Why do some countries hate bitcoin?

The best way to understand Bitcoin is to go back to its starting point——the white paper.

The white paper clearly describes the reasons why Nakamoto has invented Bitcoin, the problems encountered and the solutions that can help us build a complete knowledge system.

The Bitcoin white paper was originally called "Bitcoin: A Peer-to-Peer Electronic Cash System",. Nakamoto told us very straightforwardly that Bitcoin is essentially "money."

So, when someone tells you how to use the blockchain to save the Internet, how to use the "Token economy" to change the world, keep in mind that the essence of the token is "money", and the currency is issued a kind of "money." Since it is "money", we must follow the development logic and laws of "money."

So, what is the value of the "money" of Bitcoin?

In the first sentence of the abstract, Nakamoto tells us that the “money” he created can be transferred directly between users without the participation of financial institutions. It is called peer-to-peer (P2P technology). A breakdown will reveal that no financial institution means that the “money” has no issuer, the transaction process is not regulated, and everyone has no account.

So, where does the money come from in the Bitcoin system? Who is the issuer? No account, how to spend money? Who record the balance? How is security guaranteed? How does the entire system work?

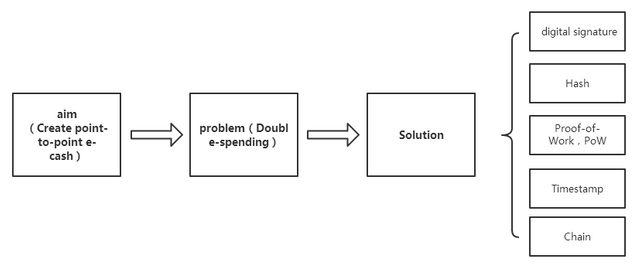

Next, as the picture shows,Nakamoto talked about the point-to-point e-cash, the problems he encountered, and how he planned to solve the problem.

Double-spending is the biggest problem, which means spending the same amount of money multiple times. Since the system is peer-to-peer, that is, the user directly deals with the user, there is no authority like a bank to book the account. For example, A can bind his e-wallet to two accounts, use the same money to make payments to merchants B and C, and only one in B and C can actually receive the money.

How to solve the problem? Nakamoto used several important concepts: Digital signatures, Hash, Proof-of-work (POW), Timestamps, and Chain, and outlined how these concepts solve the double payment problem in the abstract.

When User A transfers money to User B, A needs to attach his own digital signature and B's payment address to the bill, and use the hash algorithm for encryption. This message will be sent to the Bitcoin network.

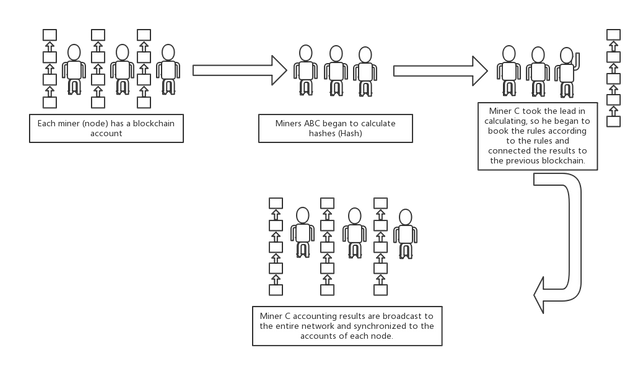

At the same time, Bitcoin network participants (Node) need to use a computer in the client (early Bitcoin can use the computer to mine, now need to use a special mining machine) to calculate a "difficult problem" every 10 minutes, to complete the workload prove.

Participants who are the first to calculate the correct result are eligible to record the transfer information within a certain period of time, including the AB user, and receive the newly generated bitcoin and transfer fee as a reward.

Participants who are eligible to book will review the transaction information according to the rules and will check the “unexpended balance” (UTXO) of all addresses associated with the transaction.

For example, if you want to judge whether A has an unspent balance, you need to check A's earlier transfer record, and so on, until "The foundation block". In theory, as long as the “The foundation block” is unchanged, the current transaction that everyone is not spending will be locked, thus avoiding the harm of double payment.

The transfer information in the current time period will be packaged into a block, covered with a "time stamp", and connected to the previous block, connected as a chain (Chain). These blockchains containing existing transfer information will be synchronized to all participants. The result is based on the "longest chain".

Once the results are synchronized to all participants, they cannot be changed. Because it is impossible to change the books of all people, unless the cheater can produce a longer chain and make the previous chain invalid, this requires at least 51% of the total network power, so even Nakamoto can not change the "The foundation" Block".

This means that if two participants complete the proof of work at the same time and pack the blocks, they will start a “race”. The person who first creates a new block has the right to keep accounts.

In this process, there is no authority like a bank or Alipay to record transaction information. Only the participants who have completed the proof of work are responsible for recording and synchronizing to all participants. This is called distributed and decentralized.

Bitcoin is not issued by any institution, but is distributed by participants in the form of rewards during the bookkeeping process. If all 21 million bitcoins are issued, the participant's reward will only be charged.

POW (Proof-of-Work) is a kind of "consensus mechanism". It is a rule to maintain the automatic operation of the bitcoin system. The specific code implementation process is much more complicated.

Some people may think Bitcoin is difficult to understand. In fact, just keep in mind that no matter how complicated the blockchain technology and nouns are, the purpose is to create decentralized and automated collaboration methods, but the implementation methods are different and have their own advantages and disadvantages.

In the following sections, Nakamoto describes the technical principles of these concepts, including how to use SPV technology to reduce distributed storage space and the cost of using computing power.

Many people may say: Oh, distributed, decentralized, pretty good, then? What is the value? Or, straightforward, why is Bitcoin so expensive? Will it rise in the future?

How is Bitcoin priced?

What really makes bitcoin worthy is the anonymity and mining machine.

The amount of money issued by the state is based on the total value of current social goods. If the total value of social goods is $1000, and the currency is just issued at $1,000, then $1 purchase power; if the total value of social goods is $1,000 and the currency is issued at $2,000, then the original $1 purchaseable item now costs $2, which is Inflation 50%

Generally speaking, the currency of the new hairstyle is subject to the risk of selling due to limited credit. When people get the money, they will be quickly converted into daily necessities. When the new China was first established, the purchase of materials had to be limited by the “food stamps” to prevent the RMB from being sold. The same is true for Bitcoin. Eight years ago, someone had "can't wait" to buy pizza with 10,000 bitcoins.

But gradually, the anonymity of Bitcoin has become a black market for “Silk Road” and its monetary value anchors the total value of black market goods in a certain sense. On the other hand, the mining machine appeared, causing the computer to no longer dig out bitcoin. Ordinary people can only use the currency to exchange bitcoin, which will give birth to the secondary market. When the two effects are superimposed, there are people who spend money to buy bitcoin, carry out black market transactions, or transfer assets, making bitcoin prices start to rise.

Rising prices have attracted a lot of hot money, creating today's high currency prices. In the short term, Bitcoin prices will continue to fluctuate as traditional investment institutions enter. Therefore, in fact, the news is good or bad, sometimes it is just an excuse for the money from the banker. The impact of the inflow and outflow of funds is the real reason for the rise and fall of the currency.

In March 2020, a halving of bitcoin production may bring the price of the currency to a small peak. But in the long run, the impact of the altcoin competition and the global trade war will cause the price of the currency to fall back within a reasonable range.

Social collaboration boundary enlargement

Broadly speaking, Bitcoin derives a blockchain that magnifies the boundaries of social collaboration.

At present, the most mainstream consensus mechanism, the workload proof POW, the equity certificate POS and the share authorization certificate DPOS represent the way of obtaining rights in actual social life: obtaining qualification certificates through class hours and exams, obtaining dividends through shareholding, and voting by voting Spokesperson.

In other words, the blockchain provides a paradigm that proves an interest and automatically receives a reward through a smart contract. We can imagine the following scene: On the street, pick up the broom with the gyroscope and clean the garbage in a certain area. After the camera confirms, you can automatically get the token reward. In the future, blockchain will be integrated with offline life through the Internet of Things, and smart contracts are the foundation.

We don't need to be affiliated with the company, we can also complete the assistance content and get the reward. Of course, this kind of collaboration does not completely replace the corporate system, but it offers more possibilities for ordinary people's lives. According to the current classification of blockchain tokens, the change in collaboration has penetrated into the fields of finance, international exchange, fair anti-counterfeiting, content copyright, medical care, virtual payment, data storage, Internet of Things, and games. In the next article, we will analyze these areas separately.

Social wealth redistribution

In fact, the digital currency is not far from life, and perhaps it can help us change some situations.

In theory, there is no issuer for digital currency, and the price of the currency is affected by the inflow and outflow of market funds. If the trade of AB is settled in digital currency, the economic level will be directly translated into the purchasing power of the currency in the country.

The traditional exchange rate is theoretically determined by the ratio of commodity value between the two countries. Take the mobile phone market as an example. If country A sells $10 and country B sells $100, the exchange rate of country A currency (A currency) to country B currency (B currency) is 1:10. With the core technology of B and the rising level of productivity, mobile phones are no longer a rarity, and prices have fallen to $20. At the same time, the price of mobile phones in country A is stable. Now, the actual exchange rate should be 1:2.

However, the relatively backward A country still maintains the exchange rate at 1:10 in order to ensure a trade surplus. The mobile phone price of country B is $20. According to the exchange rate of 1:10, it is only equivalent to $2 in country A, while the mobile phone in country A is still $10. Therefore, the mobile phone of country B quickly occupied the market of country A.

The A currency earned by the mobile phone trader of Country B cannot be used directly in Country B. Therefore, the Bank of B will exchange the printed B currency for the A currency in the hands of the merchant. In essence, the issuance of B currency is affected by foreign exchange reserves. However, Bank B did not destroy the exchanged A currency, but used it for investment, which is equivalent to the excess currency. The wealth of country B has increased, but the people have not benefited.

For country A, the influx of foreign goods has affected the domestic manufacturing industry, resulting in an increase in unemployment rate. Therefore, country A imposes tariffs and starts a trade war, but the actual losses are borne by the people of both countries.

Digital currency will change this situation. This is also why digital currencies are often hindered in the development of fast-growing trade surplus countries. When a country accepts multiple legal currency payments, the public will have more currency choices to avoid the risk of depreciation. For example, converting the legal currency into the dollar-locked TEDA (USDT), the state cannot easily harvest the poor's money, which will make the social wealth Redistribution will enter a new cycle.

On the other hand, if the state issues an official digital currency, the rules of issue need to be explained in the white paper. If there is a super-issuance in the future, the miners who participate in the bookkeeping will know that the market will make corresponding buying or selling actions, and reflect the current monetary value directly on the currency price. Every action of the bank needs to be explained.

To summarise, the Bitcoin system is an unsupervised automated “pipeline” established by Nakamoto. Participants work according to the “consensus mechanism”, sorting user transactions, checking unspent balances, and letting the system run automatically. To prevent participants from cheating.

However, the system is not perfect, and there are advantages and disadvantages. Today, people have developed two different directions based on the "good and bad" of Bitcoin.

On the one hand, according to its advantages, the development of “smart contracts” will extend the scope of participants' collaboration from bookkeeping to other fields, such as ETH and ADA. On the other hand, according to its disadvantages, improvements in transmission efficiency and experience, such as LET, XMR, etc. As a result, Bitcoin has also become the vane of the market's ups and downs. Block chain era kicked off.

Copy the following link to register for the HuobiPro account:

https://www.huobi.br.com/zh-cn/topic/invited/?invite_code=qazb3