Why can the price of bitcoin fall after halving?

The bitcoin exchange rate rose by 130% after reaching a low below $4,000 in mid-March. During the last 10 days of April, the price rose from $6,700 to $9,400. This allowed bitcoin to register the first seven-day series of continuous growth over the past 12 months.

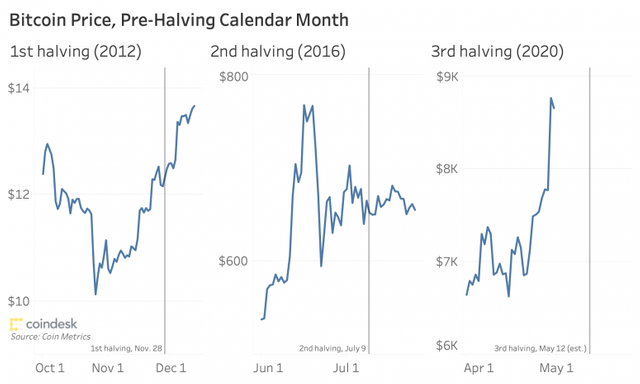

The growth is observed on the eve of the upcoming holding, the third in the history of the cryptocurrency, which is due to occur on may 12 and will lead to a decrease in block rewards from 12.5 BTC to 6.25 BTC. The current rally is consistent with the dynamics of the previous two holdings, coindesk notes.

Thus, the price of bitcoin rose by 34% from $9.5 to $12.75 during the four weeks ending November 28, 2012, when the reward for miners was lowered for the first time. The second halving took place on July 9, 2016. On this day, the cryptocurrency was trading around $660, which was 45% higher than the mid-may low of $440, although the peak was recorded in mid-June at $780.

Bitcoin showed strong growth for 12-15 months after the halfing. For example, in December 2017, it reached a historical high of about $20,000. Some experts expect a similar uptrend to occur after halving this may.

""The holding company will reduce the number of bitcoins distributed among miners, and, consequently, the supply of coins entering the market. Halving not only boosts the price as a result of increasing scarcity, but also attracts media attention. Historically, these factors have had a positive impact on the price and led to an increase in demand, " said don Guo, CEO of Broctagon Fintech Group.

Investors, however, need to take into account that in previous times growth did not start immediately after halving, and in 2016 it was followed by a noticeable drop.

"Halving bitcoin has long been discussed in the cryptocurrency community. Many believe that its impact is already reflected in the price range, " said gxs Group CEO Nick Cowan.

Data from the blockchain indicates that large and small investors are accumulating cryptocurrency in the run-up to halving and may want to lock in profits after may 12, putting additional pressure on the market. In addition, low-performing miners may be forced to liquidate their existing reserves of bitcoins to compensate for reduced rewards and Finance their current activities.

At the same time, the current halving is different from the previous ones, as it occurs against the background of the crisis caused by the coronavirus pandemic.

"This halving of bitcoin will definitely be different from the last one, since the economic system of Satoshi Nakamoto has an opportunity to show its stability before traditional wall street protocols," said Andy JI, co-founder of the Ontology blockchain project.

"Against the backdrop of a worsening Outlook for the us economy and the likelihood of a continuous increase in the money supply, which weakens the dollar and multiplies fears about inflation, we believe that it will be quite easy to test previous highs above $19,000, as investors look for protective assets outside the traditional system," said Simon Peters, an expert on eToro's crypto assets platform.

Having become the leader in profitability among other asset classes last week, bitcoin stopped the movement of about $9,000. At the time of publication, the cryptocurrency is trading at about $8,700, having lost 3% of its value in a day. Traditional markets were also in the red this Monday. If the flight from risky assets resumes, bitcoin could end up at the 200-day moving average of about $8,000, according to an analyst at CoinDesk.

Others believe in the cryptocurrency's ability to test five-digit levels before halving.

"Although the initial rise to $10,000 has stalled at $9,400, we are looking at a further push and break of the $10,000 level, which will be followed by a pullback after halving," said Jehan Chu, co – founder of investment firm Kenetic Capital.

He also noted an increase in the activity of institutional investors. Open interest in bitcoin futures on the Chicago Mercantile exchange, traditionally associated with institutions, rose to $339 million on Friday – the highest value since July 10, 2019. At lows on March 12, it was $107 million.