is still intact and am reaffirming my price target of $10,000 by year end. I just added to my BTC position at $6,000 and will add more if we drop further. Always a good idea to have some dry powder to capitalize on these corrections. Wall Street has missed the BTC train and will be getting aboard on this next leg up.

Bitcoin (BTC) price at time of writing $6,042.92.

Bitcoin Cash (BCH) price at time of writing $1,380.83.

Disclaimer: You should perform your own research and make your own investment decisions, this is not investment advice. I own or may plan to own cryptocurrencies mentioned above.